Nordea vipps. Mobile payments in the Nordics 2020-01-14

Norwegian Bank Nordea Launches Facebook Messenger Payment Feature

Up more than 3% to 300,000 transactions in September. The move comes as a bid to block competition from Nordic rival platforms and the likes of Facebook, Google and Apple. As for Nordea, the Norwegian-based bank is one of many in the country that has been focused on ramping up its digital payment services. Den gir god oversikt over bedriftens konti. We are very technologically savvy and good at adapting to new technological solutions and services. Du kan også logge ind med fingeraftryk.

Next

Another Major Bank Joins Vipps

The Danish bank made the decision despite their app having enormous market penetration in their native Denmark, where more than three million people actively use the platform to make mobile payments. . This makes us even stronger in meeting the international competition for mobile payments in the future. MobilePay kan bruges af alle, uanset hvilken bank du er kunde i. This spring person to person payments will be launched and the plan is to follow up with different solutions for the corporate customers soon after.

Next

Vipps for personkunder i Nordea

Nordea is happy about joining the solution and so are their Norwegian consumers. Nordea joins as a partner and will distribute Vipps to its approximately 1 million customers in Norway. MobilePay is known today for its user friendliness, and we want to contribute to making the solution even more widely used and to continuing the development of MobilePay as an innovative digital payment platform. When our phones became small computers with internet access, the development has continued rapidly with tablets, mobile-friendly websites, apps and mobile payment methods. As with both Swish and MobilePay, Vipps is now also available for the corporate customers.

