Ifrs 15. PwC HK: IFRS 15: Revenue 2020-02-01

IFRS 15 vs. IAS 18: Huge Change Is Here!

All readers are requested to pray for her. The information provided on this website does not constitute professional advice and should not be used as a substitute for consultation with a certified accountant. Regards, Akhil Hi Silvia, You have a talent in making standards easily understandable. Unbundling a contract may apply when incentives are offered at the time of sale, such as free servicing or enhanced warranties. This is especially true when low margin and high margin products are sold together in a bundle and allocating discount proportionately would result in the low margin product being sold at a loss. This includes partial sale transactions. Industrial sectors where long term contracts are common, will be the major affectees of the change including telecom, software houses and real estate and manufacterers.

Next

Revenue

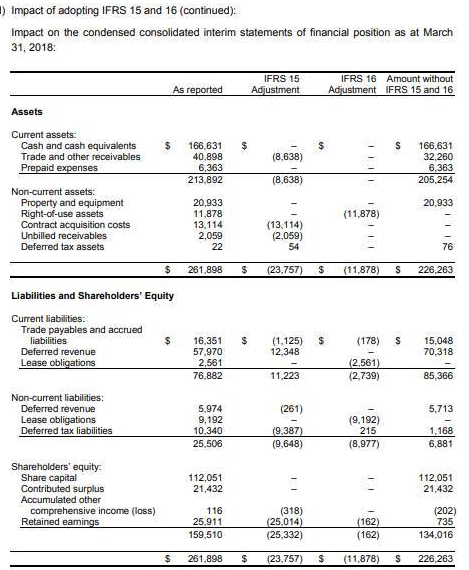

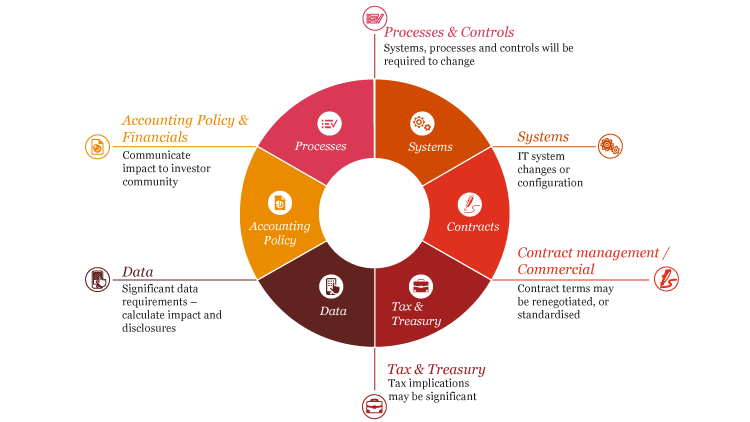

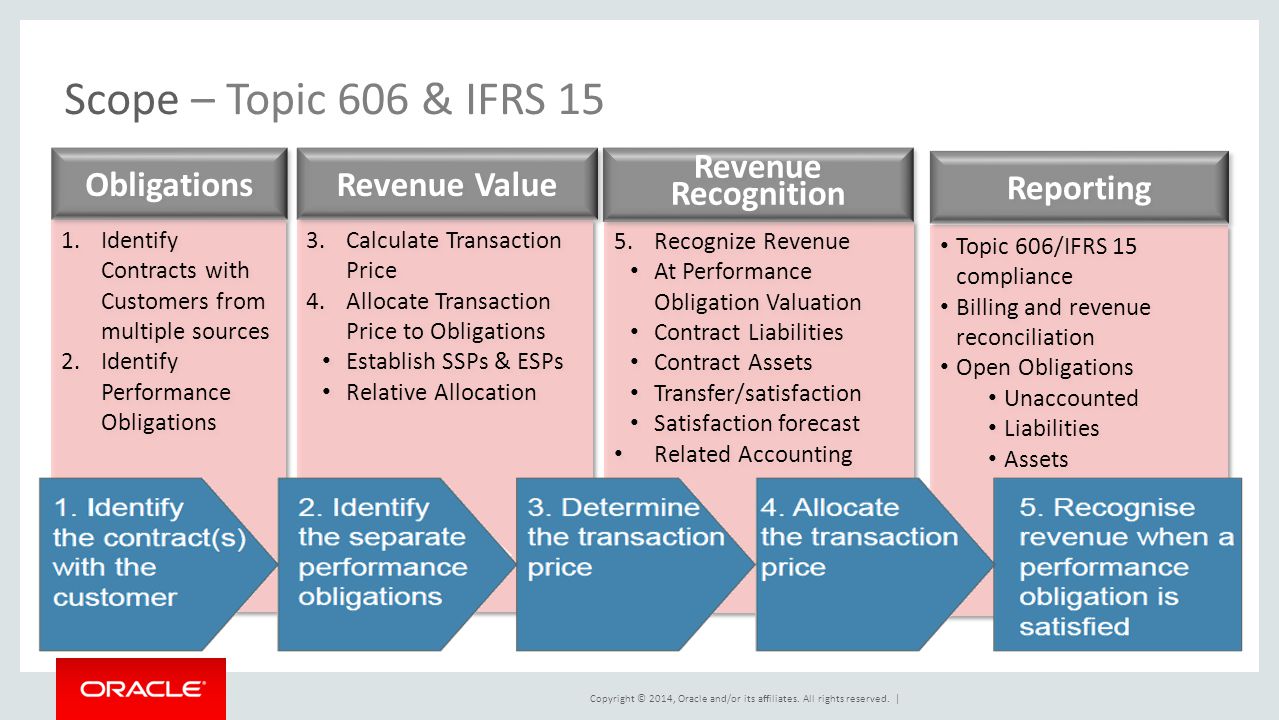

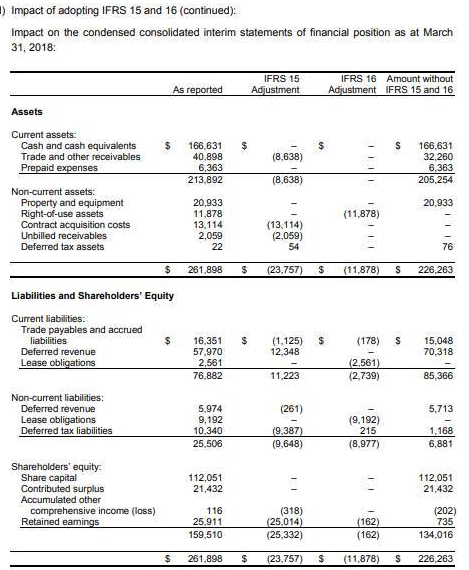

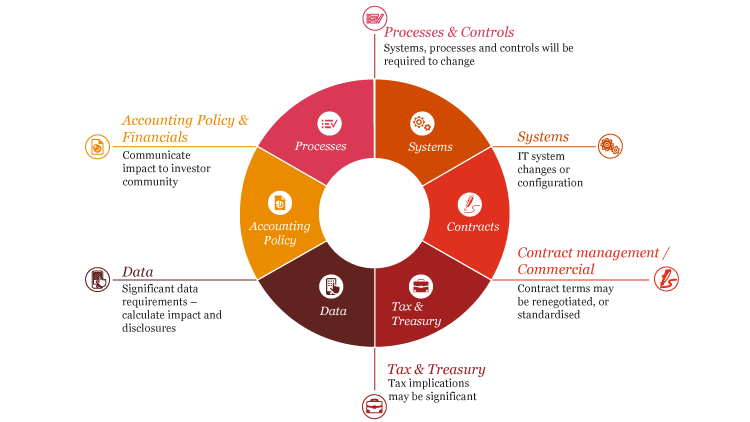

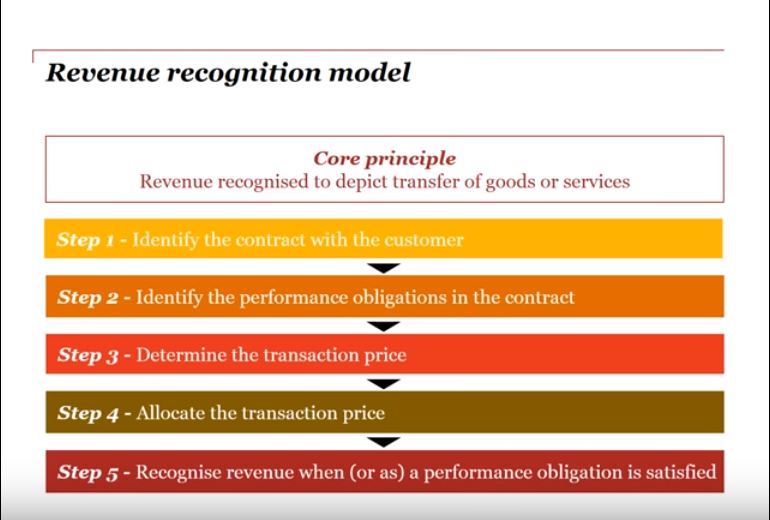

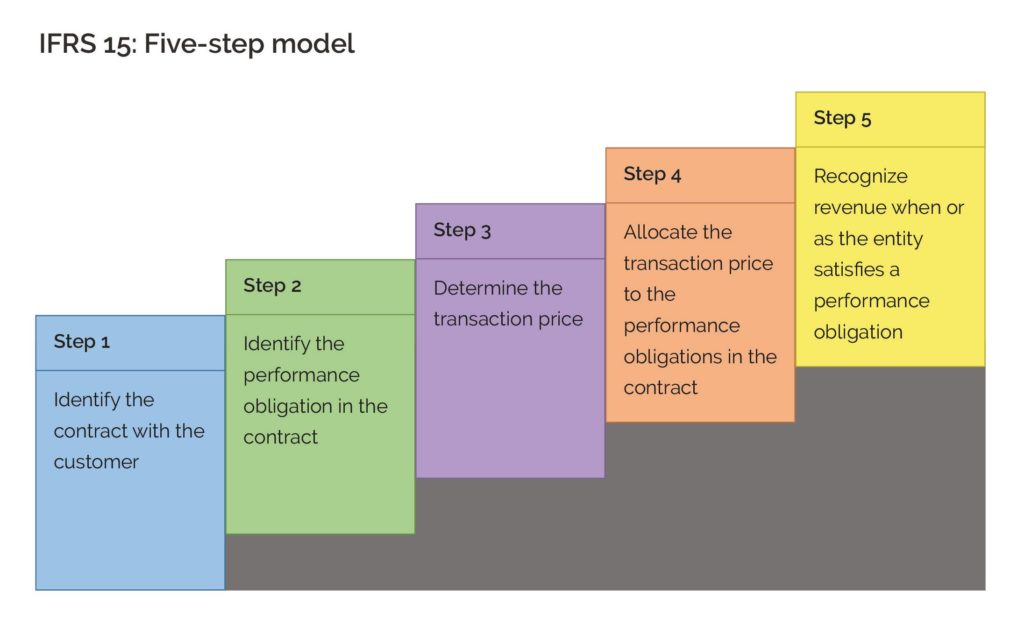

On 12 April 2016, clarifying amendments were issued that have the same effective date as the standard itself. Decisions should already have been made on which transition approach to adopt — retrospective or cumulative effect. Current guidance is unchanged except for losses on long-term construction- and production-type contracts, where an entity is allowed to determine the provision for losses at either the contract level or the performance obligation level. What do you think are the main impacts, and how will companies cope with this? How many contracts are there?. Thus, the stage of completion should be able to be valued reliably and the proportion of costs incurred for that specific accounting period has to be recognized. Now 90 days later another contract C is sold to the same customer which adds more products to contract A. Do they represent some transfer of good or service to a customer? Contact us on , by web chat, or at to get any documents from Company Reporting.

