Profit and loss formula. Excel Profit and Loss Template 2020-01-11

Profit and Loss Important Formulas

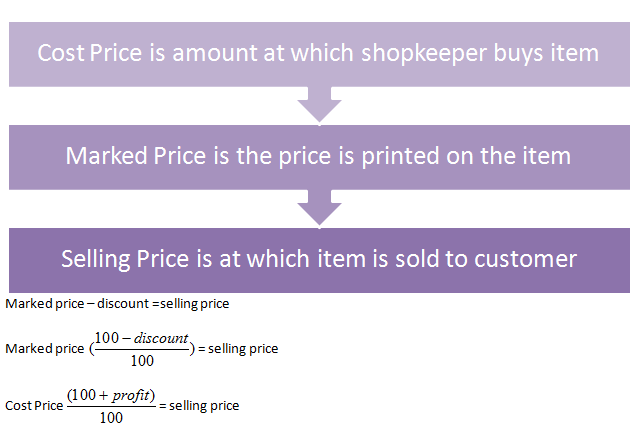

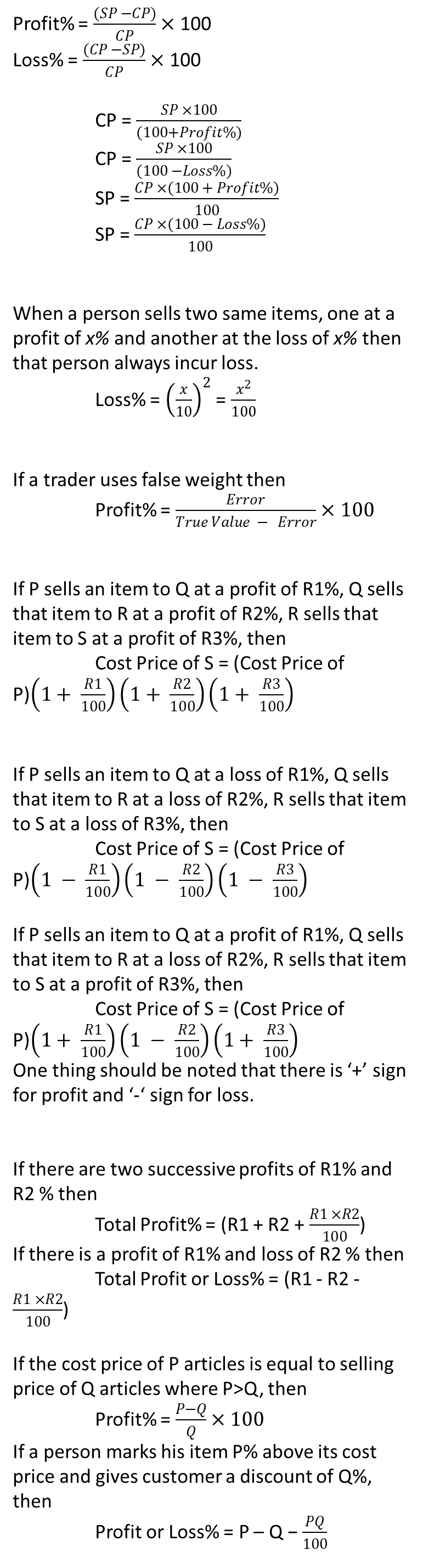

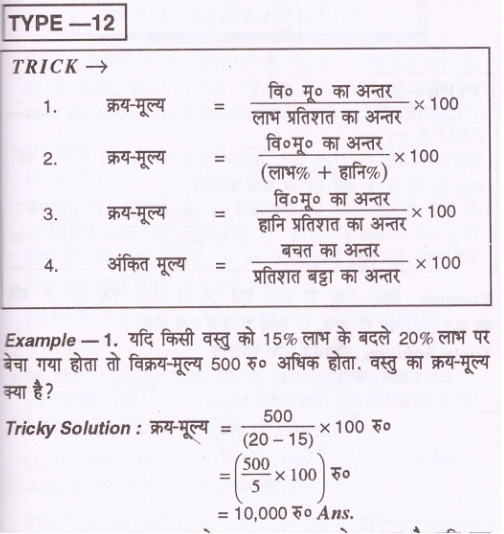

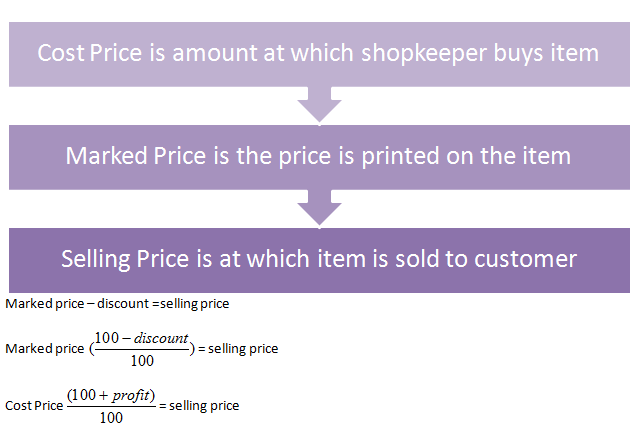

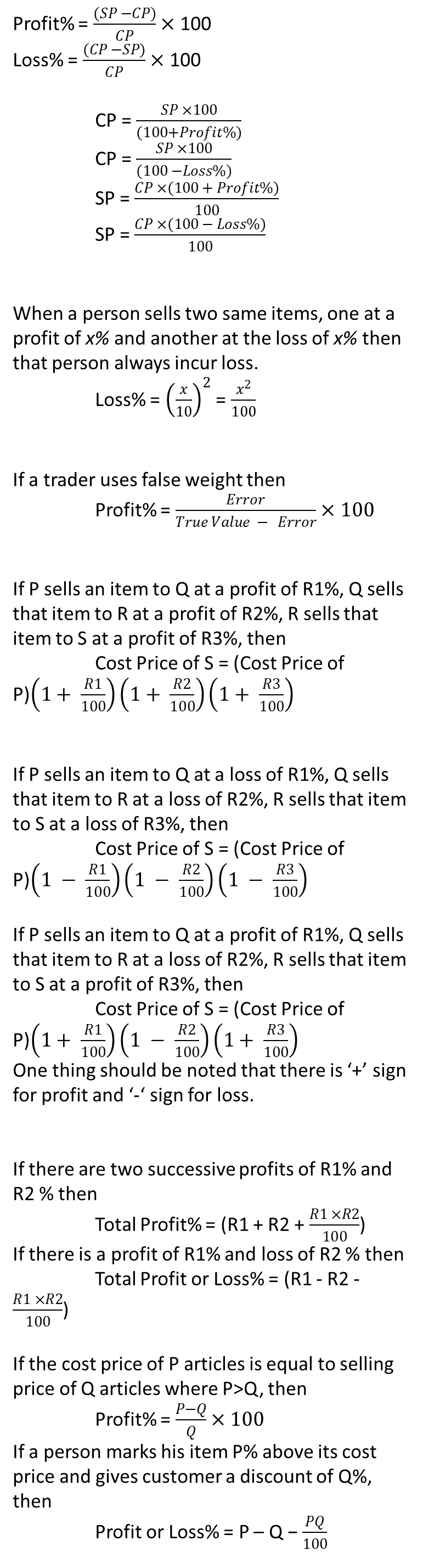

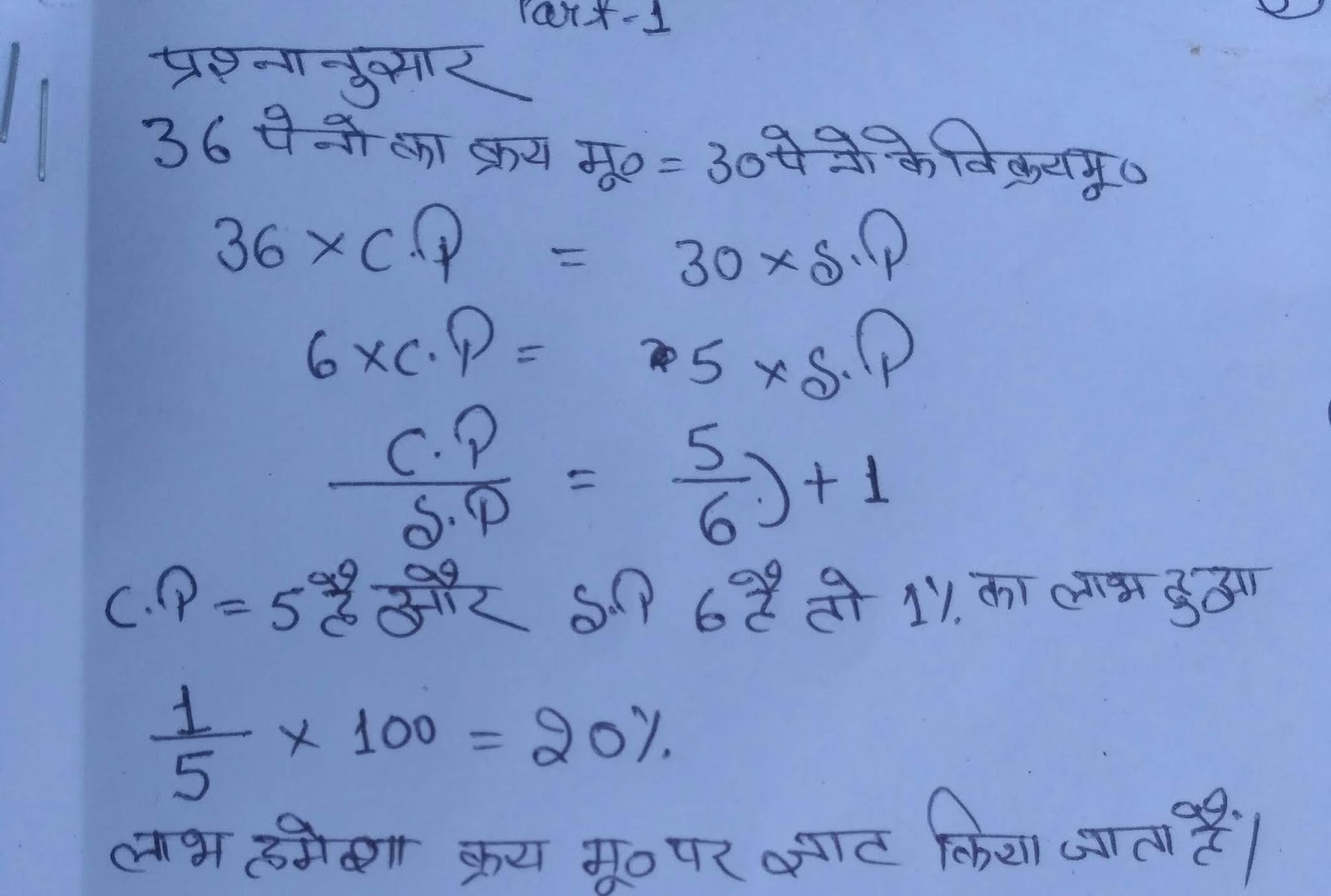

