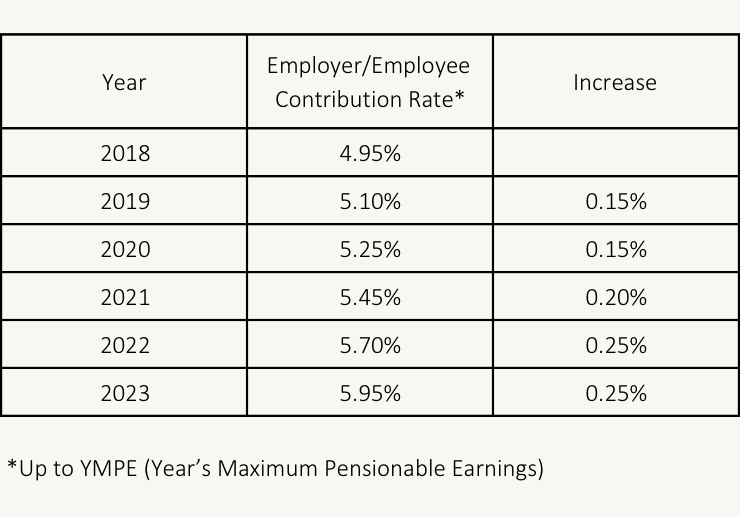

What is maximum cpp. Maximum pensionable earnings for 2019 and other CRA updates 2020-01-24

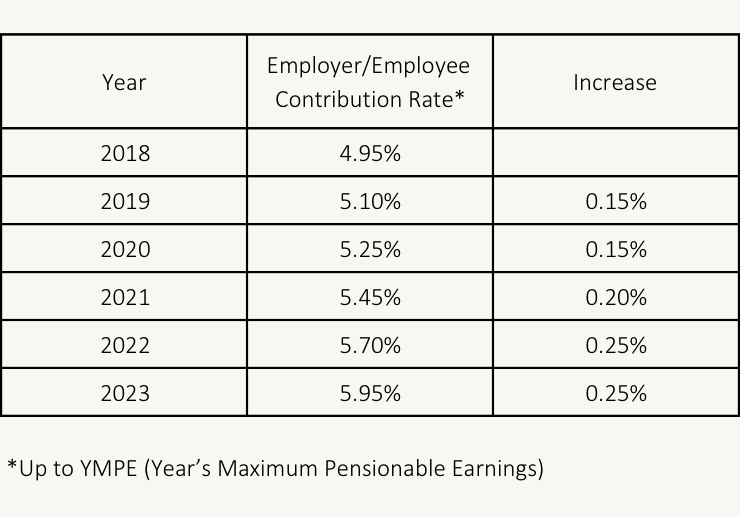

Year's Maximum Pensionable Earnings (YMPE)

Our Invest and Smart Savings products are offered by Wealthsimple Inc. Living in Alberta and working for a government organisation she also thought she might have contributed to something called the Alberta Pension. In my case, I am 61 and retired at 58. He does charge a small fee. How much do I contribute? Did you receive more …less. I want to know from people how close was their estimate in your experiences.

Next

CPP Maximum Contribution Climbs Higher in 2018

This means that the current rules will always provide you an income every month of your life, and will even increase on an annual basis to protect your income against the inevitable inflation that will occur. My husband is about 4. Depending on the dollar amount of the pension they may not even take taxes. This letter informed me that Service Canada will not be able to process my file until I fill the preposterous questionnaires. You can apply for the Canada Pension Plan either or by mail. We know you get hit 60×0. Who cares where they lived before? Yes, to claim a reduced pension you must be a minimum aged 60 Normal age 65 for an unreduced pension.

Next

CPP contribution rates, maximums and exemptions

Of those 27 years, she was employed for 24 years and I believe but cannot prove that she also earned Ms for at least 18 of those 24 years. The survivor payments include a one-time payment to the estate of the contributor, as well as monthly payments to the spouse, or common-law partner, and to dependent children. I think you are correct when you suggest there will be little net benefit to her Richard There are limited situations when an agreement would prevent a credit split, and the best source of this can be found at: There are about 4,000 men each year who are in your and my position of losing much more as a result of the overlap of the credit split and the child rearing dropout provisions. I really appreciate you posting these comments as you appear to be someone with some experience in this. Dave If that was the basis of the original question, I agree that you would be mostly correct. Maybe we can go back for asylum I here they get twice as much as I get. Assuming that you continue to be disabled until age 65, it will automatically convert to a retirement benefit at that time, at a lower rate.

