Form x as. FormX Tienda Virtual 2020-02-08

as a Signature legal definition of as a Signature

Include the following materials with your amended return. A Form 1040X based on a net operating loss or capital loss carryback or a credit carryback generally must be filed within 3 years 10 years for carryback of foreign tax credit or deduction after the due date of the return including extensions for the tax year of the net operating loss, capital loss, or unused credit. In other states the law requires courts to invalidate wills that are signed with an X unless the testator was physically or mentally incapable of signing her full name. This distinction is problematic, as the multivalued functions log z and z w are easily confused with their single-valued equivalents when substituting a real number for z. For more information, see the Instructions for Form 8959. Generally, for a credit or refund, you must file Form 1040X within 3 years including extensions after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later. Casualty loss from a federally declared disaster.

Next

ahintz.comResult Property (ahintz.com)

You must file Form 1040X by the due date as extended for filing your tax return for the tax year in which you received the grant. } This identity extends to complex-valued exponents. Out-of-pocket costs include any expenses incurred by taxpayers to prepare and submit their tax returns. If you use Form 1040X, see the special instructions for carryback claims in these instructions under Special Situations, later. Thus, commercial instruments, such as checks and promissory notes, may be signed by affixing any symbol that an individual intends to represent his signature. For 2018, you may pay the entire amount of tax due with respect to this deferred foreign income in 2018 or elect to make payment in eight installments or, in the case of certain stock owned through an S corporation, elect to defer payment until occurrence of a triggering event. .

Next

as a Signature legal definition of as a Signature

You can send us comments from. If you included these amounts in income in a prior year, you may be able to amend your return to claim a refund or credit against your tax. You also may have to pay penalties. This technology dramatically reduces plastic adherence towards mold inserts, maximizes plastic part demolding efficiency and reduces plastic injection cycle time. This property is typically set by the property of a control on the form.

Next

Instructions for Form 1040X (01/2019)

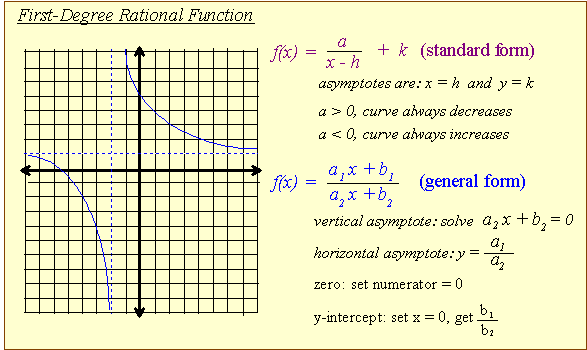

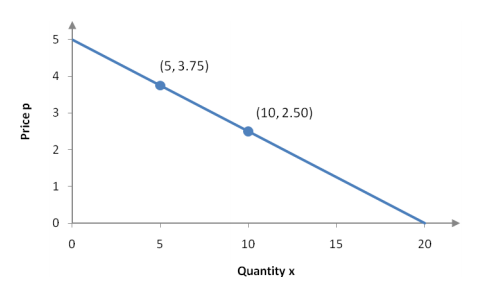

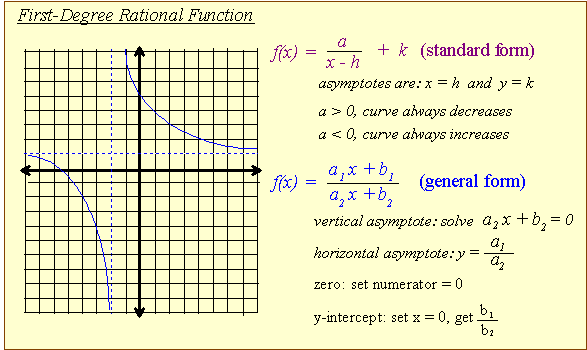

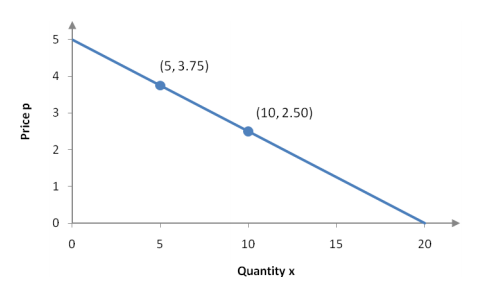

However, the law grants veterans an alternative timeframe — one year from the date the letter is received. } This was first implemented in 1979 in the calculator, and provided by several calculators, for example , , and programming languages for example. The of the to the graph at each point is equal to its y-coordinate at that point, as implied by its derivative function see above. For illiterate, incompetent, or disabled people, this mark is often the letter X. Use the following chart to find out if you must use this worksheet to figure a reduced amount to enter on line 4a. Veterans affected by this legislation should have received a notice from the Department of Defense. Interactive Tutorial 4 a Use the applet window to check the y intercept for the quadratic functions in the above example.