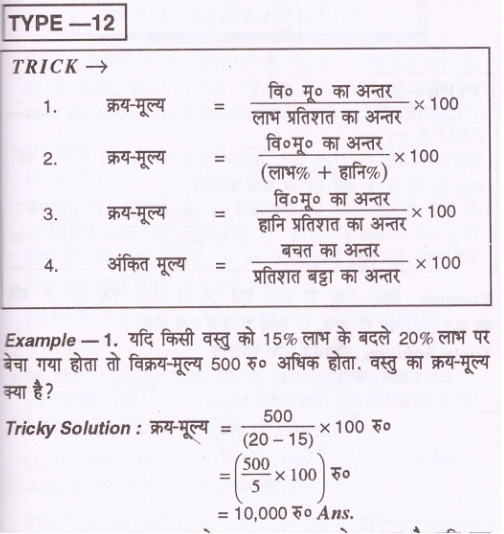

For more information on this, please visit my Bowraven website and go to my. Selling Price: The amount at which the product is sold Marked Price: The price mentioned by the shopkeeper more than the selling price, to give a discount to the buyer. This formula eliminates the effects of financing and accounting decisions. Some important profit and loss formulas are : Notations used in profit and loss: S. Successive Discounts In successive discounts, first discount is subtracted from the marked price to get net price after the first discount. You the table of contents given below to go through these articles. Each product or service in any business should make a gross profit.

