Form 15g for pf. What is Form 15G? What is Form 15H? 2019-12-12

What is Form 15G? What is Form 15H?

The difference between the two amounts is the deduction allowed. Income from sources is nil. How to fill new Form 15G? So do I have to follow the old method or is there any other way? But this will be reduced Pension. I have worked 2 years for a Company left the Job on 2014. I have read all the comments so that i can understand if there is a similar scenario. One is the one available in ur site which has 2 pages and the another one has 3 pages which briefly given the columns for different types of incomes , I.

Next

What is Form 15G? What is Form 15H?

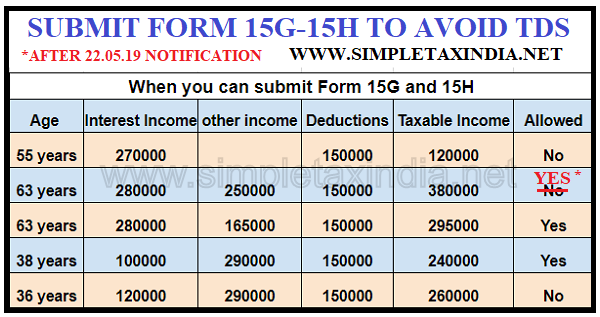

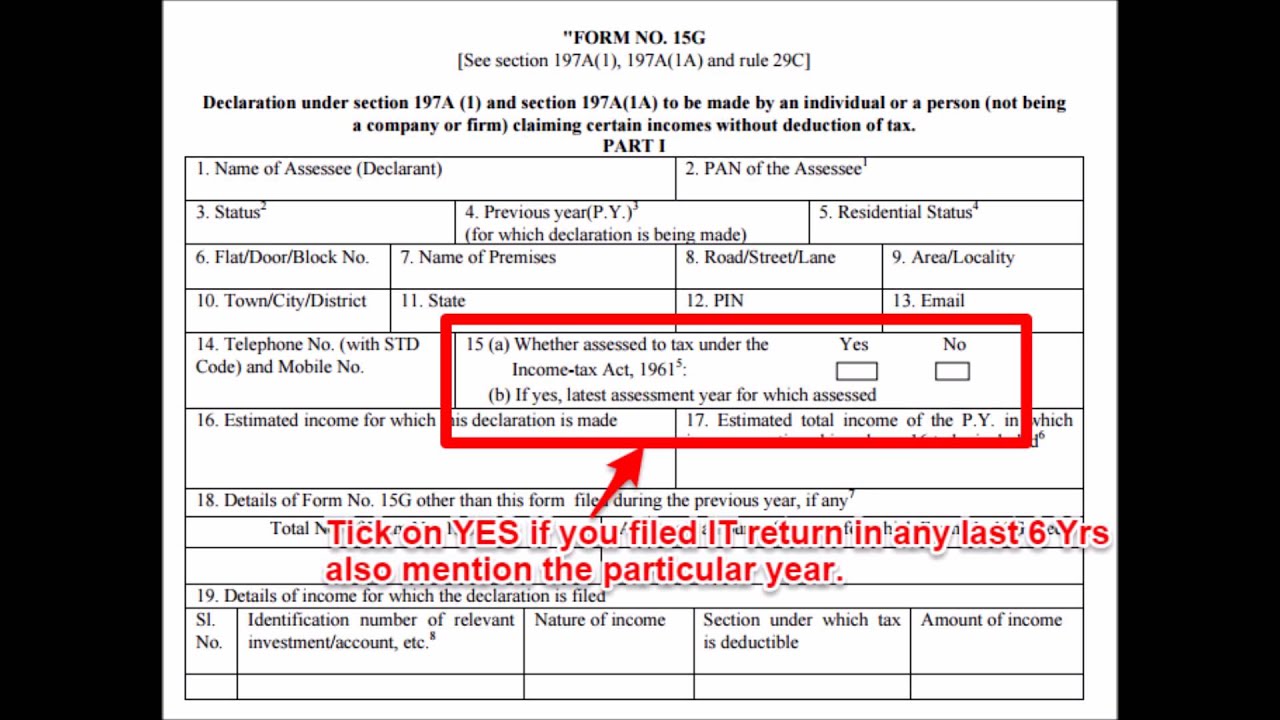

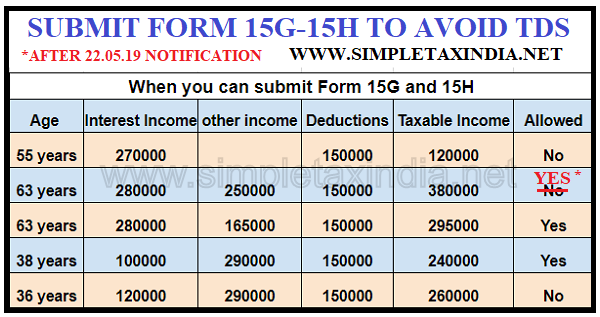

However if only interest part is to be stated then one can mention. This means that anybody who earns less than the minimum income of Rs. So, the taxable income in last year would be my 5 months