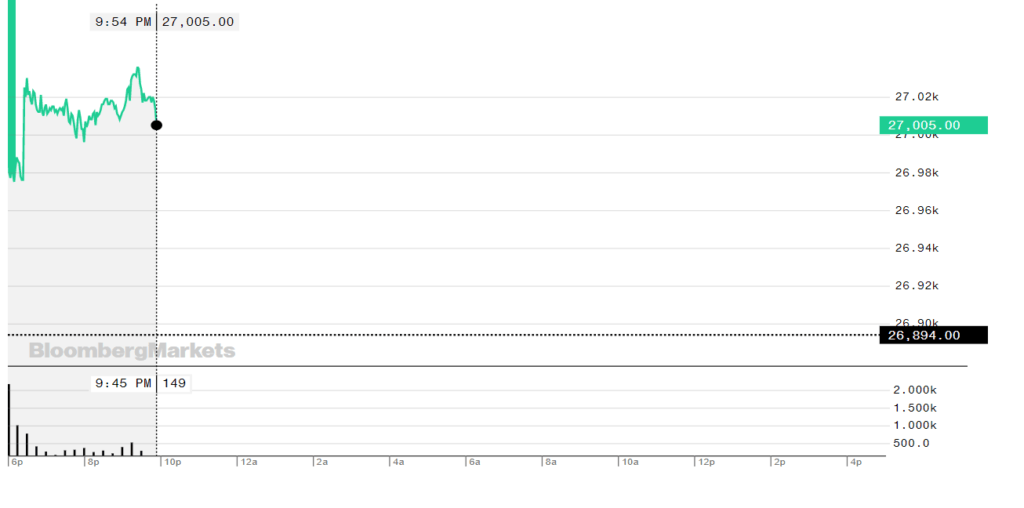

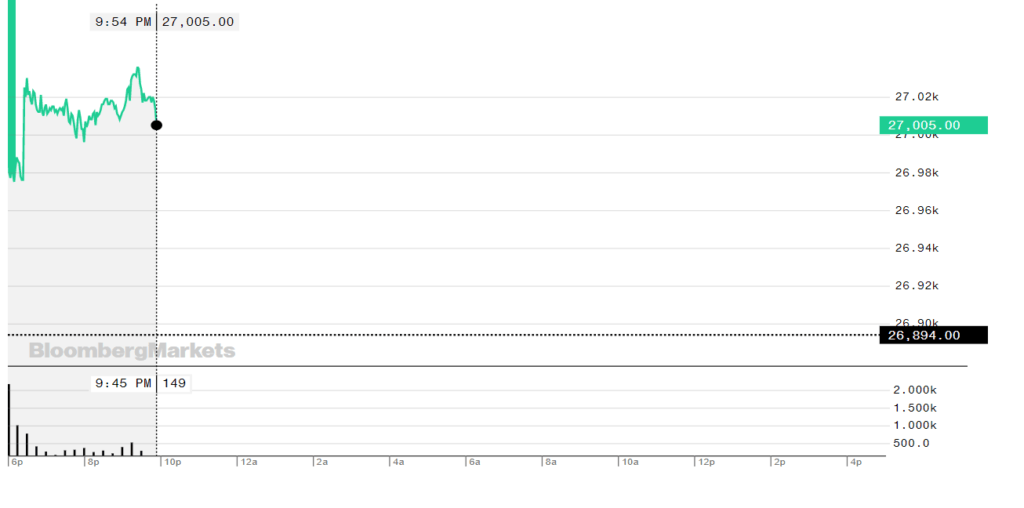

Us futures. Stock Indices Futures 2019-12-24

Stock Indices Futures

Two more awards are forthcoming. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit. Balance the current state of technology and the cash-flow requirements of the defense contractors providing the technology, that they become deliverable experiments, demonstrations, and prototypes, in an iterative process of acquisition. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. The virtual Soldier has a leadership role in an Army unit. » Not right for you? Robust infrastructure and straight-through processing.

