Sales tax in bellevue wa. Seattle Tax Law Attorneys 2019-12-24

Sales tax on cars and vehicles in Washington

Keep in mind that the Department of Revenue may review and audit declarations of buyers and sellers regarding value of used vehicles sold with possible additional tax, interest and penalties as a result. Rates last changed: Monday, July 01 2019 Copyright © 2019 Sale-Tax. Read a full explanation of. Sales Tax States do it's best to make the most accurate geolocation for every zip code. Other penalties for fraud or serial offenses include higher penalties and even criminal charges.

Next

Bellevue, Washington Sales Tax

By continuing to run Internet Explorer 6 you are open to any and all security vulnerabilities discovered since that date. Use Tax Exeptions: If you buy a vehicle while on active duty with the military, you may be exempt from paying use tax. Washington has 726 cities, counties, and special districts that collect a local sales tax in addition to the. Applicable laws and regulations may vary by state and your specific facts or circumstances. So, clean your imported vehicles.

Next

Washington Sales Tax Guide for Businesses

The actual selling price may or may not be the same as the average fair market value in cases when an individual sells a used vehicle or vessel. A use tax is charged in the absence of a sales tax. The table below shows sales tax rates for all of the counties and the largest cities in Washington. A total penalty of 29 percent is imposed if the tax is not paid on or before the last day of the second month following the due date. Whether you live in Seattle, Olympia or Vancouver, paying Washington car tax is an unavoidable expense. Amazon is headquartered in Washington state, where it also owns and operates several fulfillment centers and customer service centers.

Next

Bellevue, WA Sales Tax Rate

Dealers are required to list this amount on the window sticker. Lodging information Effective date Document January 1, 2019 April 1, 2017 pdf April 1, 2017 pdf April 1, 2017 pdf January 1, 2017 pdf April 1, 2016 pdf August 1, 2015 pdf July 1, 2015 pdf July 1, 2015 pdf April 1, 2015 pdf January 1, 2015 pdf April 1, 2014 pdf April 1, 2014 pdf January 1, 2014 pdf January 1, 2014 pdf April 1, 2013 pdf January 1, 2013 pdf May 1, 2012 pdf May 1, 2012 pdf April 1, 2012 pdf October 1, 2011 pdf October 1, 2011 pdf October 1, 2011 pdf July 1, 2011 pdf October 1, 2010 pdf April 1, 2010 pdf October 1, 2009 pdf January 1, 2007 pdf Feb 1, 2005 pdf Information and rates Complete list of. Maybe you are a business owner with a state sales tax dispute. Do you need a local Tax Lawyer in the Seattle or Bellevue area? Our Seattle Estate Planning Attorneys all have financial planning and tax backgrounds, and provide maximum value while considering your overall tax picture. These rates apply to the Washington taxable estate, which is likely less than the actual gross estate. If lower property taxes are something you are looking for, Washington may be the state for you. The information contained herein is not for resale.

Next

Sales Tax in Washington State

Military personnel If you buy a vehicle while on active duty with the military, you may be exempt from paying use tax. Yes, the Department of Revenue uses exactly the same values as the Department of Licensing. You can read more about. Additionally, if you received a vehicle as a gift and can prove that the person who gave it to you paid sales or use tax when it was purchased, you won't have to pay any use tax. Please contact Sales Tax Accountants consultant to discuss the impact of this information on your particular situation.

Next

Seattle Tax Law Attorneys

Food and food ingredients are exempt, although prepared food and soft drinks are not. Seattle Times editors and reporters operate independently of our funders and maintain editorial control over Traffic Lab content. Now that sales tax is out of the way, you can get back to what you do best — running your business. Note: While we do provide a free consultation, this involves a review of your facts and circumstances to determine your viable legal alternatives. So if you sell an item to a customer through your online store, collect sales tax at the tax rate where your product is delivered.

Next

Business Taxes

Tax Jurisdiction Sales Tax Washington State Sales Tax 6. How to Collect Sales Tax in Washington Washington is a. We are happy to provide such services on an hourly basis, with a minimum overall charge. Some rates might be different in Bellevue. Invasive species can take a toll not only on the environment, but on the economy too. These exceptions include certain groceries, prescription medicine, sales to nonresidents and newspapers.