salary ie. And she also satisfies the age criteria of below 60 Form 15G cannot be submitted since aggregate interest income for the year is more than basic exemption limit Form 15G cannot be submitted as she is more than 60 years old. Hope this information is helpful for you all. Queries: 1 Kindly need more clarity on the above points and also what exactly should i need to write in the declaration letter? Below I want to apply for, you will see Upload Form 15G as shown in the below image.

Next

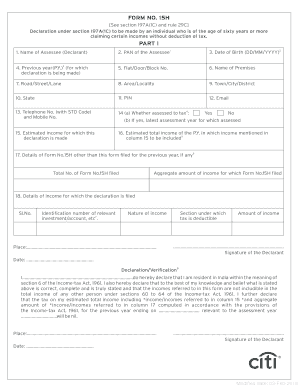

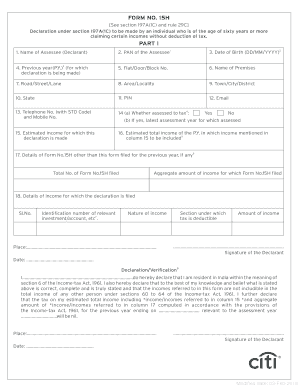

Sample Filled Form 15G & 15H for PF Withdrawal in 2019

Second part of Form 15G is to be filled out by the deductor i. Earlier this limit was Rs 30,000. Every year fresh form 15G or Form 15H has to be submitted to each and every branch of the bank where you hold deposits. But having to pay a higher tax on account of arrears is unfair to the taxpayer. I am having one querry related to form 15G.