Next

Profit and Loss Important Formulas

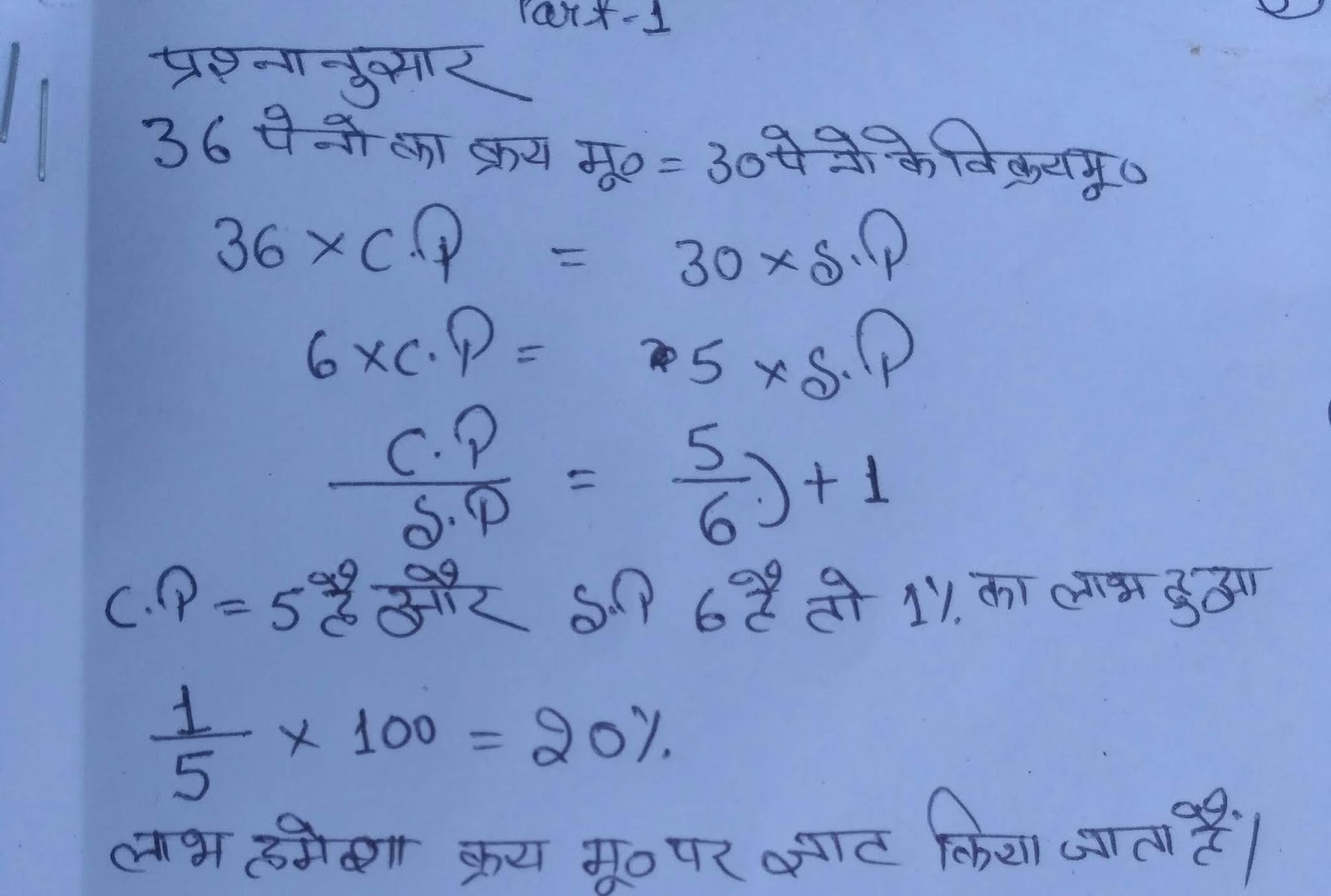

Knowing your business net profit and net profit margins will allow you to monitor how well the business is doing from one year to the next. Table of Contents: Profit and Loss Complete Lesson. If you want to understand what is profit and loss, it is important that you study before this, because profit and loss is primarily based on percentages. If the cost further increases by 20% but the selling price remains the same, how much is the decrease in profit percentage? The shopkeeper being greedy, mixed the two varieties of rice and sold the mixture at a gain of 16 %. The only time where a gross loss on a particular product or service is acceptable for a business is using it as a loss-leader.

Next

Profit and Loss Formula लाभ और हॉनि सूत्र Trick, Questions, PDF

Trading account for the month ended December 31 2017 Net sales 100,000 Net purchases 46,000 Beginning inventory 8,000 Ending inventory -9,000 Cost of goods sold 45,000 Gross profit 55,000 Again the trading account shows the gross profit of 55,000 the business made on the products it buys and sells. Profit and loss If selling price is more than cost price, profit gain occurs. Find the cost price if he incurred a loss of 7%. Taking this price as the new marked price, the second discount is calculated and it is subtracted from it to get net price after the second discount. Also, the loss can usually be used to be set against future business trading profits too. One such problem is where a stock count is not made at the year end.

Next

Profit and Loss

Revenue, or income, can be from operations or from sources not directly related to the business's primary activities. Do you need the shortcuts explained above as pdf document? It is easy to simply include costs and expenses that have been paid for in the accounting period. Find his gain or loss per cent. In addition to matching the costs or purchases that are directly related to the volume of sales, as demonstrated in the above example, business expenses also need to be accounted for in a similar way. Net profit after tax and the profit after tax formula… Net profit after tax is simply the net profit of the business after deducting the tax charge.

Next

Profit and Loss Formula with Excel Templates and pdf download

