Fed repo. Repurchase Agreement (Repo) 2019-12-10

FAQs: Overnight Reverse Repurchase Agreement Operational Exercise

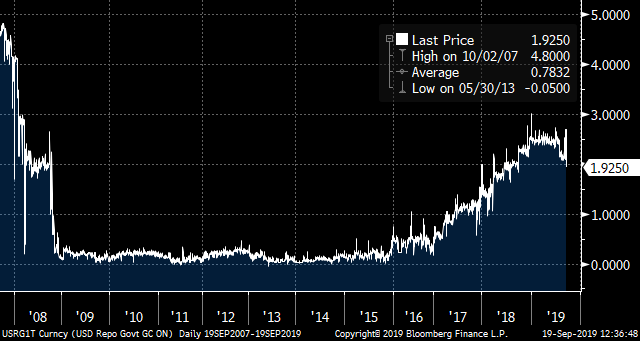

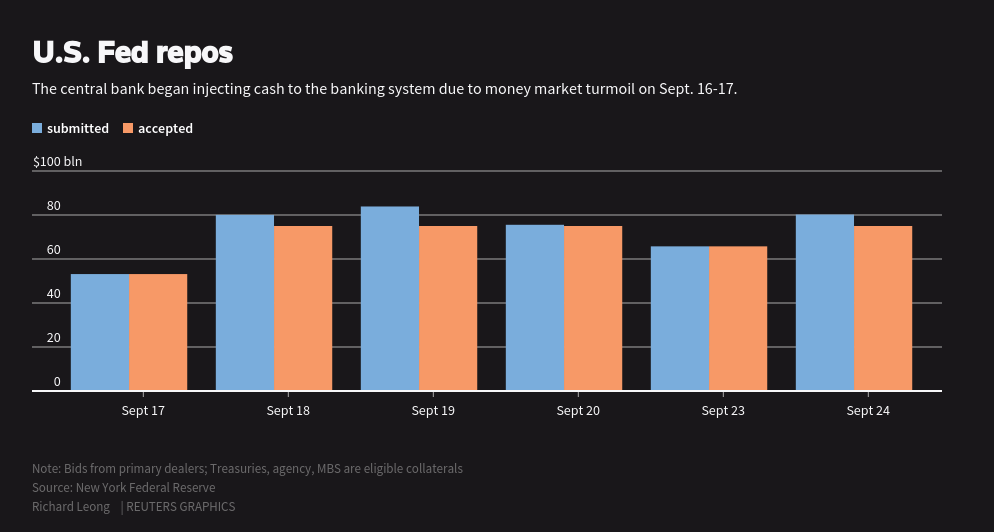

September's repo operations were the first from the Fed since the 2008 financial crisis, and marked another government action meant to relieve pressure on nation's economy. And it also began to allow its bond buying program to roll off as it stopped reinvesting maturities and interest payments. Playing into this worry is the word that the Organization for Economic Cooperation and Development has further downgraded its to 2. Additionally, these rates may serve as benchmarks for market participants to use in financial contracts. From the perspective of a reverse repo participant, the agreement can generate extra income on excess cash reserves as well. This tool can also be used to stabilize interest rates, and the Federal Reserve has used it to adjust the to match the.

