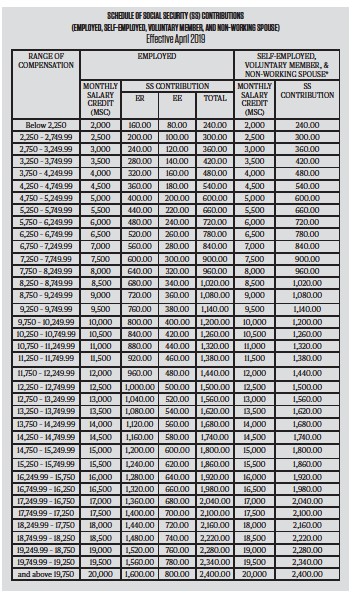

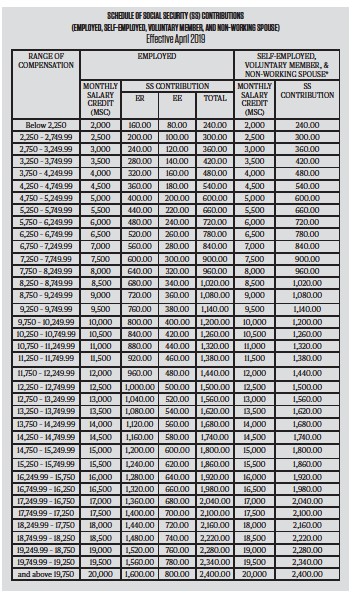

New sss contribution. SSS Contribution Table 2019 2019-12-29

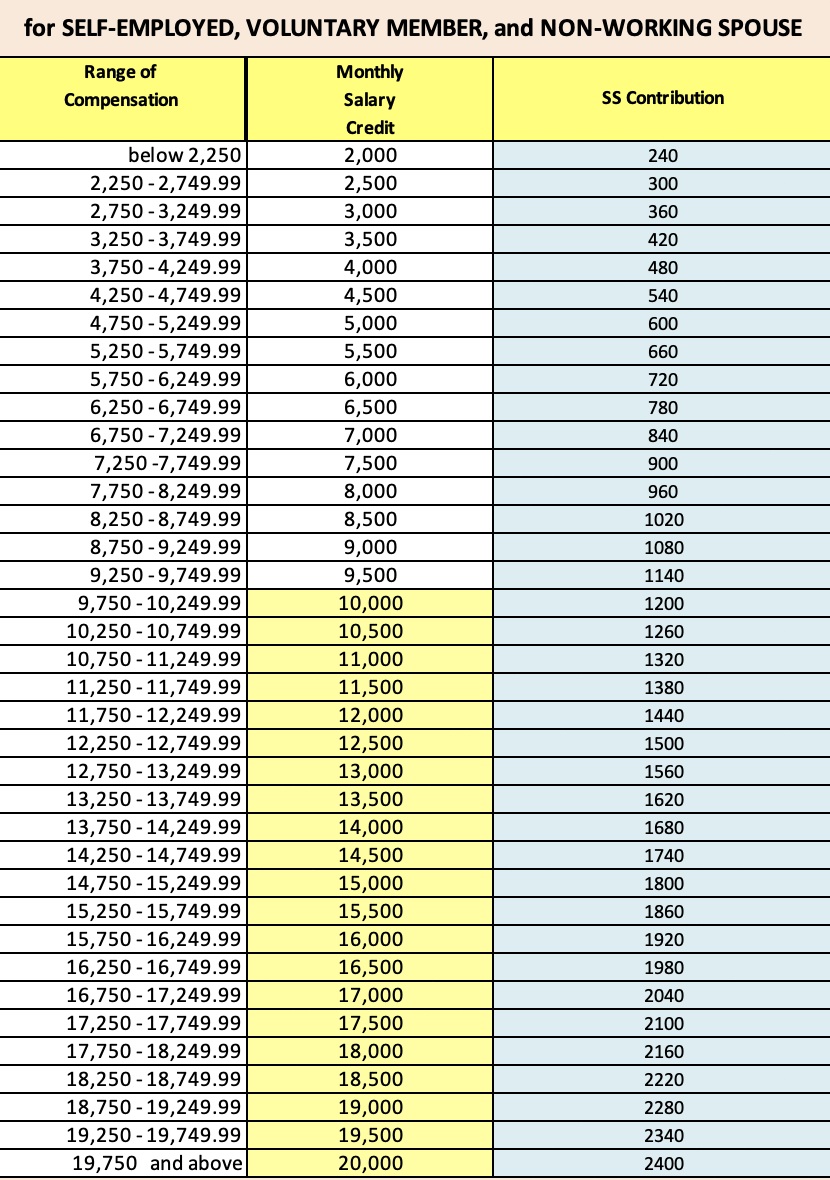

New SSS Contribution Table 2019 for all Members including OFWs

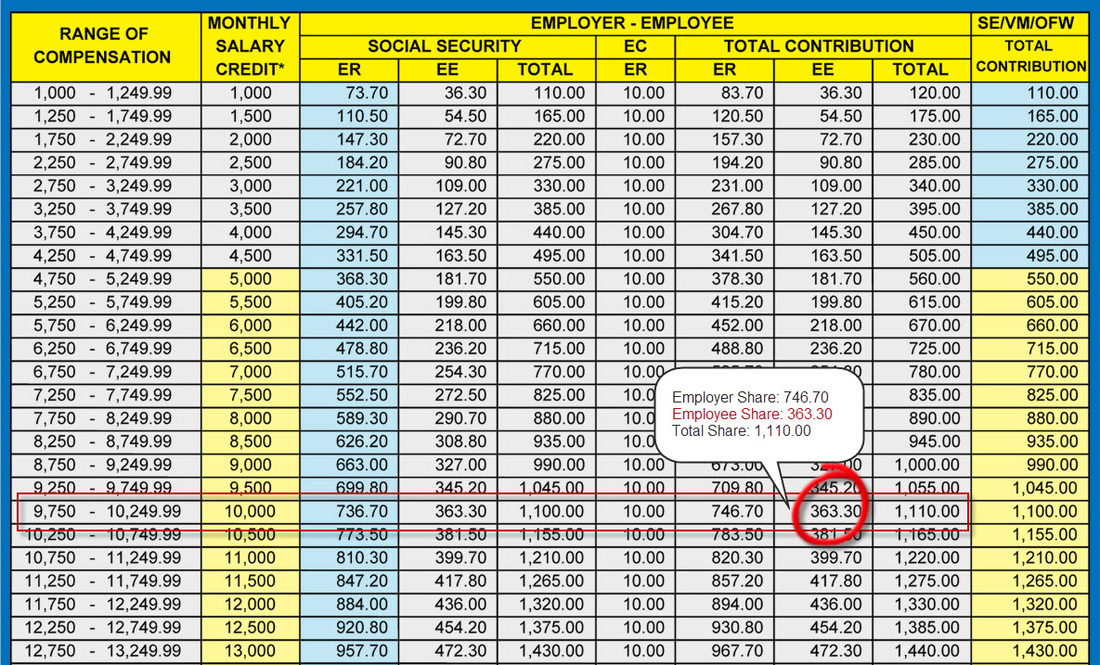

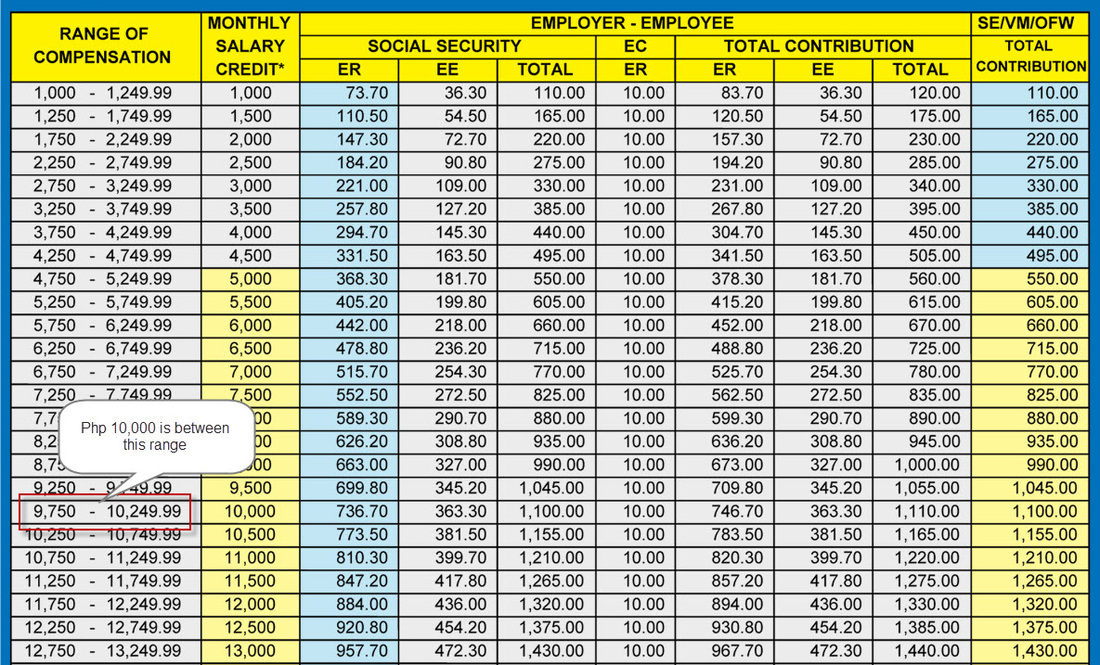

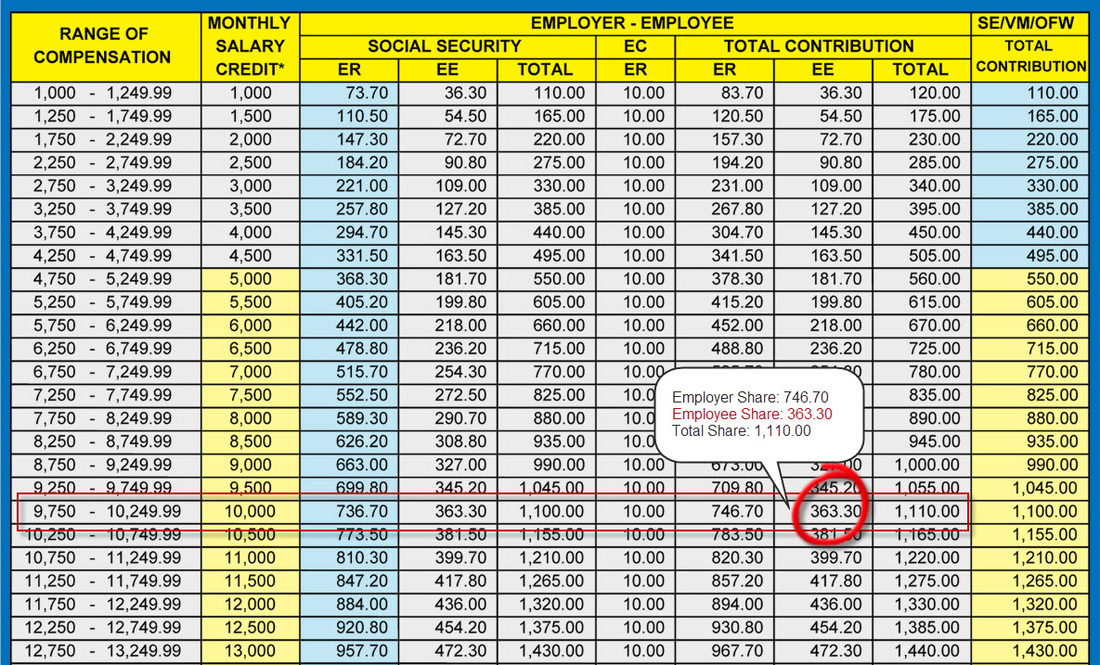

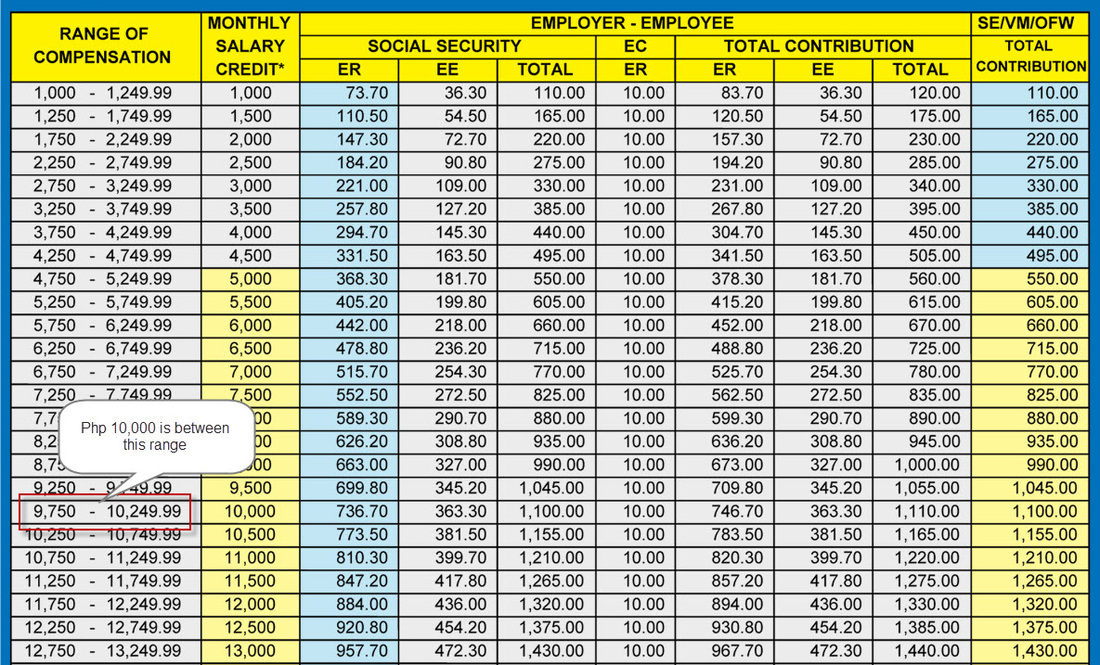

A quarter covers three 3 consecutive calendar months ending on the last day of March, June, September and December. Intersection yun ng dalawang formula. Overseas Filipino Workers Payment of contributions for the months of January to December of a given year may be paid within the same year; contributions for the months of October to December of a given year may also be paid on or before the 31st of January of the succeeding year. If ever you decided to retire at age 65 it will be Php 16,300. Alden will pay Employer share of P490.

Next

SSS New Contribution Rates Take Effect on April 2019

Contribution table for 2019 valid and up to date. The author has no responsibility against the comments posted by visitors. But an engineer in Riyadh had a weirder situation when he went home to Manila after his contract in Saudi Arabia ended. As many others panicked during the strong earthquake that rocked Matalam, Cotabato City, an old man was pictured kneeling to pray by the roadside. Suan, Hi and hello thank you for your info. Mga magkano estimated pension ko monthly if i will retire 60 option 1, 65 years old Option 2.

Next

New SSS Contribution

Now I am 62 will be reiting when I am 63 which is next year. Also I had a salary loan of Php5k that ballooned to about 80k now incl interest and penalties. The recommendation tab will show the asking rate that the user needs to be able to earn enough for the target budget. My total contribution was P 165,710. Yes, I know how you despise seeing this kind of table so do I hehe. Magkano ba ang estimated na pension ang matatanggap ko when im retired.