Next

Bellevue, WA Sales Tax Rate

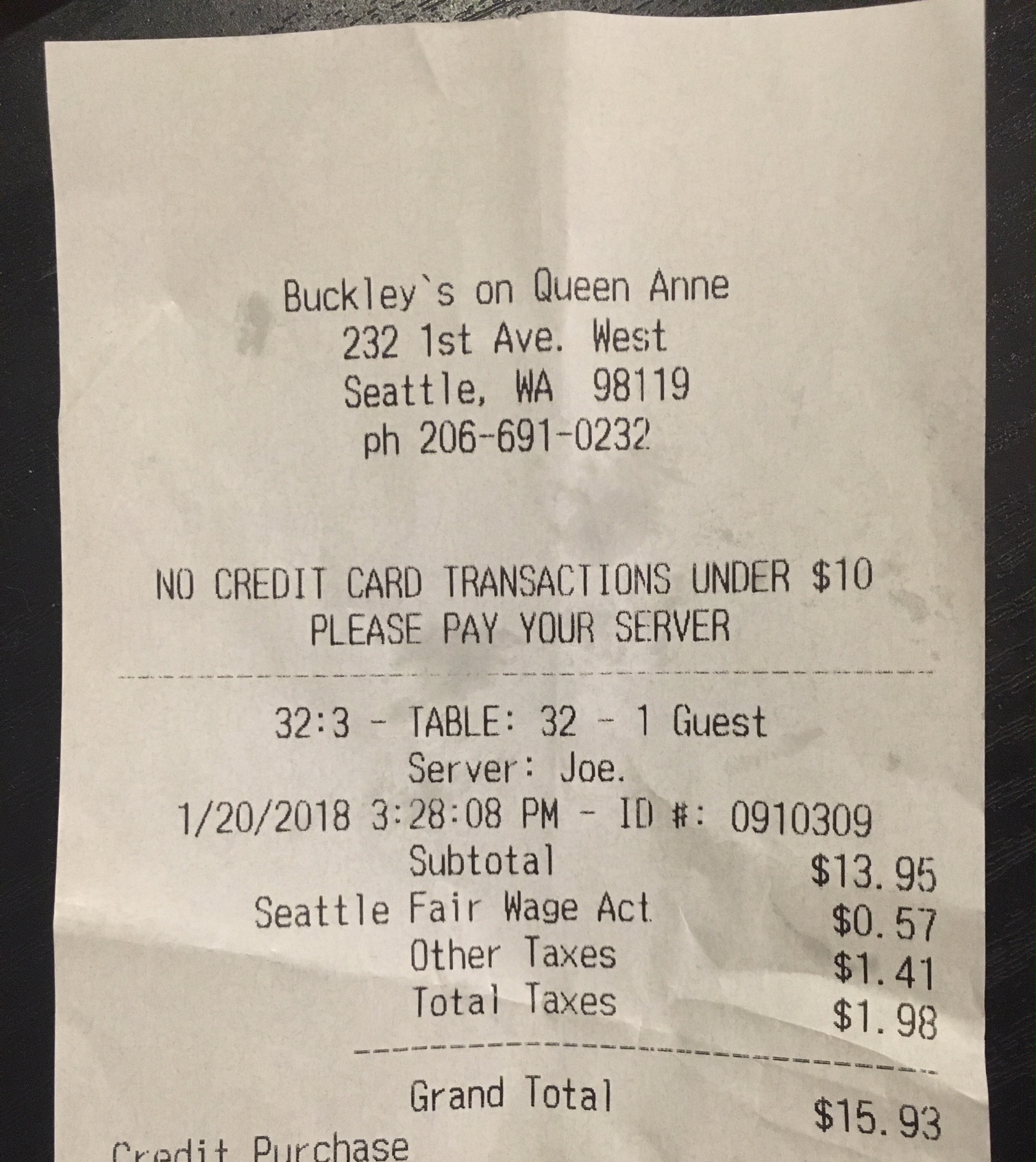

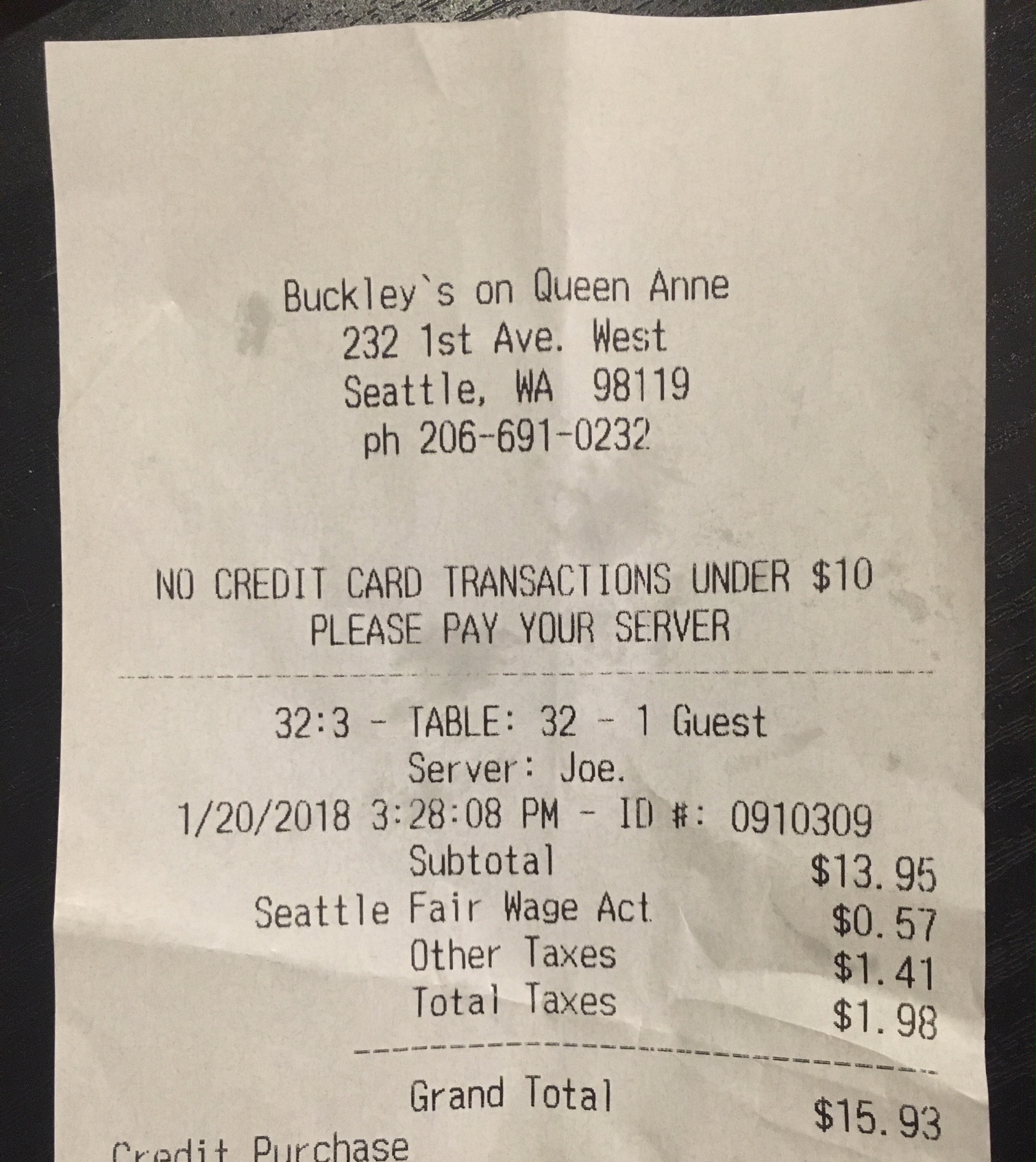

SmartAsset calculated the amount of money a specific person would pay in income, sales, property and fuel taxes in each county in the country and ranked the lowest to highest tax burden. Note that in some areas, items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. Counties and cities in Washington also collect sales taxes which apply to vehicle purchases and leases, so the total sales tax you pay will also include from 0. You have rights during every stage of your dispute, but you may lose these benefits if you do not act promptly. We then applied relevant deductions and exemptions before calculating federal, state and local income taxes. Show: Popular City Total Sales Tax Rate Sales tax data for Washington was collected from. If our Tax Lawyers cannot offer a comprehensive strategy to deal with your tax matter, you will owe us nothing.

Next

Local sales and use tax

The top rate is 10. We get average fair market values from Price Digests, an industry standard source. According to Washington you will pay tax on shipping. Commuter-train stations and capacity would be added on the south Sounder line, along with park-and-ride stations and an Interstate 405 bus-rapid transit corridor. You can find these fees further down on the page. Finally, we created the Tax Burden Index in order to show how each county in the country compares to the county with the lowest tax burden that is the county with a Tax Burden Index of 100. How often you are required to file sales tax in Washington follows this general rule: Click here for more info on.

Next