Next

Here are 5 things to know about the recent repo market operations

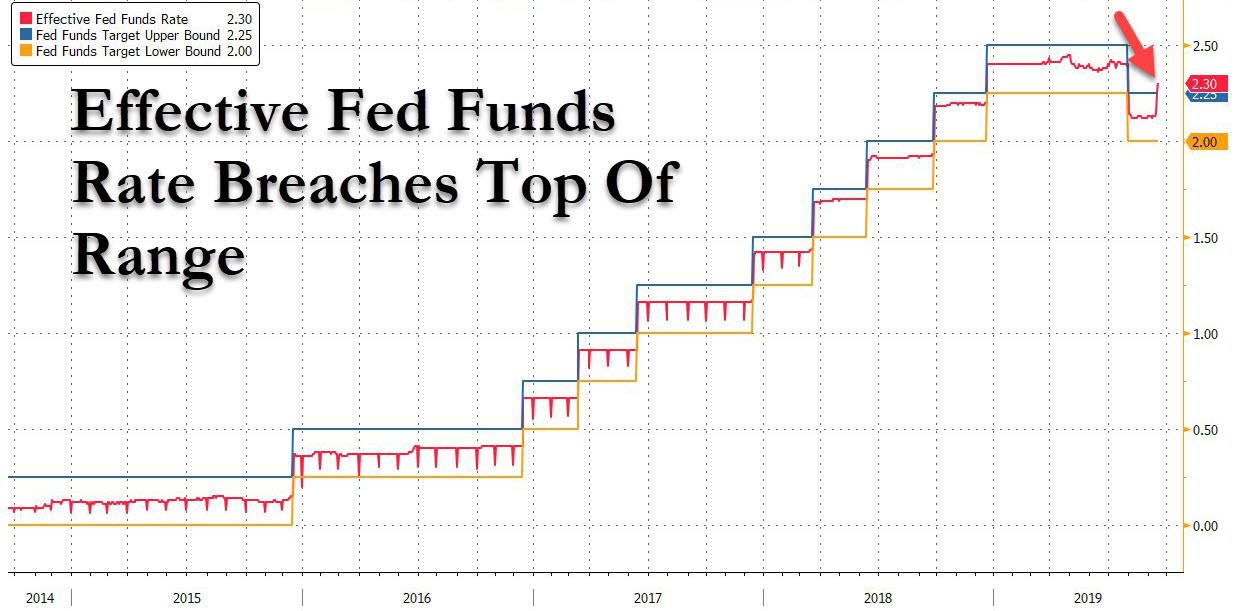

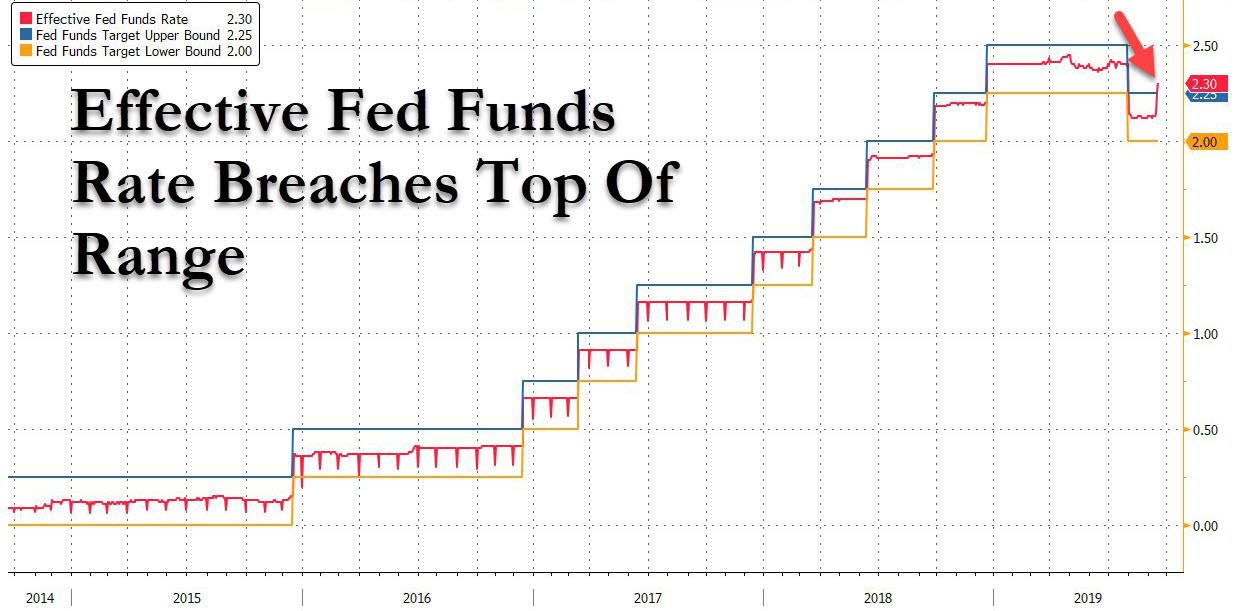

Neil George was once an all-star bond trader, but now he works morning and night to steer readers away from traps — and into. Federal Reserve intervened in the role of investor to provide funds in the repo markets, when overnight lending rates jumped due to a series of technical factors that had limited the supply of funds available. For example, hedge funds may borrow money from mutual banks to finance leveraged investments. . It also set its offering rate in the repo market at 1. In a reverse repo, dealers offer interest rates at which they would lend money to the Fed versus the Fed's Treasury general collateral, typically Treasury bills. The interest rate on an open repo is generally close to the.

Next

Fed’s Repo Rescue Leaves Many Searching for Answers

