Winnipeg property tax calculator. Property tax calculator for Canada in 2019 2020-01-21

Property Taxes

This calculator is an estimating tool and does not include all taxes that may be included in your bill. While this shows a specific example, you may not find the same breakdown of tax levies where you live. We are California Licensed Real Estate Appraisers; however, we are acting as Tax Agents in this service. Down payment Down payment The amount of money you pay up front to obtain a mortgage. Mortgage default insurance is required on all mortgages with down payments of less than 20%, which are known as high ratio mortgages. To put it all together, take your assessed value and subtract any applicable exemptions for which you're eligible and you get the taxable value of your property.

Next

How are Taxes Calculated

Fractional interest: The fractional interest will be determined automatically by the Fair Market Value and Value Conveyed, and used to calculate the Land Transfer Tax payable. What Are Property Tax Exemptions? When you purchase a house, there are a number of costs you'll need to put cash aside for in addition to your down payment. Number of Years Enter the number of years you want to calculate property taxes. This is the ratio of the school rank to the combined crime rate per 100,000 residents. One important thing to know is that certain categories of property are exempt from property taxes. Type of home: When determining the size of home you can afford, it's important to look at the long term horizon.

Next

Property Tax Calculator

In our calculator, we take your home value and multiply that by your county's effective property tax rate. Disclaimer: Please note that we can only estimate your property tax based on median property taxes in your area. To mitigate your tax liability, it is important that you review your assessment and act on revisions prior to the deadline. Tax Appeal Consultants is a valuation service firm specializing in assessment appeal advocacy consulting. Your actual property tax burden will depend on the details and features of each individual property. For the latter group, this means funding all county services through property taxes. For state and local governments, property taxes are necessary to function.

Next

California Property Tax Calculator?

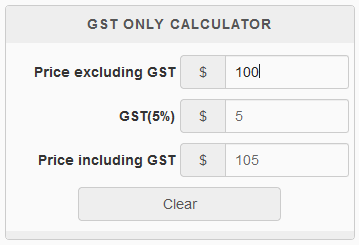

Please use if you want to fill your tax return and get tax rebate for previous year. The lender keeps that money and then pays the government on behalf of the homeowner. Please note that we can only estimate your property tax based on median property taxes in your area. Tax Rate The annual tax rate used to compute your property taxes Annual Increase If the assessed value is automatically increased and taxed on the increased value then enter that percentage here. Current and are listed below and check. When you a buy a house, condo or land in Manitoba you are subject to land transfer tax which is due upon closing.

Next

Property Tax Calculator

With an average effective rate of 0. Do you know what to do? Other people pay their property tax bill directly to the county government on a monthly, quarterly, semi-annual or annual basis. The proposed tax hike was tabled by the city's executive policy committee on Feb. Here is list of free to file your tax return. Another crucial term to understand is millage rates. Unfortunately there is no reliable state property tax calculator available online or elsewhere since tax rates vary from state to state and county to county within each state. Some states offer exemptions structured as an automatic reduction without any participation by the homeowner if your property is your primary residence.

Next

Winnipeg 2017 Property Tax Assessments are out!

Overview of Property Taxes Property taxes in America are collected by local governments and are usually based on the value of a property. You can hire an appraiser yourself to do a walkthrough of your home. All the separate tax levies are added and then applied to your taxable value. The mortgage rate you pay today could be substantially different from the mortgage rates available when the time comes to renew your mortgage. While some states don't levy an income tax, all states, as well as Washington, D. How you pay your property taxes varies from place to place.

Next

Manitoba income tax calculator

The California State Board of Equalization administers all of its various forms of taxes. We will try to do our best to get the new rates as soon as they will be published. Starting Year The starting year of the years you want to calculate. Longer amortization periods allow homeowners to make smaller monthly payments, but equate to more interest paid over the life of the mortgage. Our mortgage calculator contains Winnipeg current mortgage rates, so you can determine your monthly payments. This could be listed on your tax bill and in some cases this starts at the most recent purchase price. The calculation below shows how much of your mortgage principal will be left at the end of the term.