Next

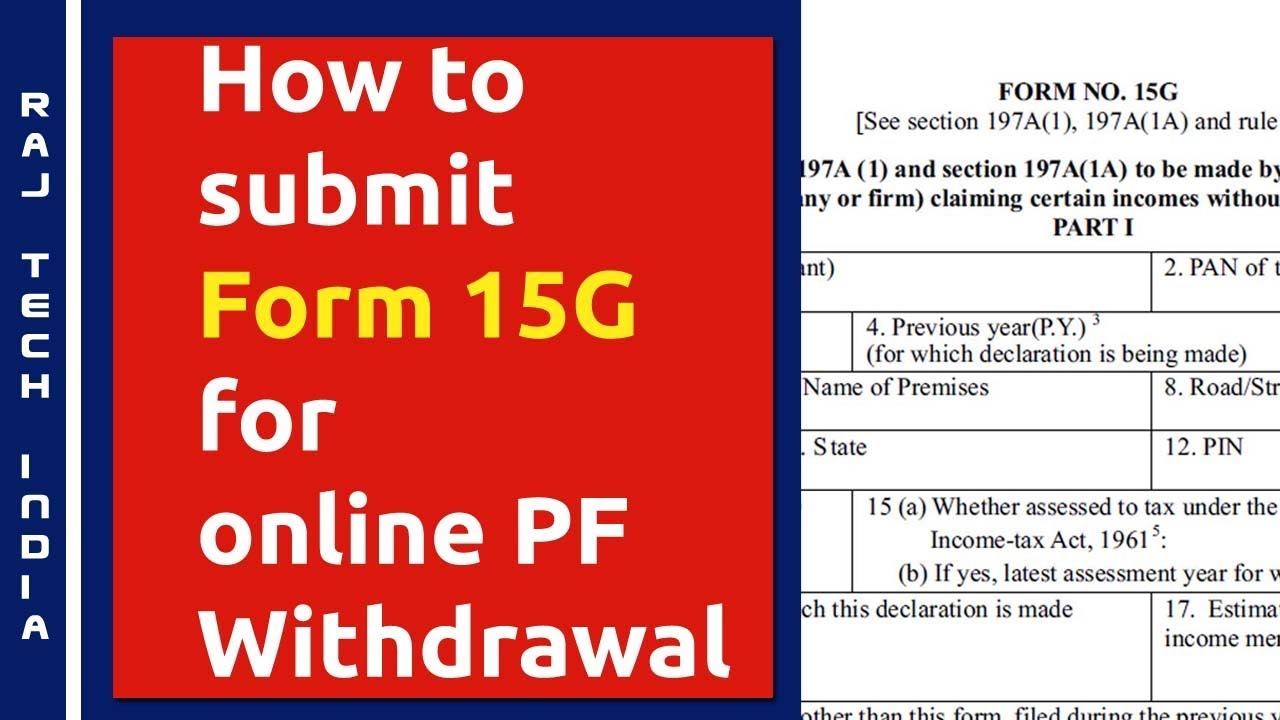

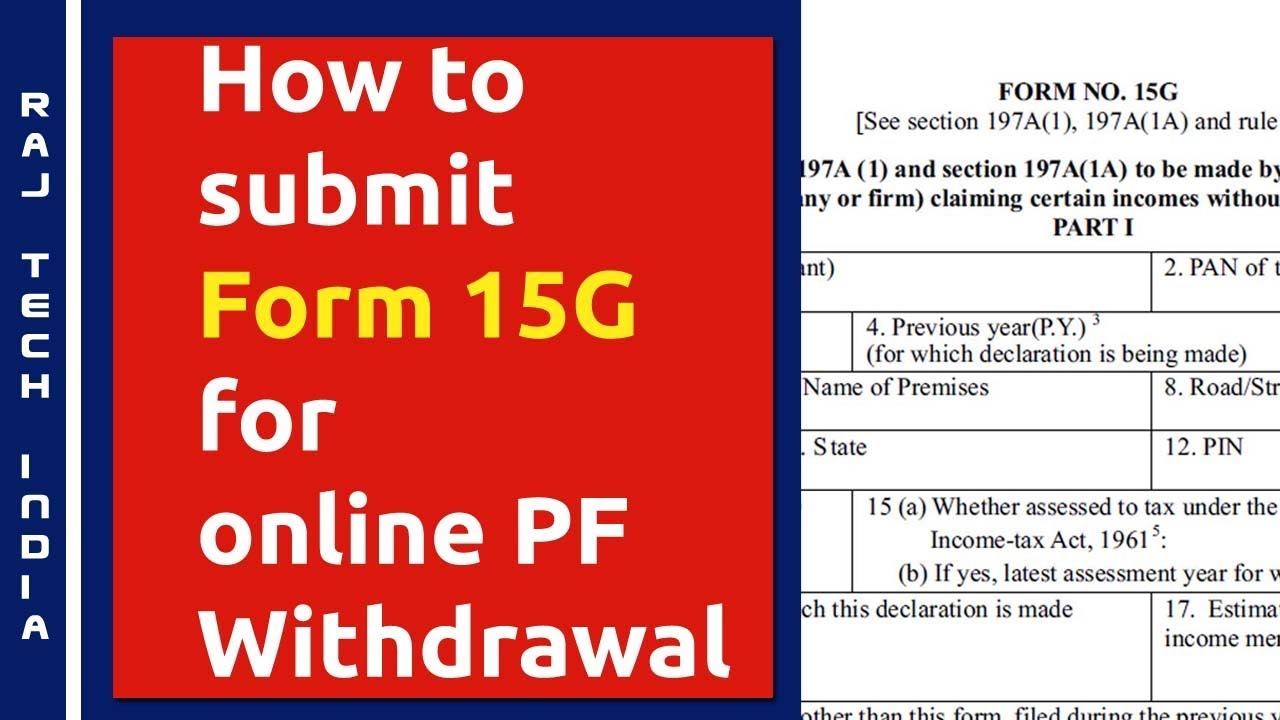

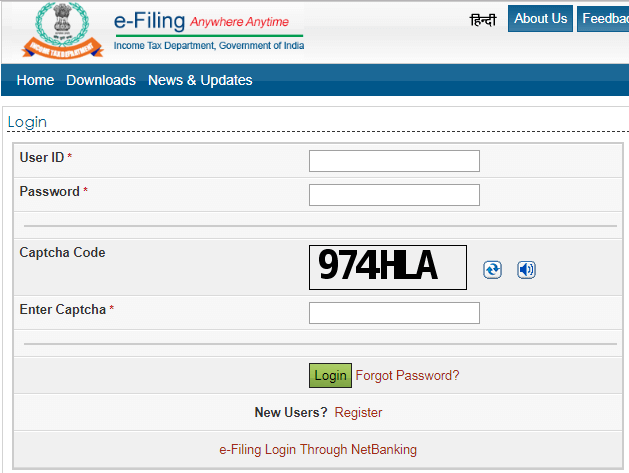

How to Submit Form 15G for Online PF Withdrawal

I dont understand the tax part. Please replay me with your suggestions. Is the total interest less than the minimum exemption limit? Income Tax Authorities can make further inquiries regarding the declaration filed by the depositor. These should not be construed as investment advice or legal opinion. I have following questions: 1.

Next

What is Form 15G? What is Form 15H?

You need the following information for withdrawing. Thank you for your support. Pf dept asked to fill in the form 15g and submit Pan card document. Enter the other details and submit for withdrawal. Now, am in a hopeless situation. You have to submit either Form 15G or Form 15H when your total income does not exceed the basic exemption limit in case of Financial Year 2019-20 the basic exemption limit for an individual is Rs. I moved to a new organization in 2016 and have been there since.

Next

Form15G for EPF Claim Withdrawal