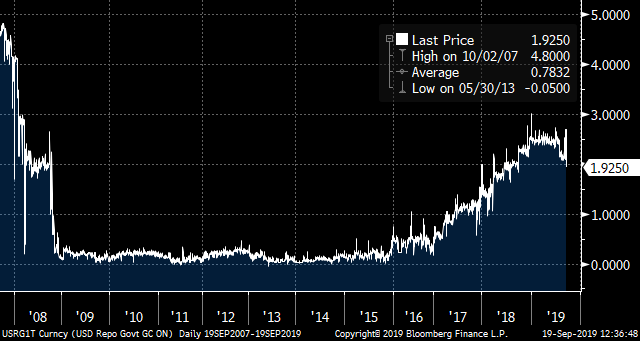

Will the Fed be stepping in at regular intervals? They are incentivized to not lend them out through repo agreements. At this point, reserve balances are extinguished. Through 2017, it began raising the rate closer to to 1%. There are a number of differences between the two structures. The Fed's announced operation, however, pushed that overnight rate back down to 0% shortly after it was launched, isolating, for the moment at least, any cash crunch that either a primary dealer or one of its largest clients could be facing. However, a key aspect of repos is that they are legally recognised as a single transaction important in the event of counterparty insolvency and not as a disposal and a repurchase for tax purposes. Banks were hobbled from participating the credit markets with limited trading ability and capital requirements.

Next

Explainer: The Fed has a repo problem. What's that?

