Financial post gic rates. GIC rates comparison chart 2019-12-28

Financial Post

I consent to the collection, use, maintenance, and disclosure of my information in accordance with the Postmedia's. One of the economic controls the Bank of Canada has at its disposal is the ability to set the. For a quick rate overview, check the. The rates below have been in effect since. The Financial Post was an English business newspaper, which published from 1907 to 1998.

Next

National Post online GIC Rate Guide listing

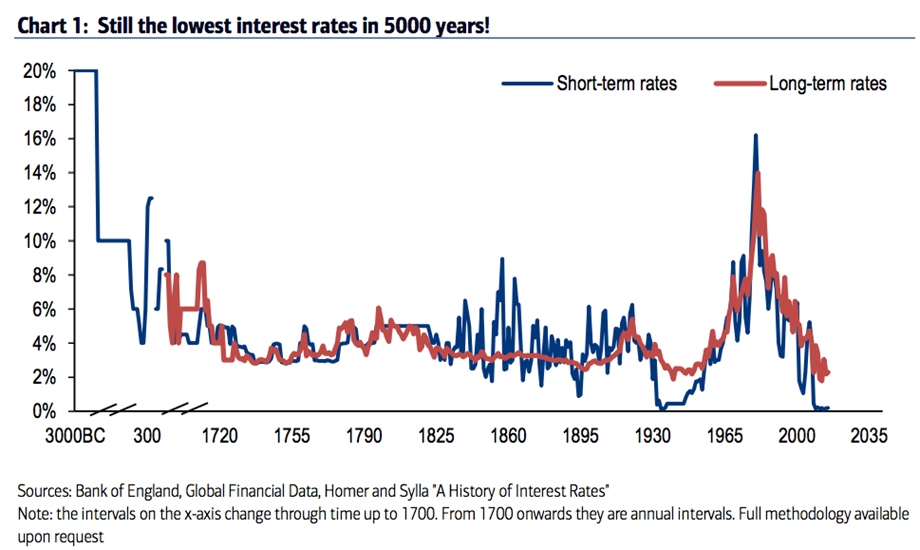

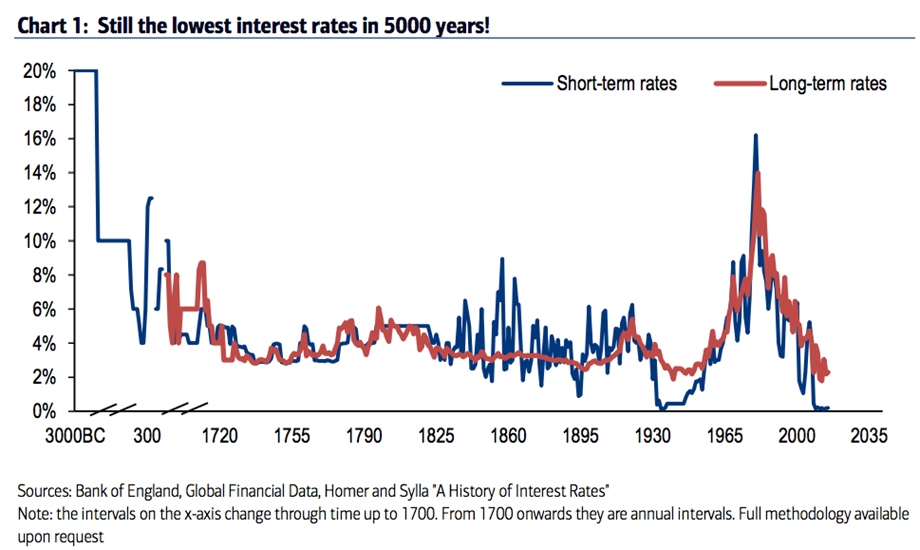

He has a master's degree in Finance and Investment Management from the University of Aberdeen Business School and has a passion for helping others win with their finances. The differences between rates at varius institutions might be more significant if rates were higher in the first place - may it be in our lifetimes! Good for us that our readers remain vigilant when we let something slip. The columns in this table can be sorted by clicking on the headings. They all have faith in something that I don't share. It seems rates are now going to be cut by the Bank of Canada and U. I appreciate your thoughts and experiences, Bill - and relieved I haven't been through the last year on the markets. Please read my for more info.

Next

ahintz.com

GreedyRates Hey Vishal, Appreciate the question. Every decision has risk of some sort, seems to me. So much for using a deposit broker! If you rarely need to enter a branch for your day-to-day banking transactions, an online bank like Oaken Financial may suit your needs. And I wouldn't worry about currency risk or inflation as long as you don't leave the country and don't lock up money for more than a year or so - you can always roll funds over as rates go higher. The Peoples Trust rates in the Financial Post table agree with those shown on the.

Next

Our Products

Attention Print Newspaper Subscribers For verification of Print Subscriber offers e. The other possibility, especially for the non-registered funds, is annuities, but this is a bad time to buy them although could get worse! And thanks for cleaning up, Peter. It was a weekly publication, and one of the core assets of Maclean's media business, which eventually became. Related: Is Oaken Financial For You? Talk about all things regarding Canadian high interest savings accounts in the and read. I always use the one below. Editors of the paper included , and , who was the paper's last editor prior to the launch of the National Post. I've heard some people say that stocks work out in the long run, don't worry about short-term ups and downs, but it all depends.

Next

Oaken Financial Review: Online Banks In Canada

So, rightly or wrongly, I don't pay much attention to what the investment, real estate or other financial industry folks say, I just don't believe their clichés because, never mind their obvious self-interest we all have to make our money , history has shown anything can, and eventually does, happen. The Financial Post started publication in 1907 by. If you go to Fiscal Agents site you will see those much lower rates available for Peoples on their listing. Financial institutions pay us for connecting them with customers. The higher interest savings rate and lower bank fees are possible because digital banks save on overhead costs that come with maintaining physical branches.

Next

RIF 10

Plus I don't keep paper records forever, maybe a few years or so, and then it's in the fireplace so I'd have no complete trail of transactions to prove the latest statement I've printed off is not counterfeit. We take great pride in offering some of the highest savings rates in Canada, so that you can make the most of your hard-earned money. And thanks for cleaning up, Peter. The columns in this table can be sorted by clicking on the bold headings. It is getting really bad for responsible, prudent savers and looks like a repeat of the last past period of 2015 to 2017 when rates were getting very low.

Next

GICs / Term Deposits

I use these lists to order them by yield and only consider the top few, so I wouldn't have noticed Peoples as it was too far down the list it's just that I happened to notice Peoples wasn't near the top and I knew it should be. They are safe investments and as such work well in conservative investment portfolios or can represent some portion of the fixed income component of any portfolio. If you want to do all your banking in one place, may be more convenient. You can always change the information you share with us by editing your profile. It looks the rate has gone up lately.

Next

RIF 10

So now I wonder about the whole list. There are plenty of Canadian banks, credit unions, and other financial institutions to choose from. © Fiscal Agents Financial Information Services Data powered by. The rates shown are as posted on their respective websites on September 20, 2019, and are subject to change at any time. The copyright at the bottom of the table is © Fiscal Agents Financial Information Services So, the Financial Post table data from Fiscal Agents, an Ontario deposit broker. You can simply apply through their website, call them on phone, drop by one of their few offices, or complete the application form and mail it in. For all registered plans, interest is compounded annually and paid at maturity.

Next