Next

IFRS

And there are couple of other things to watch out, like up-front fees, loyalty programs e. Regards, Irfan Hi Silvia, Your article is excellent. Also, as the rules are more detailed, the entities cannot interpret them in their own way as until now and as a result, financial statements will be more comparable among companies. Significant judgement is needed when a customer receives a gift card which can be used for purchases with various retailers. What factors should be considered? Whether the latter type of modification is accounted for prospectively or retrospectively depends on whether the remaining goods or services to be delivered after the modification are distinct from those delivered prior to the modification. For example, telecom companies recognized revenue from the sale of monthly plans in full as the service was provided, and no revenue for handset — they treated the cost of handset as the cost of acquiring the customer.

Next

Difference Between IFRS 15 and IAS 18

Revenue however cannot be artificially inflated as discussed in the section on. This is a common practice when nature of the business transactions are becoming more complex day by day. Under the new model, companies in telecom and software will probably recognize revenue earlier than under older rules. When making this determination, an entity will consider past customary business practices. If the client pays you the same amount as under cash price equivalent, then you should discount the amount to be received by the interest rate applicable for similar instruments in the market and recognize discounted amount as revenue.

Next

Revenue: Top 10 Differences Between IFRS 15 and ASC 606

It entered into a contract with a customer for renovation of an old house. They are long-term and reporting revenues in incorrect accounting periods might cause wrong taxation, different reporting to stock exchange and other things, too. As an accounting student, my knowledge is somewhat limited at the moment so I apologise if this sounds naive. These costs are not expensed in profit or loss, but instead, they are recognized as an asset if they are expected to be recovered the exception is the contract costs related to the contracts for less then 12 months. Customer credit risk As mentioned earlier, the transaction price is the amount of consideration to which an entity expects to be entitled. For example, are these papers delivered at 1 point of time and a client takes a control over them at the delivery date? I am still a student and we are currently undergoing a research on the impacts of the recent amendments on the software industry.

Next

Revenue

Hi Silvia, First of all thank you for your article. Interest, Royalties and Dividends In addition to the principle recognition criteria, the following should be considered for each type of revenue. The best way to determine a stand-alone selling price is simply to take observable selling prices and if these are not available, then you need to estimate them. May be i;m wrong but i seek your guidance on this matter. Certainly, the most significant difference to consider is the presentation of the revenues received from the customer. Specifically, variable consideration is only included in the transaction price if, and to the extent that, it is highly probable that its inclusion will not result in a significant revenue reversal in the future when the uncertainty has been subsequently resolved.

Next

IFRS 15 — Revenue from Contracts with Customers

Last updated: 26 July 2019 Contract asset Contract asset is recognised when a performance obligation is satisfied and revenue recognised , but the payment is conditional not only on the passage of time. For a contract that has more than one performance obligation, an entity should allocate the transaction price to each performance obligation in an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for satisfying each performance obligation. It also includes a disclosure checklist. But you cannot bill the revenue based on invoice as sale of handsets would be 0. But shortly to your questions: 1 you need to apportion the revenue to handsets based on relative stand-alone prices. Residual approach Under the residual approach, the stand-alone selling price is determined as the difference between the total transaction price less the sum of the observable stand-alone selling prices of other goods or services promised in the contract. If certain conditions are met, a contract modification will be accounted for as a separate contract with the customer.