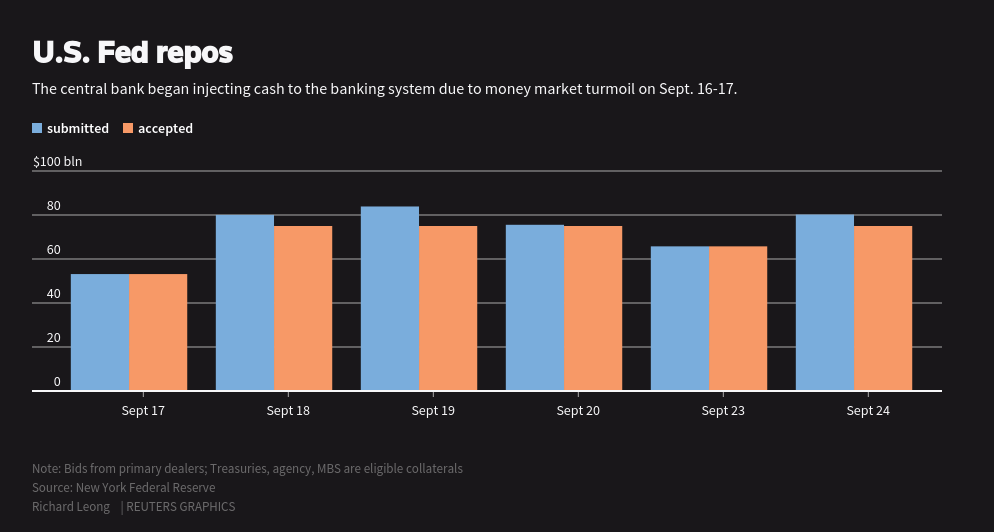

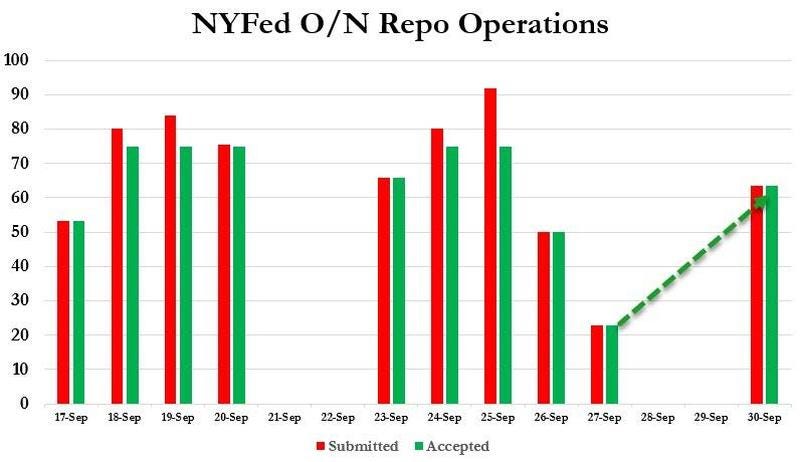

The Federal Reserve and the European Repo and Collateral Council a body of the have tried to estimate the size of their respective repo markets. This only adds to liquidity trouble. Many types of institutional investors engage in repo transactions, including mutual funds and hedge funds. Currently, the Fed is keeping the repo market calm with fresh capital injection. The New York Fed engages with individuals, households and businesses in the Second District and maintains an active dialogue in the region. By propping up the money market, the Fed can stabilize interest rates and slowly bring them within the window they feel is best suited for sustainable economic expansion. The repo market is at the core of financing all sorts of entities — from banks and their general cash and credit management to other financial institutions.

Next

Explainer: The Fed has a repo problem. What's that?

In other words, the repo seller defaults on their obligation. Due to the high risk to the cash lender, these are generally only transacted with large, financially stable institutions. In the case of a repo, a dealer sells government securities to , usually on an overnight basis, and buys them back the following day at a slightly higher price. Home sales for the most recent reported month is at a 12-month high at 12. The security, however, may have lost value since the outset of the transaction, as the security is subject to market movements. The New York branch of the U. A repurchase agreement repo is a form of short-term borrowing for dealers in.

Next

Explainer: The Fed has a repo problem. What's that?

The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. The New York Fed held an overnight repurchasing operation for the second time this week on Wednesday morning. Analysts say the repurchase operations will boost reserves at banks and help ease funding pressures. October 2012 When transacted by the of the in , repurchase agreements add to the banking system and then after a specified period of time withdraw them; reverse repos initially drain reserves and later add them back. Like , repo rates are set by central banks. Thus if you can borrow cheap money with an interest rate of less than 2% and you gain more than 3% on your leveraged trade, you earn profits plus the capacity to repurchase the security that you pawned. For instance, many repos are over-collateralized.

Next

Repurchase Agreement (Repo)