Irrespective of the fact whether the Form is used or not, the respective income should be compulsorily declared in return of income. Our article explains it in detail with images and video. I have over 10 years of experience in the field of insurance and have worked with top two private insurance players in the country. Who can fill Form 15H? So my queries sections wise have been mentioned below: 3 assessment year:wht should be filled here. So can I submit the 15g and composite claim form offline in Hyderabad pf office? Document pdf format lists the steps in detail with images at each step. You can take the pension earlier from the age of 50 years.

Next

Form15G for EPF Claim Withdrawal

I already have my Form 16 and 26A. Regards, Sampat When did you file returns for the year 2015? You can apply for Withdrawal Benefit or Scheme Certificate through Form 10C for retaining the Pension Fund Membership. Let us look at some examples to understand this better! Is there any other option. However I have been switch jobs every three to 4 years. The article is really informative.

Next

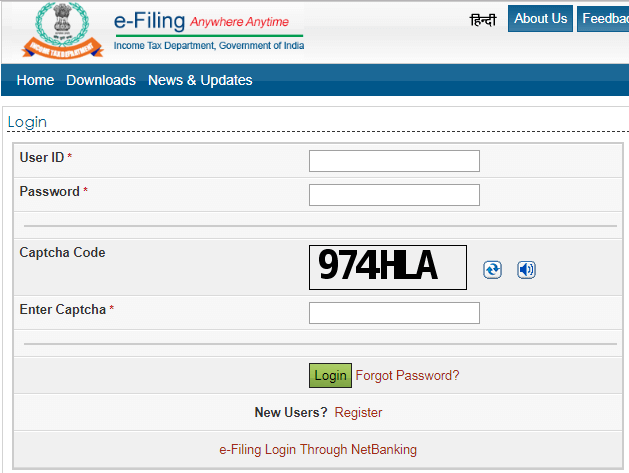

How to Submit Form 15G for EPF Withdrawal Online?