Next

IFRS

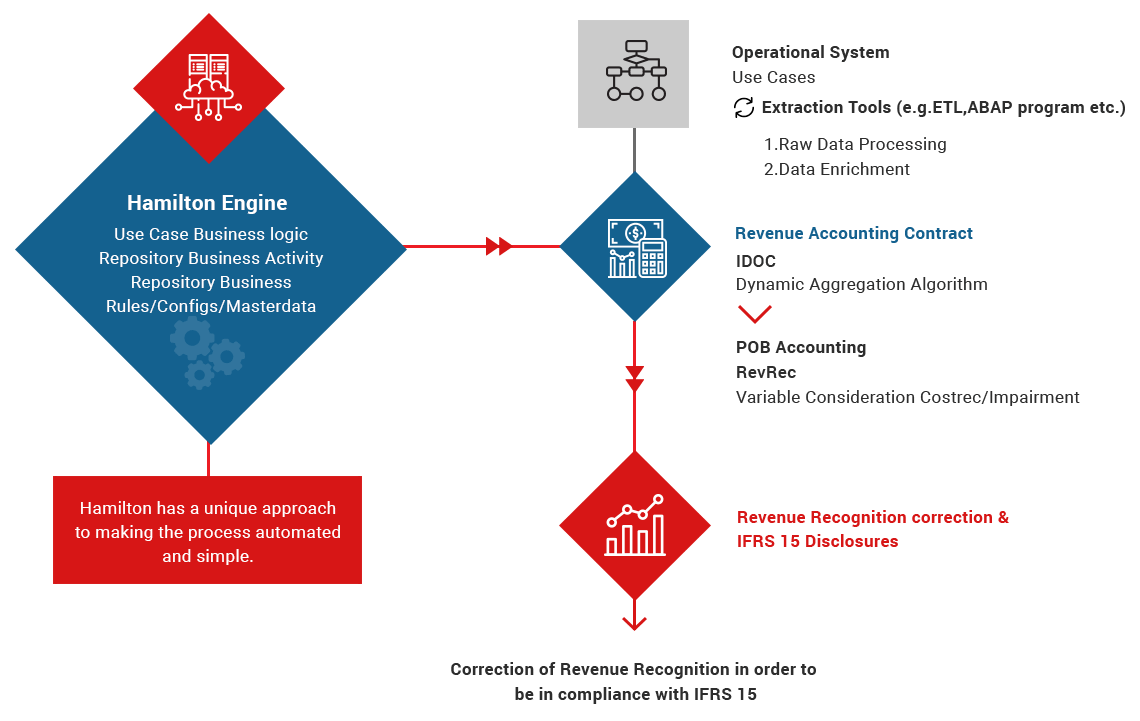

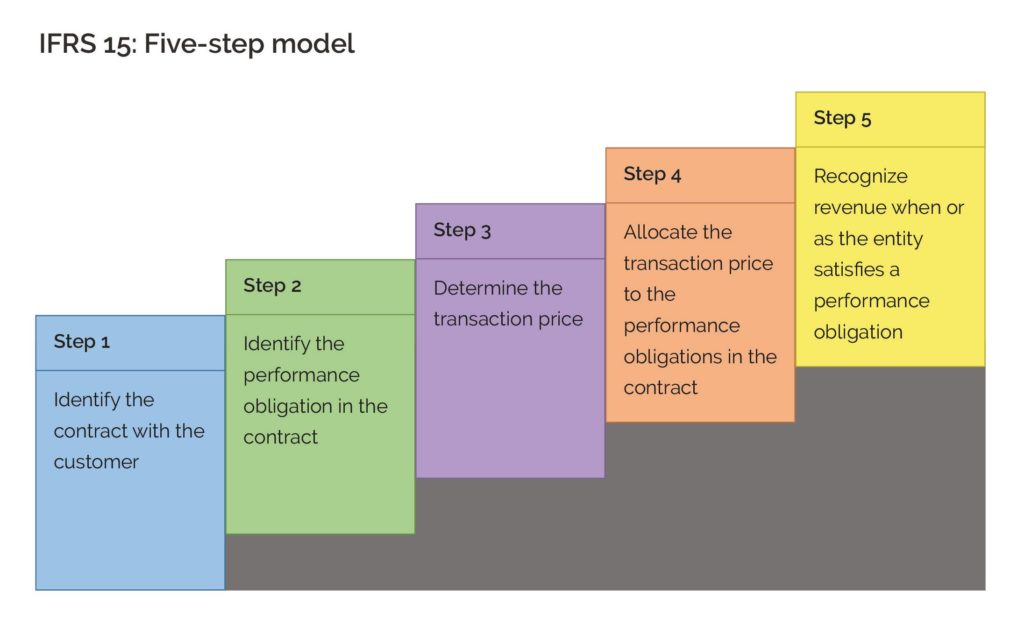

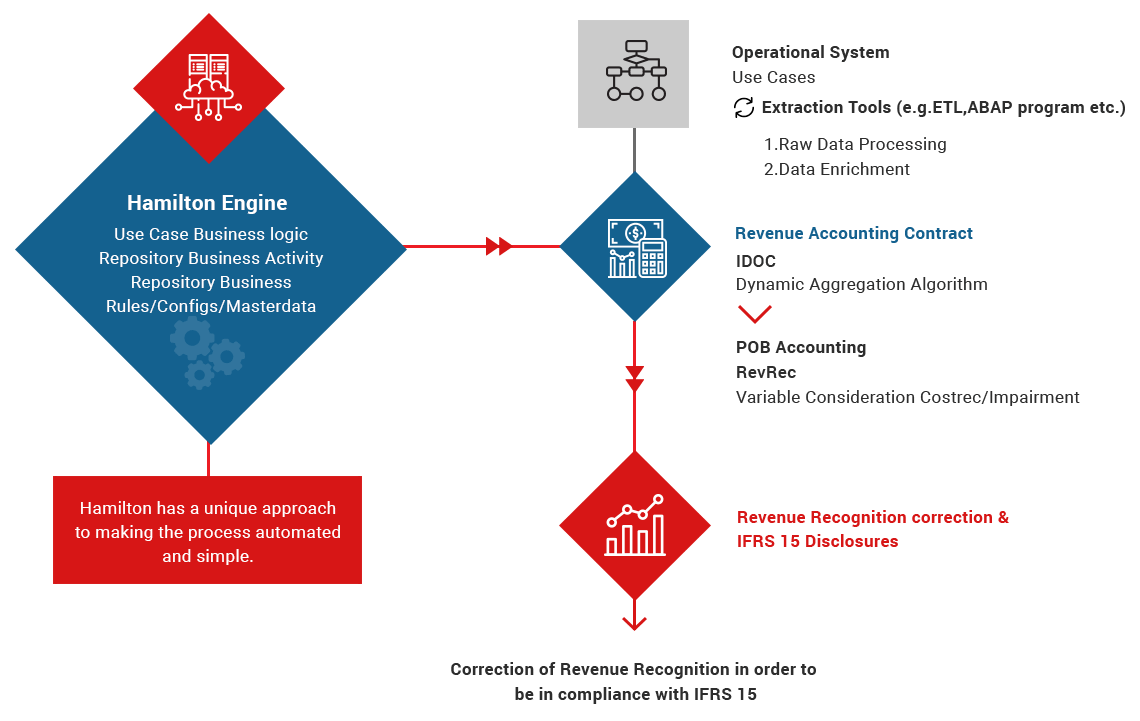

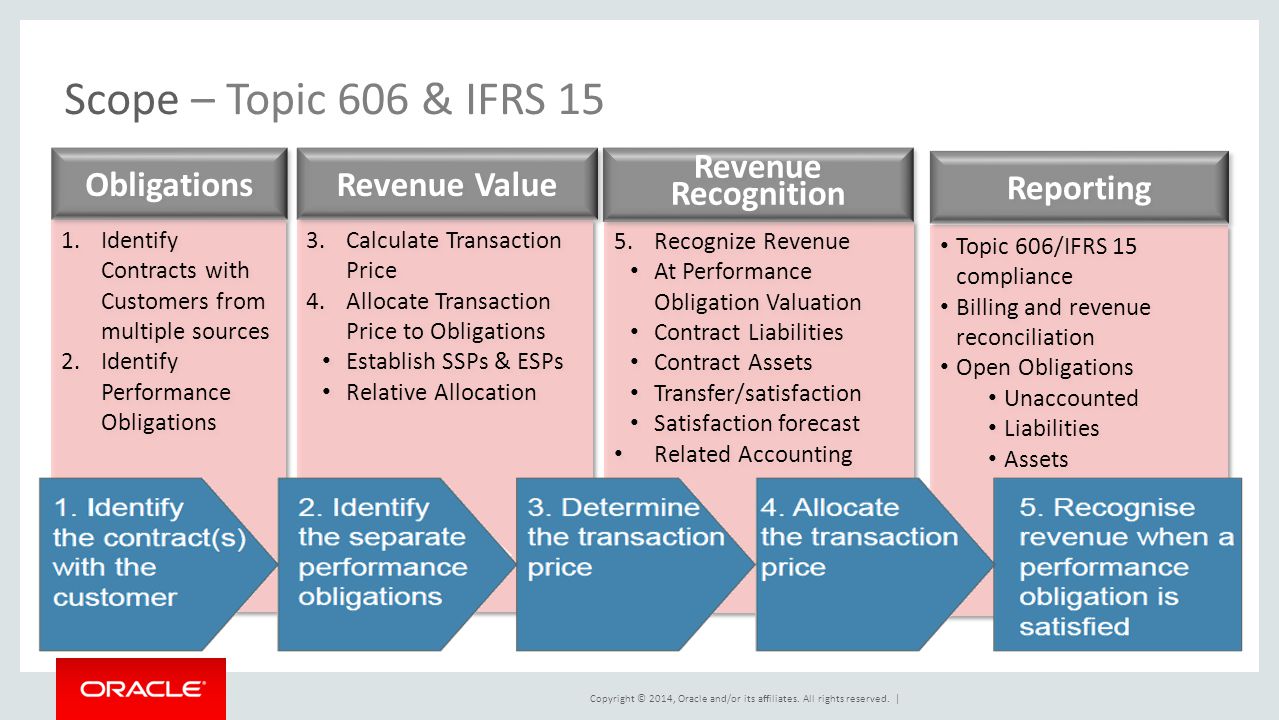

And once you decide how to recognize revenue for each type of contract that you have, then you need to implement this accounting process into your accounting software or system. Or are they internal costs in order to prepare for performance e. Step 3: Determine the transaction price. The existence of a significant financing component need not be explicitly stated in the contract — it can be implied by the payment terms. Policy election to present all sales and similar taxes on a net basis.

Next

IFRS 15

Unconditional right to payment may arise both before and after a customer is billed. Are you a construction company? The experts say that the most impacted industries are telecom, software development, real estate and other industries with long-term contracts. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. And only a small change in contractual terms decides whether to apply 1 or another approach. Please turn to someone from that company — hope they will be able and willing to help. Reporting Criteria Reporting criteria will be recognized based on the contract and performance obligation. Hi Mike, again, it depends on the terms stated in the contract.

Next

Revenue: Top 10 Differences Between IFRS 15 and ASC 606

For more on how Zuora RevPro can help, click. In certain circumstances, it may be appropriate to allocate such a discount to some but not all of the performance obligations. It therefore excludes the impact of customer credit risk. Are you making your plans to adopt or implement it? Noncash consideration, such as shares or advertising, is measured at fair value for inclusion in the transaction price. In case of doubt, the may be helpful.

Next