Next

U.S. Treasuries

When you're ready, we can help you find a futures commisssion merchant or clearing firm to get you set up. To mitigate the risk of default, the product is marked to market on a daily basis where the difference between the initial agreed-upon price and the actual daily futures price is re-evaluated daily. Those that buy or sell commodity futures need to be careful. A good example is : The prototyping has been exceptional. Follow-up on Modernization reviews is forthcoming, on a regular basis, according to the G8.

Next

ahintz.com Futures

More typical would be for the parties to agree to true up, for example, every quarter. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website. It will allow units the repetitions necessary to accelerate individual skill and unit task proficiency for achieving and sustaining readiness. Our clearinghouse reduces your risk of counterparty default to nearly zero and, with around-the-clock market access, you can act on market-moving events as they happen. These reports are released every Friday including data from the previous Tuesday and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. That gives them greater potential for leverage than just owning the securities directly.

Next

ahintz.com

Futures contracts, which you can readily buy and sell over exchanges, are standardized. However, when the deliverable commodity is not in plentiful supply or when it does not yet exist — for example on crops before the harvest or on Futures or futures in which the supposed underlying instrument is to be created upon the delivery date — the futures price cannot be fixed by arbitrage. Some traders like trading futures because they can take a substantial position the amount invested while putting up a relatively small amount of cash. Initial margin is set by the exchange. For example, for most and contracts, at the expiration of the December contract, the March futures become the nearest contract.

Next

ahintz.com Futures

Innovative product solutions that minimize your total cost of execution. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract. This paper applies external sources to examine the evolution of liquidity in both cash and futures markets as well as other important factors such as settlement fails in cash Treasuries. Thus futures are standardized and face an exchange, while forwards are customized and face a non-exchange counterparty. This volatility means that speculators need the discipline to avoid overexposing themselves to any undue risk when trading futures. Thus there is no risk of counterparty default.

Next

Futures contract

Army Futures Command leads a continuous transformation of Army modernization in order to provide future warfighters with the concepts, capabilities and organizational structures they need to dominate a future battlefield. Financial Derivatives: An Introduction to Futures, Forwards, Options and Swaps. The commanding general is assisted by three deputy commanders. Note that F T,T should be the spot price of J at time T. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers. Nor is the contract standardized, as on the exchange.

Next

Futures & Options Trading for Risk Management

The current tests show the range has doubled. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity. Otherwise the milestone is planned, but not yet met at this time. Taxes related to these offers are the customer's responsibility. At this stage, one goal is to formulate the plans in simple, coherent language which nests within the national security strategic documents.

Next

United States Army Futures Command

Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. With many investors pouring into the futures markets in recent years controversy has risen about whether speculators are responsible for increased volatility in commodities like oil, and experts are divided on the matter. Boston: Harvard Business School Press. Plan out the detection, control and engagement; the sensors, the command-and-control, the fire control, and the weapons the kill vehicles. This could be advantageous when for example a party expects to receive payment in foreign currency in the future, and wishes to guard against an unfavorable movement of the currency in the interval before payment is received.

Next

NFA

The social utility of futures markets is considered to be mainly in the transfer of , and increased liquidity between traders with different risk and , from a hedger to a speculator, for example. Trading on margin increases the financial risks. For both, the option is the specified futures price at which the future is traded if the option is exercised. Five design vendors were selected, with downselect to two for prototyping by February 2020. Innovative We must create and cultivate a culture that front-loads smart risks through iteration and prototyping. The Budget Control Act will restrict funds by 2020.

Next

Index Futures

Clearing margins are distinct from customer margins that individual buyers and sellers of futures and options contracts are required to deposit with brokers. For information on futures markets in specific underlying , follow the links. In other words: a futures price is a with respect to the risk-neutral probability. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level. Expiry or Expiration in the U. Calls and options on futures may be priced similarly to those on traded assets by using an extension of the , namely the.

Next