An example trading profit and loss account format is shown below. Before looking at profit margins, I want to look at a two important definitions… Net profit definition… The definition of net profit is the profit that remains after taking cost of sales, all operating costs, interest costs, depreciation and amortisation, taxation and dividends away from sales. What was the selling price? A lean business plan will normally include sales, costs of sales, and expenses. The next steps will vary based on whether you are using single-step or multi-step, but some elements are shared. When we define loss we are now looking at the amount of money that an organisation loses in a period instead of a profit.

Next

Profit and Loss Shortcuts Tricks Pdf

.gif)

Profit: If the selling price S. Having said that, there are many ways you can improve how you run your business to make a profit or increase your profits. Another way to describe gross profit margin is gross profit ratio. P Shortcut 7 : Selling price and loss percentage are given. The price at which any article is purchased is its cost price. Bookmark this page for getting more updates about Formula of Profit Percentage.

Next

Important Formulas (Part 1)

Discount is the rebate on marked price. Year to date profit and loss statement versus current month profit and loss account Most organised businesses track their month-by-month profit and loss accounts. A loss leader is where a product is given away for free or at a loss in order to gain further sales of profit-making products from the same customer. There is no escaping from profit and loss if you are appearing for. In the Excel template below I have created a gross profit calculator or gross margin calculator.

Next

Profit and Loss Formula in Maths

What was its original price i. Also, you can download this article in pdf format too: Finally please social share and comment below… If you enjoyed reading this article about profit and loss formula, please share. This page will assist candidates to Calculate Profit and Loss Percentage and you can get the complete Formula For Profit And Loss Percentage. In case of successive discounts a% and b%, the effective discount is: Example 13: An article is listed at Rs. Lastly, you will need to decide which one of two formats to use that comply with generally accepted accounting principles, either the single-step or the multi-step income statement. Taking each of these questions in turn… How do I run my business in order to make a profit? Q8 If a Book costs Rs. Bearing in mind 8 out of 10 small businesses fail within their first 12 months, and of the 2 that survive 50% of those do not survive the next two years.

Next

.gif)