Next

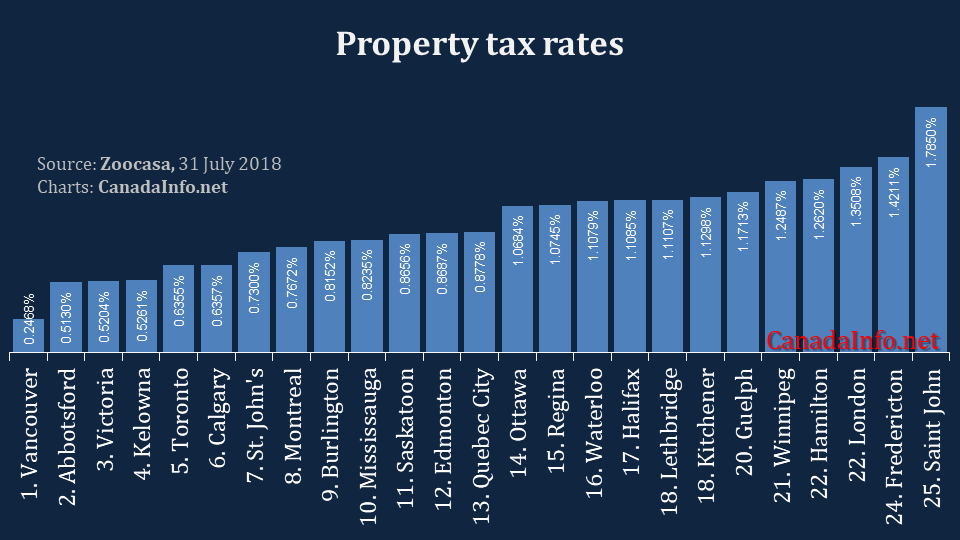

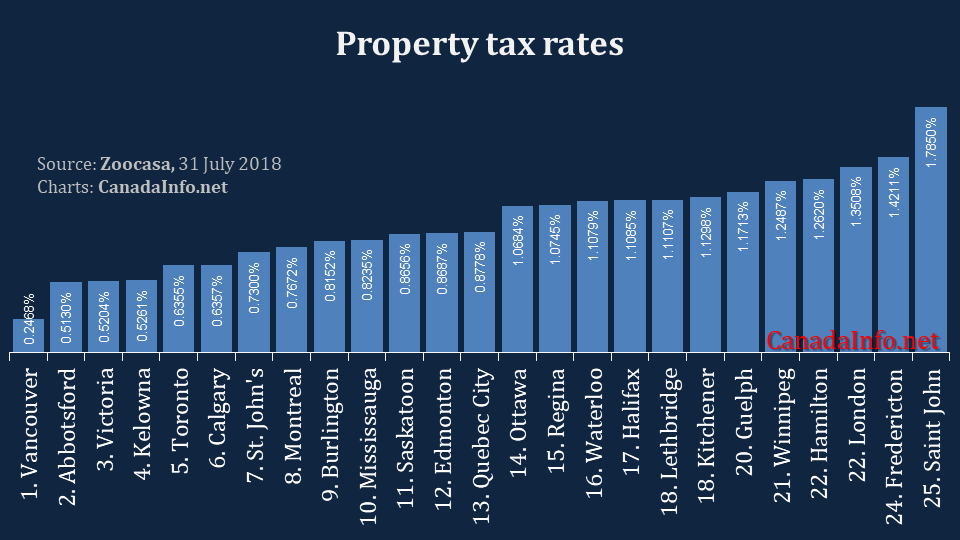

Property Taxes

The gives all the needed information about it. As of January 1st 2019, the rate are those of 2018, as none of the city as yet showed their new property tax rates. When you purchase a home, you'll need to factor in property taxes as an ongoing cost. States such as California increase the assessment value by up to 2% per year. Manitoba land transfer tax calculator Best fixed rates 2. While some states provide state funds for county projects, other states leave counties to levy and use taxes fully at their discretion. Please note that while we make every effort to ensure that this calculator is as accurate as possible, we cannot be held liable for the results of using this tool or the tax information provided.

Next