Next

Updated SSS Contribution Table 2019

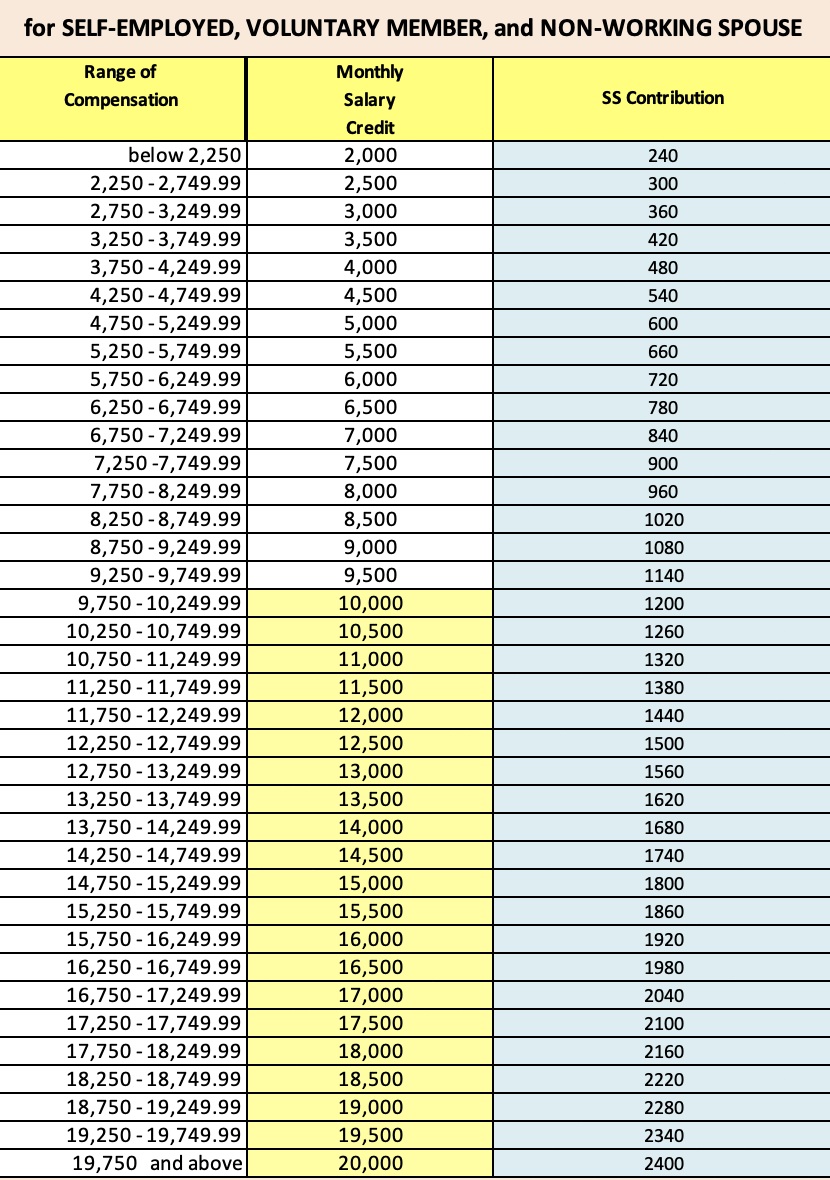

Anyway, ask ko lang, simula nong mawalan ng trabaho father ko i think 8yrs ago e hndi na sya nakakahulog sa sss then may naiwan pa ata syang utang doon na hindi parin nababayaran,makakakuha pa kaya sya ng pension? With the new schedule, the maximum compensation range was changed to P19,750 and above. They will be assured of social security protection as long as they are not over 60 years of age. The top monthly salary credit—or the maximum benchmark used in the calculating how much the social security contributions should be for employees based on their salaries—was also increased from P16,000 to P20,000. He was an engineer in Riyadh a few years ago. I understand that sss is only considering the last 5 years contribution 55yo — 60yo monthly contribution in pension computation.

Next

SSS Contribution Table 2019

Though it is very easy enough to know your monthly contribution by just looking at the table, I still created a calculator to automate the process. Based on the info provided, formula 3 yields the highest at 5200 per month of pension. Ang monthly contributio k with my employer is 1485. I made inquiry a couple more times up to the time I actually filed my pension application on Sept 2018. Retirement planning should start as early as possible. If approved by President Duterte, the new salary credit will be Php 20,000, from previous Php 16,000. Resulting pension is Php 11,800 Php 10,800 plus Php 1,000 additional pension as per R.

Next

New SSS Contribution

House Bill 2158 and Senate Bill 1753 is pending to be signed into law as the Social Security Act of 2018. A quarter covers three calendar months which end on the last day of March, June, September, and December. Are Earthquakes Common in the Philippines? This is just your basic monthly salary in which the remaining components are based on. The last formula, however, is very straightforward and easy to compute. When he reaches age 55. If financially sufficient ka until age 55 then pwede mo yan gawin.

Next

SSS Contribution Table 2019

