Estimated Ultimate Recovery (EUR)

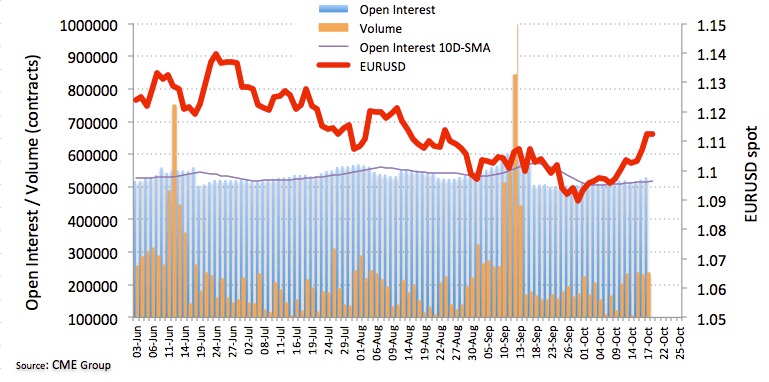

It was introduced in 1999 in hopes of integrating the of the. A number of countries outside the eurozone have formally or informally adopted the euro as well. After the , the euro is the most in the world, and it is the second-largest currency. It circulates in the eurozone, which includes a majority of the states in the European Union. This results in reserves being reclassified from proven back to probable or even possible. These reserves can be re-categorized for a number of reasons ranging from improvements in oil recovery methods and techniques to changing oil prices.

EUR financial definition of EUR

If oil reserves become too expensive to recover at current market prices, the probability of them being produced also falls. Proponents of the euro state that it is more valuable than the former currencies, while opponents say that it has made goods and in their home countries more. At introduction, it was an ; entered in 2002. Understanding Estimated Ultimate Recovery Estimated ultimate recovery can be calculated using many differing methods and units depending on the project or study being conducted. Without an estimated ultimate recovery, oil companies would not be able to make rational investment decisions. Reserves that were too expensive to produce at lower oil prices become viable as oil prices rise. .

EUR financial definition of EUR

For example, as oil prices rise, the quantity of proven reserves also rises because the of recovery can be met. The opposite happens as oil prices fall. Keep in mind that part of an oil field's probable and possible reserves are converted into proven reserves over time. This makes it possible to reclassify these more costly reserves as proven. .