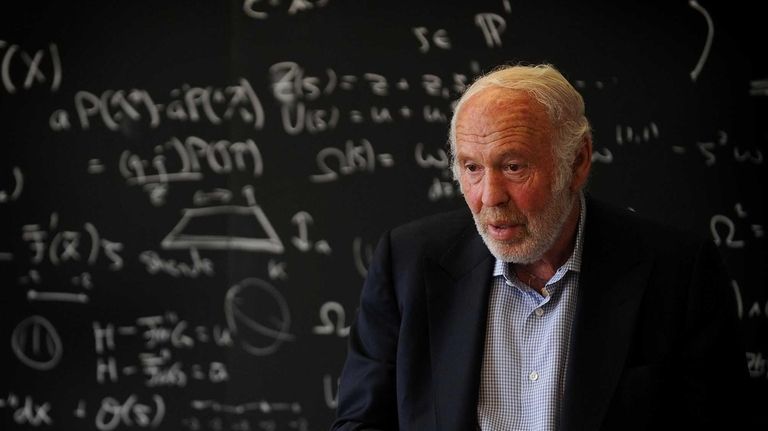

Jim simons. RENAISSANCE TECHNOLOGIES LLC Top Holdings 2020-01-15

The Making of the World’s Greatest Investor

I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out. We assume all data to be accurate, but assume no responsibility for errors, omissions or clerical errors made by sources. Thinking about the right experiments is important. Chern-Simons was not meant to solve Poincaré's conjecture, but it does offer calculations that are useful for distinguishing among shapes in three dimensions. Archived from on March 28, 2012. We don't hire people from business schools.

Next

Smartest James Simons is Cal Alumnus of the Year for 2016

He found that stocks bored him. Renaissance's flagship Medallion fund, which is run mostly for fund employees, is famed for the best track record on Wall Street, returning more than 66 percent annualized before fees and 39 percent after fees over a 30-year span from 1988 to 2018. Simons retired from his company, Renaissance Technologies, back in 2010. He's contemplating retirement in three to four years. A book about Simons and his investing methods, The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution by ; 382pp , was released November 5, 2019. After big reverses, Julian Robertson closed down , and George Soros scaled back the activities of his Quantum Fund this year. Simons ran Renaissance until his retirement in late 2009.

Next

Stock Portfolio:

Are you prouder of your mathematical legacy, or of this firm? In 1979 Simons and scientist Peter Yianilos, an expert in artificial intelligence and speech recognition, had founded Proximity Technology, a pioneer in hand-held electronic book technology and spell-check software. Every six months all employees receive cash bonuses based on fund performance. The entire contents of this website are based upon the opinions of Michael Covel, unless otherwise noted. But this year, with the index down 2. Simons ran Renaissance until his retirement in late 2009. But technology nowadays plays a prominent part in his U.

Next

Jim Simons (mathematician)

In 1988 Simons decided to launch a fund that concentrated on pure trading. They were top donors to the presidential campaigns of Hillary Clinton and Donald Trump. Renaissance now has funds, open to outsiders, that trade over longer horizons. And one after another, over the past few years, these celebrated managers have either blown up or folded their tents. We assume all data to be accurate, but assume no responsibility for errors, omissions or clerical errors made by sources.

Next

The Making of the World’s Greatest Investor

After seeing some fairly ho-hum returns on his initial investment, he went to visit his Merrill Lynch broker in San Francisco and asked him where he could make some real money. In part, the fund was looking for new ways to invest excess capital that investors didn't want back. Forty years old, with a slight paunch and long, graying hair, the former professor hungered for serious wealth. Yet you hire mathematicians and scientists to do much of your work. Because Medallion could claim that it owned just one asset — the option — and held it for more than a year, investors could declare their gains to be long-term investments. And some of what he said was, frankly, unintelligible. It makes you wary in a general sense.

Next

Jim Simons: Top Quant Trader by a Country Mile

Simons is known for his studies on. That fee had been 20%, but after 2000 it increased initially to 36% and then to 44%. As a result Medallion experiences high transaction costs and high expenses. Thanks to Simons' generosity, Stony Brook is considered one of the top ten math departments in the country; several math professors hold the title of James Simons Instructor. It just seemed a rotten business, so I spoke out against it.

Next

A life’s rich tapestry

He subsequently began to work with on the theory of characteristic classes, eventually discovering the secondary characteristic classes of 3-manifolds, which are related to the Yang-Mills functional on 4-manifolds, and have had an effect on modern physics. You say that eventually things will come together. These models are based on analyzing as much data as can be gathered, then looking for non-random movements to make predictions. In 1994, Simons founded the with his wife to support researches in mathematics and fundamental sciences. Fortunately, I did not start a movie theater. In fact, in the past decade, it's never returned less than 21 percent. The Renaissance team views the narratives that most investors latch onto to explain price moves as quaint, even dangerous, because they breed misplaced confidence that an investment can be adequately understood and its futures divined.

Next

The Secret World of Jim Simons

Mr Simons studiously avoids publicity. The information on this website is intended as a sharing of knowledge and information from the research and experience of Michael Covel and his community. Recently, Simons has expanded his equity business. By visiting, using or viewing this site, you agree to the following and. As a result Medallion experiences high transaction costs and high expenses. Mr Simons started investing in 1978 by looking for patterns in currencies.

Next

Stock Portfolio:

He had to overcome his own doubts to turn Wall Street on its head. Simons' trading record over the past decade is more than luck. Simons, by contrast, just keeps getting better. He is best known for his math related accomplishments as a code breaker and for studying pattern recognition. So we just kept looking at it and saying, Why is this? Once a week Simons meets with the research group, discussing in detail the progress of trading strategies under development.

Next