Nagpunta po kc ako sa opisina ng sss branch ay 6000 lang daw po ang maloloan ko. Malaki nga yung matitipid mo kung sakali pero paano kung kailangan mo siya ng mas maaga? The frequency of payment is on a monthly basis for business and household employers. Photo credit: Bobby claimed that their mom only sleeps under the stairs because his house is very small, but Maria Socorro refuses to accept the excuse. Because he only paid 12 years 51 mos. He already had 51 months contribution amouting 110 a month from nov 2017 up to dec 2021.

Next

Updated SSS Contribution Table 2019

Makukuha ba ng member yong total contribution niya from age 60 to 65 2. This site rocks the Skin for. Concerned netizen Mae Regala shared his story, in hopes that she could help him find his parents or any family member. Personally, I will not recommend that to you. For Employee Members: Check if your employers are paying for your monthly contributions and member loans based on the prescribed schedule of payment as shown above.

Next

New SSS Contribution Table effective April 1, 2019

The company is already a dissolved company, so ano po habol ng employee. It turned out that this old man is Maximino D. This benefit is granted up to the first four deliveries or miscarriages only. So ngayon pong 2019 January 2019, am wondering kung dapat ba na mag increase na ulit ang aking monthly contribution kaso wala po ako basis dahil dko alam or wala akong record kung magkano ang declared earnings ko during my first contribution. Are you ready to know how small much it will be? So in the case of an Employee earning P15,000 salary per month, the Employer Share is P1,230.

Next

NEW! SSS Contribution Table 2019 (With Computations!)

At the year 2022, he is already 55 and only allowed to increase one salary bracket per year. Pag nag file ba siya ng pension at the age of 65 agad ba siyang makakuha ng lump sum for 18 months and monthly pension after 18 months? This news affects you, be in the know. Yes, it has an indirect effect considering the number of years you missed paying the contribution. The President signed it last month. Wise Guy, Kudos to your blog. If you like my content, kindly subscribe to my blog, share this post to Facebook, Twitter, Pinterest, LinkedIn, Email, and follow my Facebook Page and Twitter Profile.

Next