Few Banks have started accepting Form 15G and Form 15H online. Some questions about Form15G are addressed in the below post 1. His interest income from April 1 till July 7 is say 5000 Rs. Form 15H is an undertaking that your taxable income for that year is well within the basic exemption limit and there is no tax liability. Who can Fill Form 15G? I have left the organizationn in the month of Sep, 2015 and I am currently unemployed. Note that you have to take signature and stamp in every page of the application.

Next

EPFO

Interest income earned by a non-earning spouse has to be clubbed with the spouse who is earning an income. Who can Fill Form 15G? This was a huge concern for such taxpayers. Form 15G Sample Most banks and financial institutions offer their own variants of Form 15G, but, the generic version of the form is available on the official Income Tax Department website. He can reduce tax outgo on the employer share and interest using section 89. However, relief under Section 89 will be available.

Next

How to Submit Form 15G for EPF Withdrawal Online?

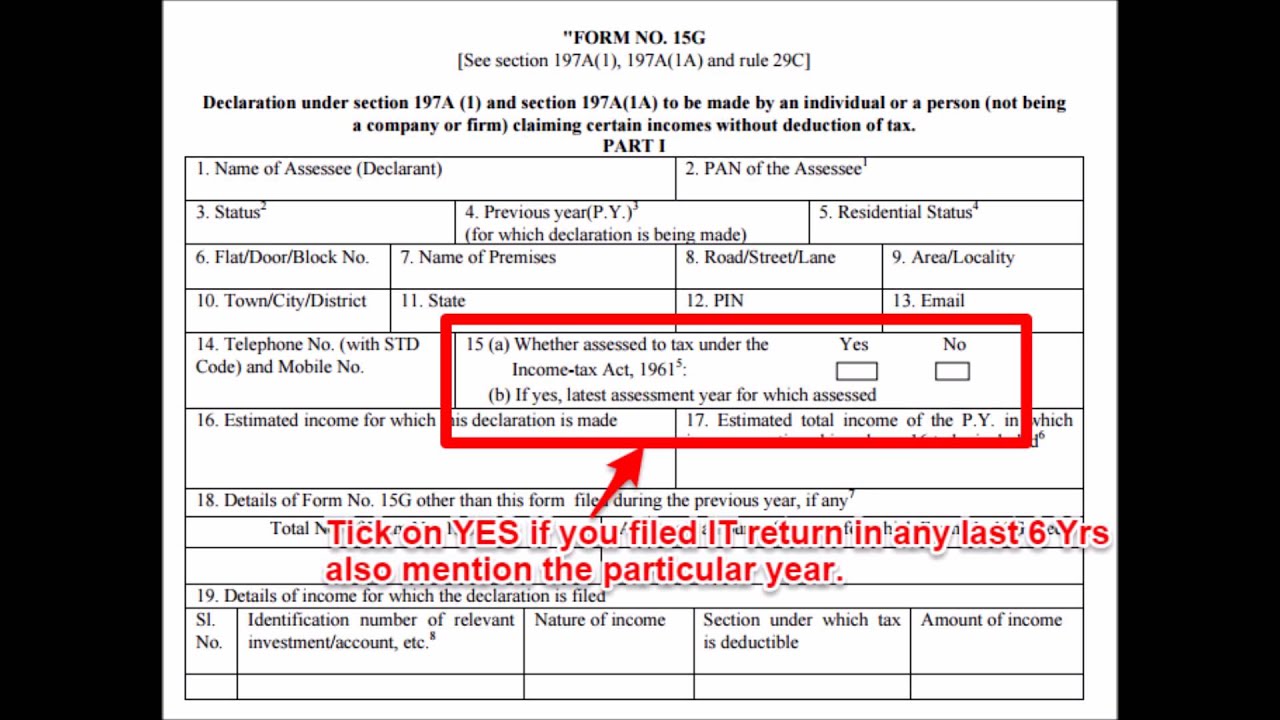

If you meet these requirements then you can withdraw online. I am a Certified Financial Planner and currently working as a Paraplanner with Mr. You will have to fill up Form10E with these details and then submit it to your current employer to claim the relief. He expired on 27th July 2014 since than we could not do so. I have served in previous company for around 2. Instructions to fill out Form 15G Form 15G has two sections.

Next