Next

Vipps

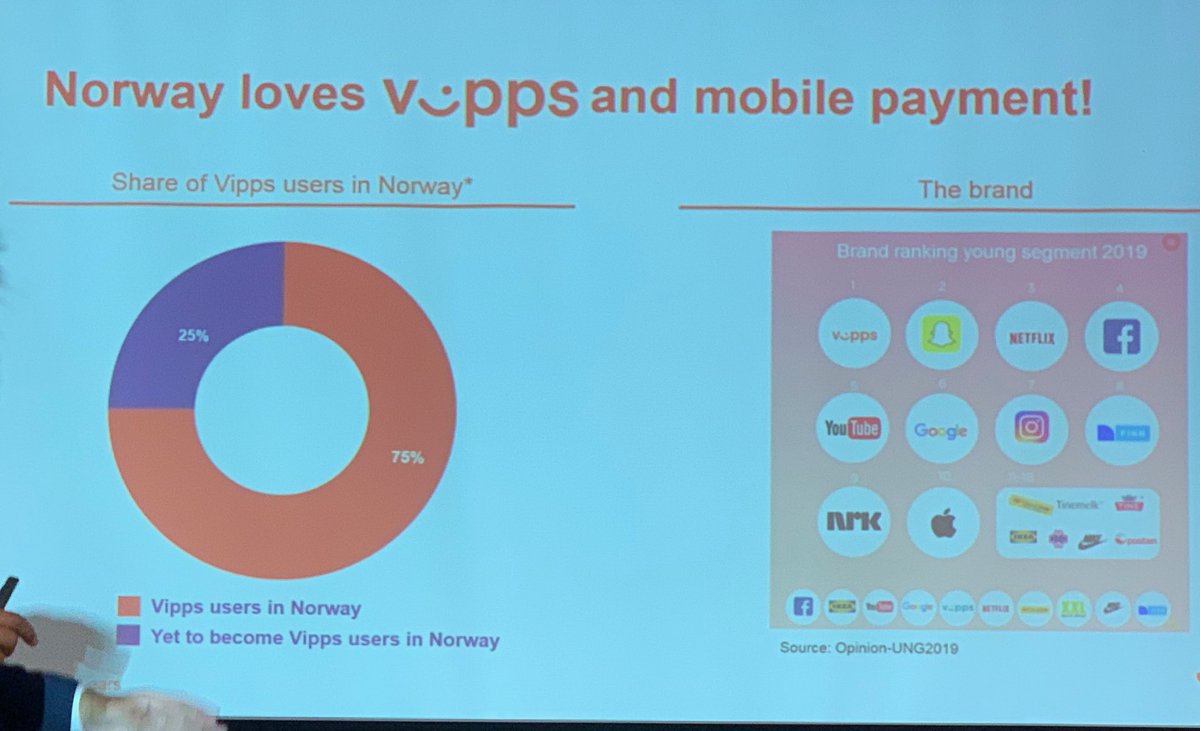

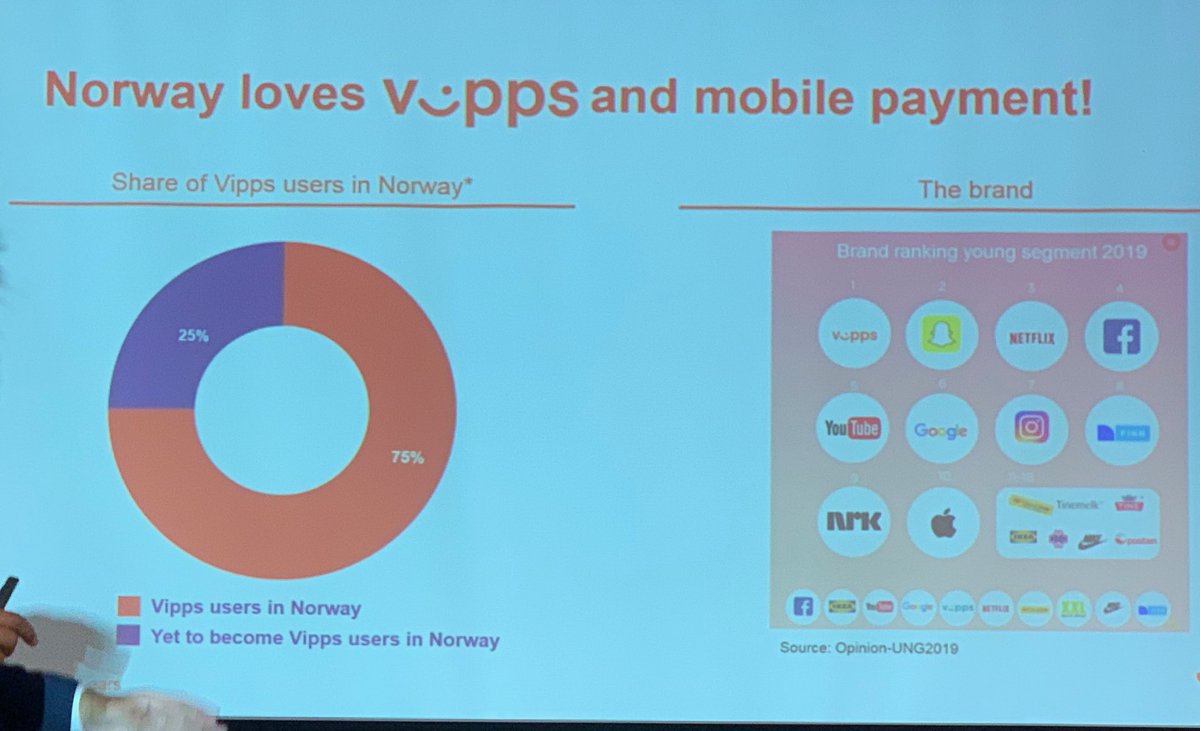

You will find it in the left hand menu. After three years, almost 3,3 million Danes have downloaded the app and MobilePay is now also available as a payment method for instore payments, in web shops and apps. With the new partnership, Nordea will leave the Swipp collaboration and will in future instead invest in the further development of MobilePay. Du trenger kun å taste inn mobilnummeret ditt i de nettbutikkene som tilbyr Vipps som betalingsløsning. Vipps was released on the 30th of May 2015 and by the 5th of November 2015, had become the largest mobile payment app in Norway with more than a million users. Denmark's MobilePay - which ranks Norway's largest bank Nordea as a member - claims 3.

Next

Norwegian Bank Nordea Launches Facebook Messenger Payment Feature

What is a mobile payment? I apper vil du bli flyttet til Vipps når du legger Vipps inn som betalingsmetode. However, the service has struggled to gain ground in Norway against fierce competition from Vipps. Support og forbedringsforslag Har du spørsmål eller tilbakemeldinger, vennligst kontakt oss på contactcentre nordea. Vippser du mer enn 5000 kroner, blir du belastet 1% av beløpet. MobilePay er i dag en betalingsløsning, der kan bruges i flere tusinde fysiske butikker, onlinebutikker og i apps. Why pay with your mobile phone? And even though we might feel a bit dazzled by the speed of the development, one thing is for sure — change will never be this slow again! Under the agreement, the SpareBank 1 alliance will own 25%, the independent savings banks 12%, the Eika alliance 10% and Sparebanken Møre one per cent.

Next

UPDATE 2

As of today, Nordea and some other banks have joined MobilePay as distribution partners. Now, they can pay their e-invoices at any time and from anywhere, without leaving their favorite social media platform. The agreement is subject to approval from Norwegian authorities. The Vipps app currently has 2. In these countries, the registered users amount to 210,000 and 180,000, respectively. According to a statement sent to Bank Innovation today from Nets, the payment services powering this feature, John Sætre, head of consumer market services at Nordea Norway, stated: This is a new way for customers to pay, and if customers respond positively it will be natural for us develop this further… With this service, Nordea wants to make banking easier for customers.

Next

Another Major Bank Joins Vipps

Other banks expected to join MobilePay Other banks in Denmark, Norway and Finland are expected to join the partnership in the coming quarters. The Swedes put high trust in the payment systems and its actors which in combination with a strong technology-interest lead to a willingness to use mobile payment services. Under the agreement, the SpareBank 1 alliance will own 25%, the independent savings banks 12%, the Eika alliance 10% and Sparebanken Møre one per cent. Public awareness of the payment method is almost 100 percent and 5 million persons, more than half of the Swedish population, is enrolled to the service. A number of business solutions have been launched in these countries in 2016.

Next

UPDATE 2

Afhængigt af hvordan du er identificeret i MobilePay, kan du overføre op til 10. To sum up — it happens a lot in the mobile payments area! In Denmark, Norway and Sweden different domestic mobile payment methods are predominant. Up to 400,000 transactions are made every day. If you are a merchant or corporate with payment requirements or e-commerce needs towards the consumer or even other companies, Nordea is committed to meeting the expectations of both you and your customers. I disse videoer kan du se, hvordan du benytter de forskelige betalingsmuligheder. One of the long-term aims will be to enable Nordic personal users to make payments between MobilePay and Swish.

Next

MobilePay

Det er irriterende å måtte trykke på tilbakeknapp i navbar isteden for å swipe fra venstre. Vælg det beløb, du ønsker at overføre, og lav et swipe for at sende pengene. A year later they had 1. Mobilbank Bedrift er appen for din bedrift. In Digital Mailbox you can also receive account statements, annual statements and more.

Next

UPDATE 2

Open the app on your mobile. Up more than 6% to 365,000 transactions in September. Med Vipps på Nett, gjør du det enklere for kundene dine og optimaliserer kjøpsopplevelsen — null stress! Nordea has decided to join a partnership on MobilePay in Denmark and Norway. On that day, the number of transactions totalled 878,000. Nordea has joined Vipps and Danske Bank are not far behind.

Next