Next

SOLUTION: Write each equation in the form y = a(x

DialogResult DialogResult { get; set; } member this. If you are changing the wages paid to an employee for whom you filed Form W-2, you must also file Form W-2c, Corrected Wage and Tax Statement, and Form W-3c, Transmittal of Corrected Wage and Tax Statements, with the Social Security Administration. Limitation on personal casualty and theft losses beginning after 2017. See What's New, earlier, and the instructions for the 2018 form you are amending. The time limit for filing Form 1040X can be suspended for certain people who are physically or mentally unable to manage their financial affairs. Reducing a casualty loss deduction after receiving hurricane-related grant.

Next

Exponential function

Exemptions are still available for prior years' Forms 1040. Dispose ' Display a message box indicating that the Cancel button was clicked. Any excess gain is used to reduce losses from a federally declared disaster. The items that follow give you this specialized information so your amended return can be filed and processed correctly. A similar approach has been used for the logarithm see. An exception applies to certain farming losses. See Line 9—Health Care: Individual Responsibility, later, to report a shared responsibility payment or to change the amount of a shared responsibility payment reported on your original return.

Next

Sinker EDM machine

Also include any excess advance premium tax credit repayment from Form 8962. Firstly, whenever transmitting random data in separated parts, it is always possible that the chosen boundary will be present in the payload. Any change to the income or adjustments on the return you are amending will be reflected on this line. Generally, tax returns and return information are confidential, as required by section 6103. Most taxpayers experience lower than average burden, with taxpayer burden varying considerably by taxpayer type.

Next

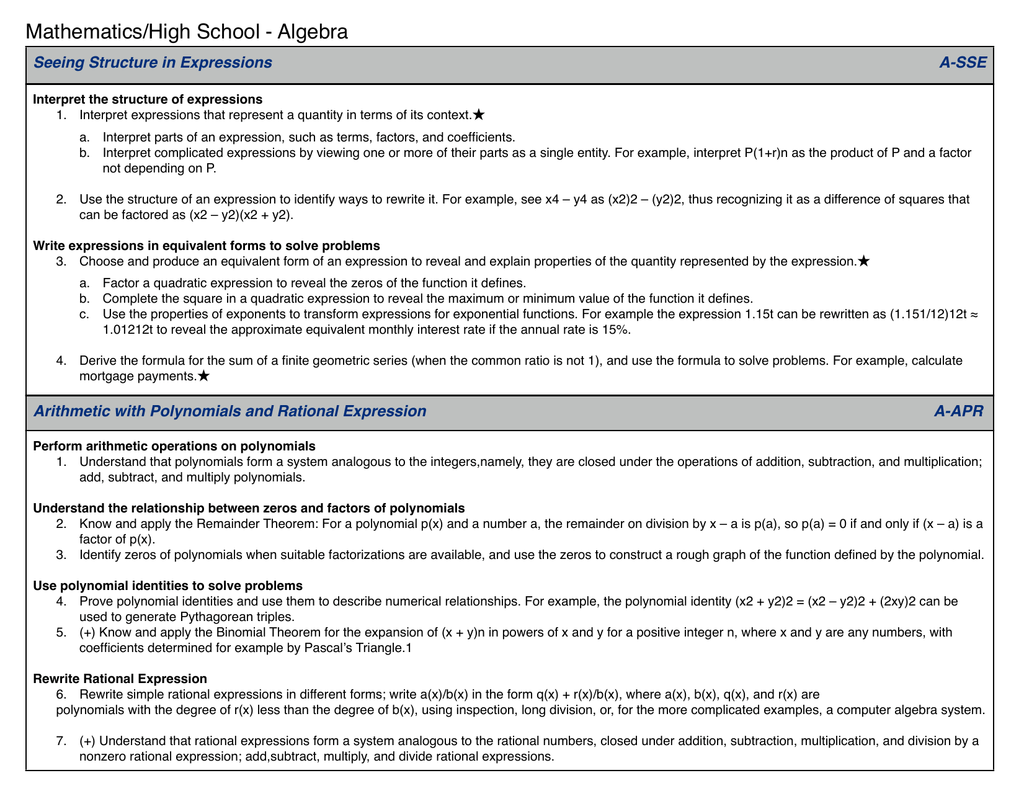

Quadratic Functions (General Form)

Penalty for late payment of tax. But, if the airline payment was made under the approval of an order of a Federal bankruptcy court in a case filed on November 29, 2011, you could have rolled over the airline payment within the period beginning on December 18, 2014, and ending on June 15, 2016. This election must be made by filing your return or amended return for the earlier year, and claiming your disaster loss on it, no later than 6 months after the due date for filing your original return without extensions for the year in which the loss took place. Who must use the Deduction for Exemptions Worksheet. Penalty for erroneous claim for refund or credit. Excellent activity where quadratic functions are matched to graphs.

Next

as a Signature legal definition of as a Signature

This alternative one year time frame is especially important because the normal deadline is the later of 3 years after filing the original return or 2 years after paying the tax and claims may date as far back as 1991. Some alternative definitions lead to the same function. However, you may qualify for innocent spouse relief. Cancel ' Set the caption bar text of the form. Doing both the addition and subtraction of does not change the equation Now factor to get Distribute Multiply Now add to both sides to isolate y Combine like terms Now the quadratic is in vertex form where , , and. Refund or Amount You Owe The purpose of this section is to figure the additional tax you owe or excess amount you have paid overpayment.

Next