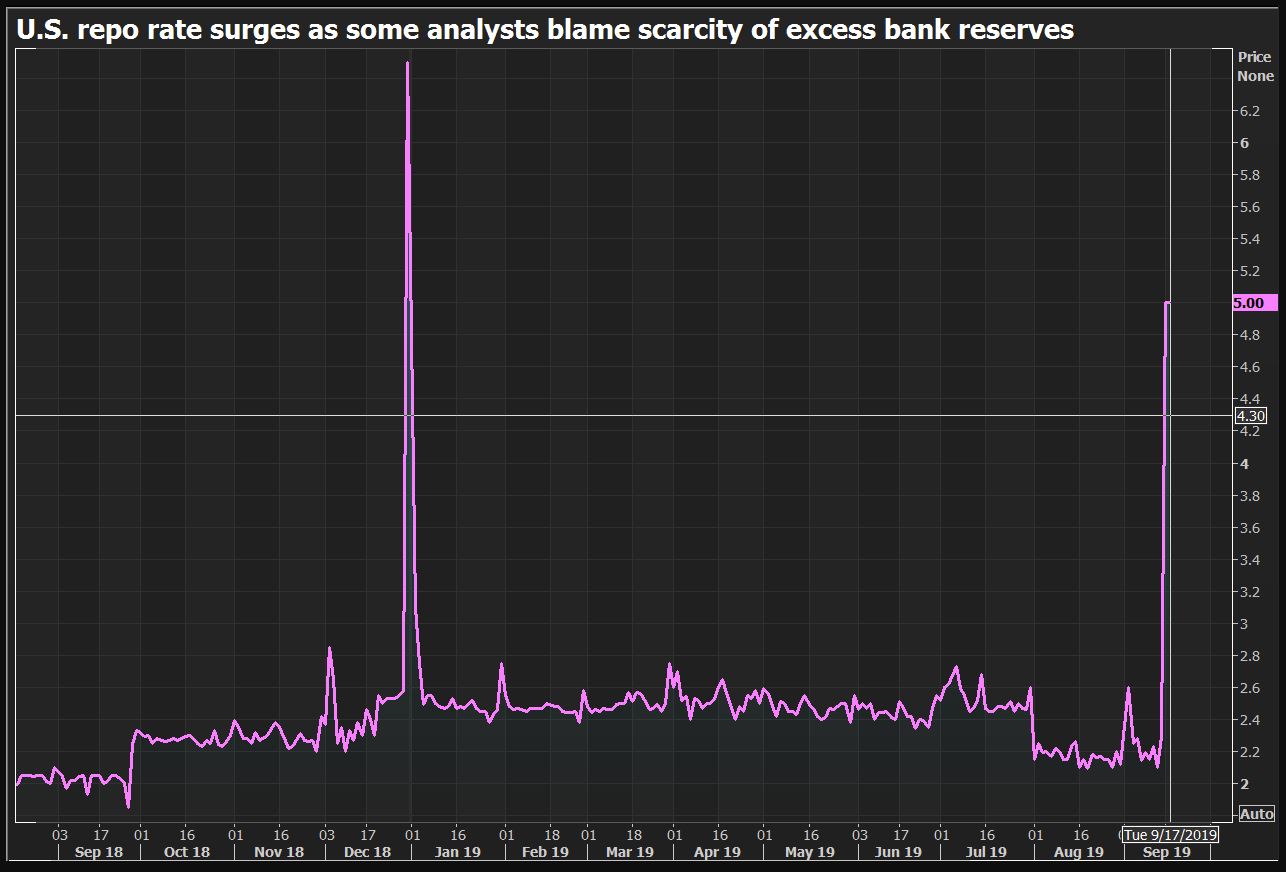

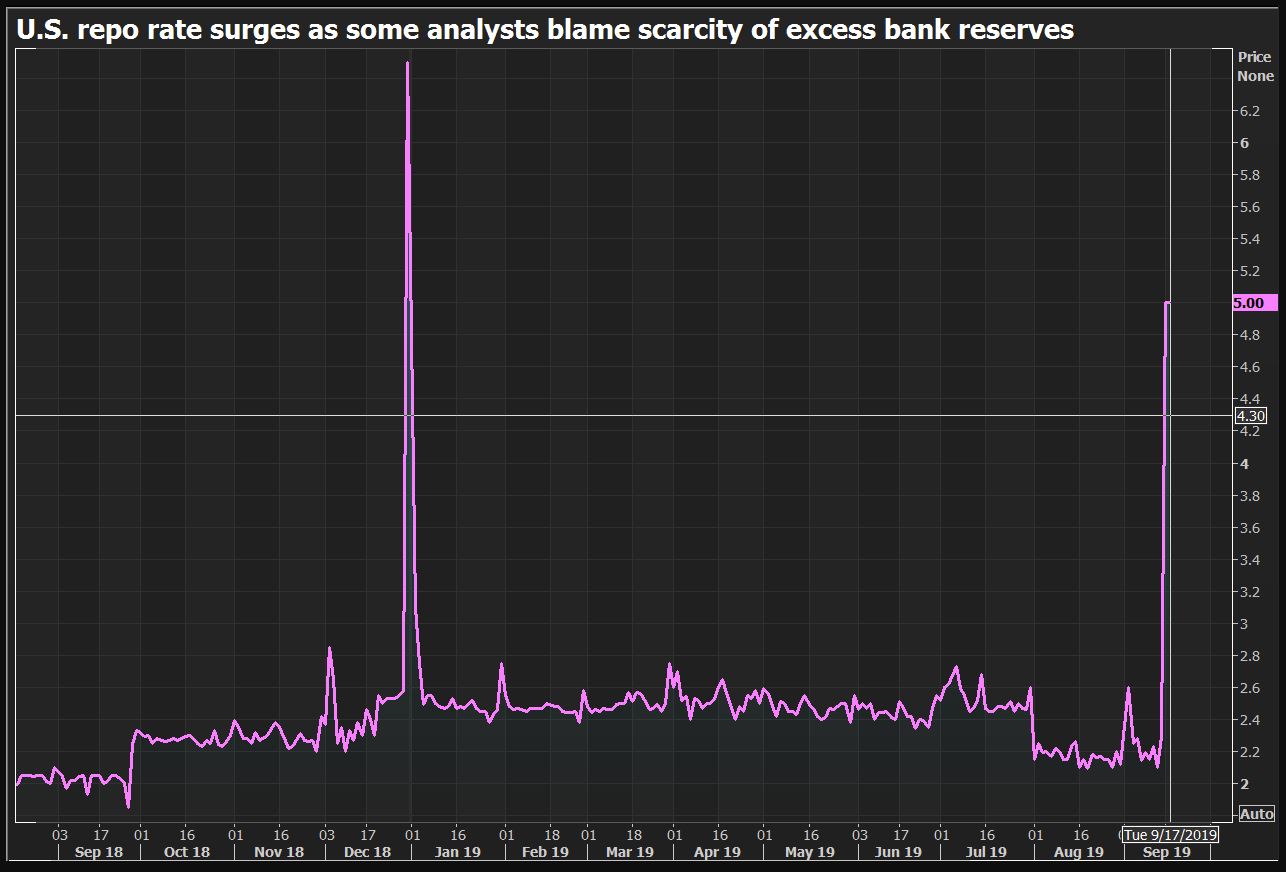

Office of Financial Research, produces and publishes three reference rates based on overnight repurchase agreement repo transactions secured by Treasury securities, in order to provide the public with more information regarding the interest rates associated with repo transactions. The tri-party agent is responsible for the administration of the transaction, including collateral allocation, , and substitution of collateral. The buyer acts as a short-term lender, while the seller acts as a short-term borrower. But when investors get fearful of lending, as seen during the global credit crisis, or when there are just not enough reserves or cash in the system to lend out, it sends the repo rate soaring above the Fed Funds rate. During September 2019, the U.

Next

Surging Repo Market Rates May Signal Another 2008 Economic Meltdown

Each dealer is requested to present the rates they are willing to pay for the agreements versus various types of collateral. But, by mid-2010, the market had largely recovered and, at least in Europe, had grown to exceed its pre-crisis peak. The offerings come with set interest rates, which create capital over the short borrowing period which was previously not part of the country's economy. The Fed continues to worry about a default by a major repo dealer that might inspire a fire sale among money funds which could then negatively impact the broader market. The Fed hadn't offered them for more than a decade before the September sales, and their reintroduction signals the bank is ready to intervene more frequently to steady the borrowing landscape.

Next

Treasury Repo Reference Rates

In this way, the cash lender acts as a security borrower and the Repo agreement can be used to take a in the security very much like a security loan might be used. This in turn meant that their portfolios were worth less. But, they have an agreement to repurchase those securities the next day at a set price. The strain forced the Fed to open three daily borrowing facilities, so far, to add juice to funding markets. Earlier this week, a surge in the repurchasing rate, used by hedge funds and banks to fund their trading operations, pushed the fed funds rate close to the top of its targeted range.

Next