Next

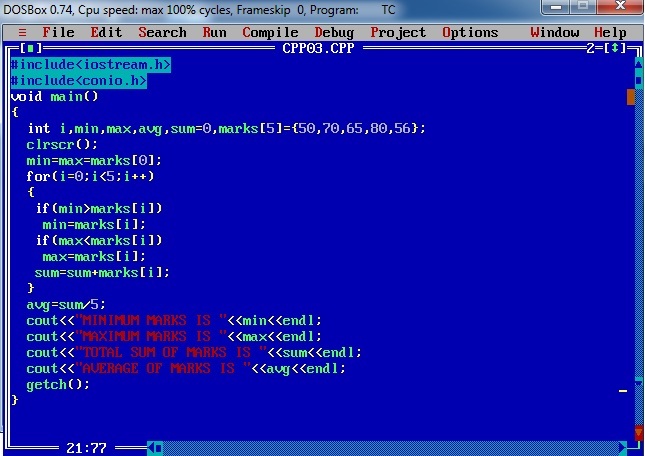

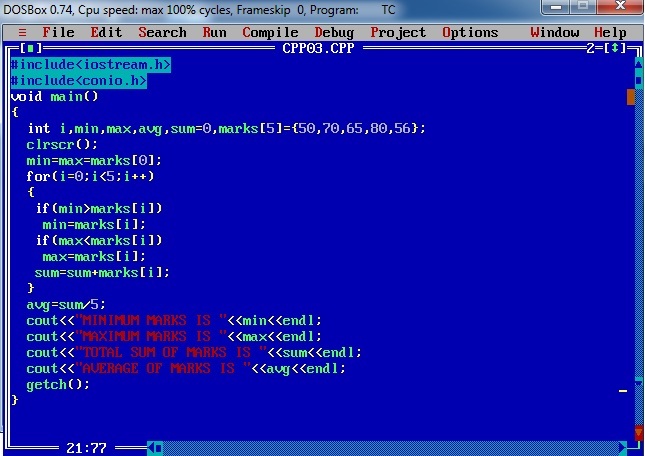

Canadian Payroll Legislation : CPP & EI deductions

I am already retired and my wife will retire next year. To do that, transparency is critical. You only need to work 6. Unfortunately including in your bogus example that the worker was from India and not a Canadian citizen does nothing to engender me to want help you. Attention Doug, Your posts are excellent. If your income is low then you may also be eligible for some guaranteed in come supplement. The next part of the estimate calculation is not quite clear, but it works out close.

Next

Discover, How much will CPP and OAS Pay You in Retirement?

I also traveled to Massachusetts to have another child in 1975. Thanks Doug for your kind response- you are right — when you call service canada they are unable to give the combined estimate but just a few approx figures- this is pathetic — I mean they should be able to give more specific amounts so seniors can prepare God forbid something dire were to occur to one. My ex worked during the early years but was at home from 1989 on. Thanks for all your help. Do you know if a Member of Parliament could help expedite the disability decision. We provide investment services through several affiliates.

Next

CPP Maximum Contribution Climbs Higher in 2018

On top of just working and contributing, the taxpayer must contribute the prescribed amount in each of those years. Thanks for the clarifications, Tom! The requirements under the social security agreements vary from agreement to agreement. When they calculated his pension they used the final 5 years of earnings, so his reduced income in 2015 resulted in a reduced pension. Have a look in the other posts, and come back for more. The innfo you have received is not correct. Will you be able to retire when you want to? Add up all the fractions and add that to your 24 Ms. Thank you for your comment on my case.

Next

What is the Maximum CPP Benefit for 2018?

You can calculate these partial amounts. Contributed the maximum from 1971 to 2000 30 years. Maybe you can write a post consolidating all regular sources of income for pensioners. It does not start automatically. In other words does accepting the initial lower age 60 amount then preclude your disability claim from proceeding. Thanks Sarah In answer to your questions: 1.

Next

Year's Maximum Pensionable Earnings (YMPE)

Have you had a lot of other people contacting you with a similar experience? Under the current legislation, the answer remains the same ie. I was at home with a child under the age of 7 from 1972-1992 in all 5 children. If you had 2 different social insurance numbers provide them both in your letter. What agreement are you referring to and what are you expecting to receive? I believe R means they refunded contributions because you over contributed based on your income and having no R means you contributed just the right amount based on your income. Thursday, February 08 at 12:54 am Irene Stratton: Many female seniors are single or divorced, without having a partner or significant other to help pay rent or another form of housing. I think I understand the process: contributions for both parties are combined for full calendar years spent together, then split evenly.

Next

What is the Maximum CPP Benefit for 2018?

If so, you can email be. The calculator will then forecast your future income based on the assumptions you entered earlier. In other words if you were working part-time you might want some years that were above average included and others which were below average excluded. If I have earnings over max amounts in one year and under in another, can this be averaged out? The standard age is 65, but you can either take a reduced benefit as early as 60 or an enhanced benefit as late as 70. I will try going through it again with actual numbers and let you know. This post may contain affiliate links. If you use those 9 years to calculate your retirement pension though, you can never get to a maximum benefit amount.

Next

Year's Maximum Pensionable Earnings (YMPE)

Jeff Kirshen is a founding Partner at Rosen Kirshen Tax Law. Not sure if my situation applies to other jobs such as cooks, drivers, etc. If you had any children during the period of marriage, the sad thing is that she may not even use the earnings that you lose, as she would likely be eligible for the Child Rearing Dropout for any periods while they were under age 7. When my sister and I got older, Mom worked the afternoon and midnight shift so that Dad was home with us. But, until politicians at the Municipal, Provincial and Federal levels are ready to start looking at them, there will be no change. Payments are based on your marital status and level of income.

Next