The great depression. Great Depression History 2019-11-22

ahintz.com: Great Depression, The: Mario Cuomo, Jonathan Towers, Charlie Maday: Movies & TV

Nonetheless, stock prices continued to rise, and by the fall of that year had reached stratospheric levels that could not be justified by expected future earnings. Created in 1913, the Fed remained inactive throughout the first eight years of its existence. Construction was virtually halted in many countries. In 1938, the Republicans made an unexpected comeback, and Roosevelt's efforts to purge the Democratic Party of his political opponents backfired badly. However, it is evident that the banking system suffered massive reductions across the country due to the lack of consumer confidence. In terms of the financial reform, since the recession, Hoover had been trying to repair the economy.

Next

Great Depression

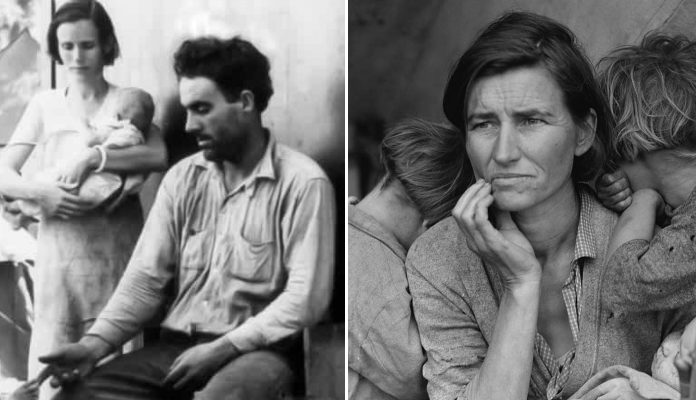

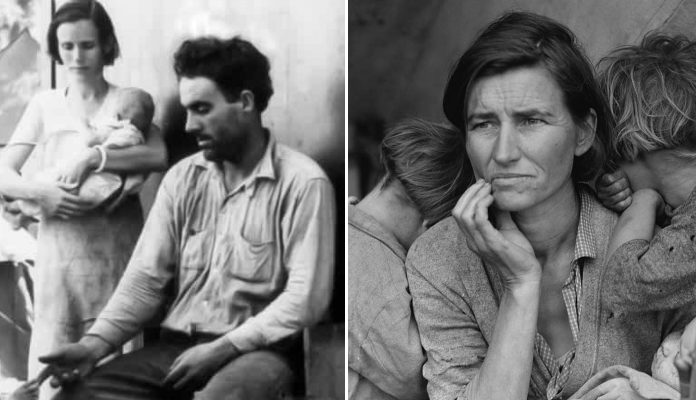

Millions were hired in the Great Depression, but men with weaker credentials were not, and they fell into a long-term unemployment trap. The market continued to suffer due to these reactions, and in result caused several of the everyday individuals to speculate on the economy in the coming months. In 1935, Congress passed the , which for the first time provided Americans with unemployment, disability and pensions for old age. The Depression had profound political effects. Banks had already closed due to cash shortage, but this reaction to the Check Tax rapidly increased the pace.

Next

The Great Depression Facts

A Reassessment of the U. By the end of 1938 reform had been struck down, as no new reform laws were passed. I would like to say to Milton and Anna: Regarding the Great Depression, you're right. Output had fallen so deeply in the early years of the 1930s, however, that it remained substantially below its long-run trend path throughout this period. There were mass migrations of people from badly hit areas in the the and the South to places such as California and the cities of the North the. The Journal of Economic Perspectives Vol.

Next

Effects of the Great Depression

Those hurt the most were more stunned than angry. The Dow would continue to decline for 3 years in the wake of these three disastrous days. As the Depression lingered and the New Deal failed to live up to people's expectations, some Americans fought back against a system they felt had betrayed them. Some have even argued that the Fed is the reason it became a depression at all, and that had they been more active and aggressive, it could have been held to a recession. The Great Depression began on 29th October 1929, when the stock market in the United States crashed. Loose money supply and high levels of by investors helped to fuel an unprecedented increase in asset prices. Numbers soon proved the optimists incorrect.

Next

Great Depression

The lead-up to October 1929 saw equity prices rise to all-time high multiples of more than 30-times earnings, and the benchmark Dow Jones Industrial Average increased 500% in just five years. Most people withdrew their cash and put it under their mattresses. It spread across the globe. The new Weimar Republic had weathered a period of intense inflation in the 1920s due to reparations required by the. Individual households were bankrupted as banks and lenders called in outstanding loans. Most did not experience full recovery until the late 1930s or early 1940s, however. Due to the inability to immediately determine current value worth these fire sales and short sales would result in massive losses when recuperating any possible revenue for outstanding and defaulted loans.

Next

The Great Depression: Crash Course US History #33

Ironically, it was that panic that led the government to create the Federal Reserve to cut its reliance on individual financiers such as Morgan. Deteriorating economic conditions in Germany in the 1930s created an angry, frightened, and financially struggling populace open to more extreme political systems, including fascism and communism. It had the greatest impact on the cities of the West Coast, especially Los Angeles, San Diego, San Francisco, Portland and Seattle. While the crash likely triggered the decade-long economic downturn, most historians and economists agree that the crash alone did not cause the Great Depression. An increase in the currency-deposit ratio and a money stock determinant forced money stock to fall and income to decline. Many Americans forced to buy on credit fell into debt, and the number of foreclosures and repossessions climbed steadily. American demands for loan repayment had disastrous repercussions for an already fragile German economy, with banks failing and unemployment rising.

Next

The Great Depression

Much of the stock market crash can be attributed to exuberance and false expectations. But all those threats diminished sharply after 1938. The Act was initially a way to protect agriculture but swelled into a multi-industry tariff, imposing huge duties on more than 880 foreign products. Federal deposit insurance was as-yet unheard of, so when the banks failed, people lost all their money. Most industrial growth, however, was geared toward expanding the nation's military power. Altogether about 400,000 Mexicans were repatriated. The Federal Reserve doubled reserve requirements between August 1936 and May 1937 leading to a contraction in the money supply.

Next

The Great Depression: Crash Course US History #33

This difference is because it was the first time that the general public, and not just the Wall Street elite, lost large amounts in the stock market. The Depression affected virtually every country of the world. Many cited economic concerns, fearing that immigrants would compete for jobs, which were scarce during the Depression. During the first 100 days of his administration, Roosevelt laid the groundwork for his New Deal remedies that would rescue the country from the depths of despair. The economy was never prosperous. It is precisely because of the shaky banking system, the United States was using monetary policy to save the economy that had been severely constrained. As the depression reached its nadir, though, it worsened significantly.

Next