Nugt. NUGT: Quote and summary for Direxion Daily Gold Miners Index Bull 3X Shares 2019-12-11

Gold Miners Bull & Bear 3X ETFs

Exchanges report short interest twice a month. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance please visit the funds website at www. Percent of Float Total short positions relative to the number of shares available to trade. Your research might lead to a different conclusion.

Next

Direxion Daily Gold Miners Index Bull 3X Shares (NUGT) Option Chain

One cannot directly invest in an index. If Acquired Fund Fees and Expenses were excluded, the Net Expense Ratio would be 0. Active and frequent trading associated with a regular rebalance of a fund can cause the price to fluctuate, therefore impacting its performance compared to other investment vehicles. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the return of their underlying index for periods other than a single day. Direxion Shares Risks — An investment in each Fund involves risk, including the possible loss of principal.

Next

Direxion Daily Gold Miners Inde (NUGT) Stock Price, Quote, History & News

Direxion © 2010 - 2019. Sources: FactSet, Tullett Prebon Currencies: Currency quotes are updated in real-time. International stock quotes are delayed as per exchange requirements. For other risks including correlation, compounding, market volatility and specific risks regarding each sector, please read the prospectus. Direxion Funds Risks — An investment in the Funds involves risk, including the possible loss of principal. Source: FactSet Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Next

NUGT Stock Price & News

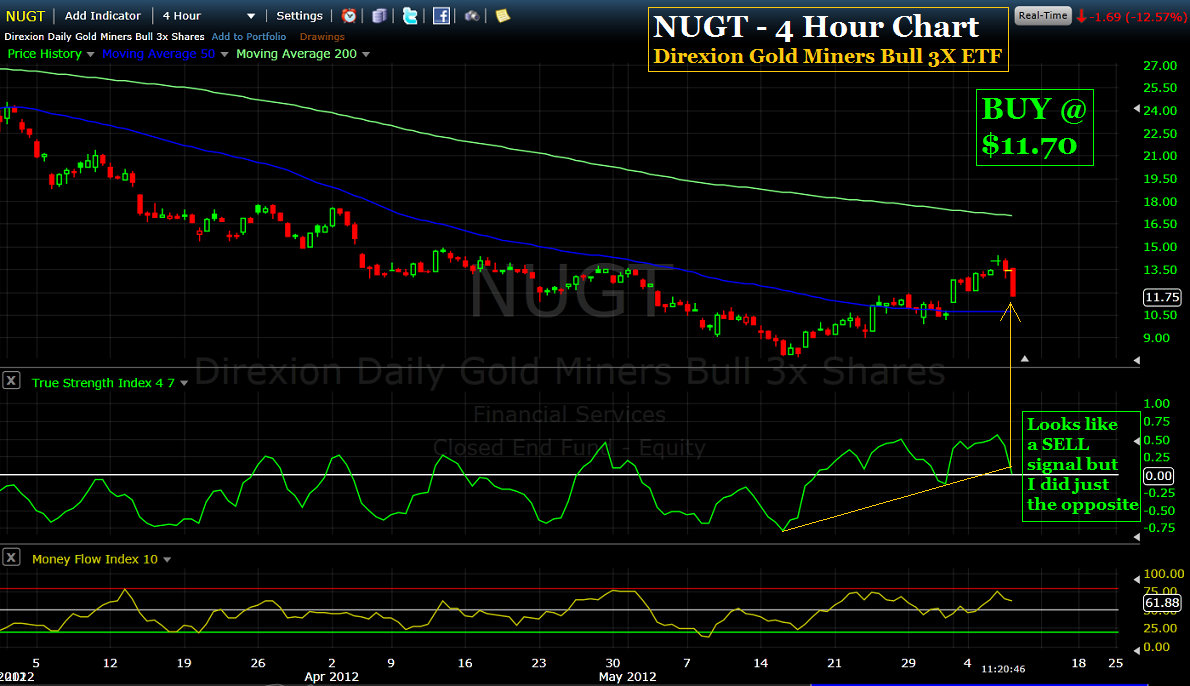

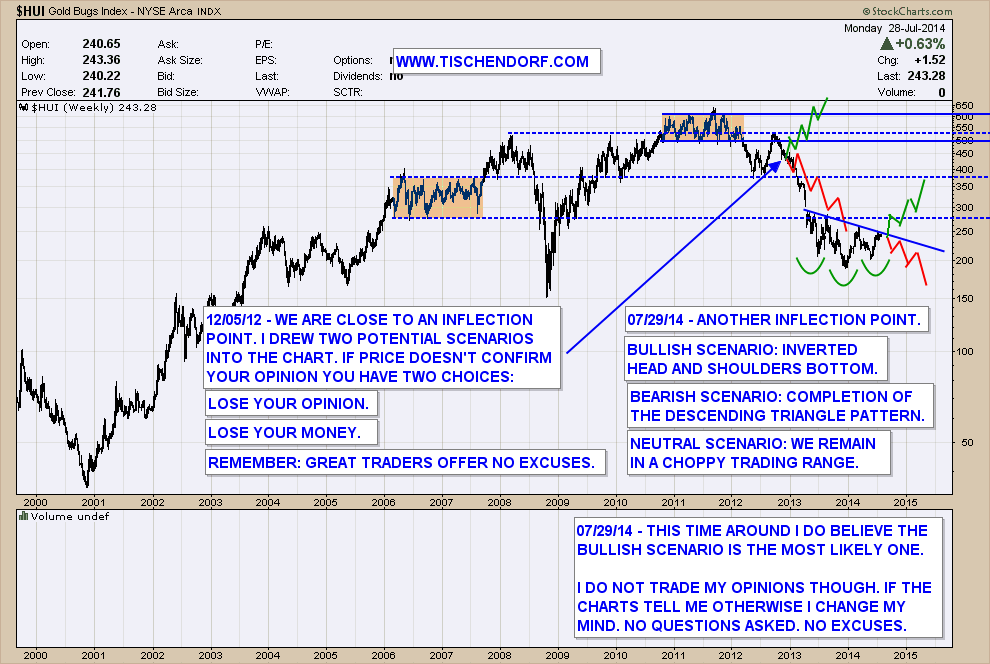

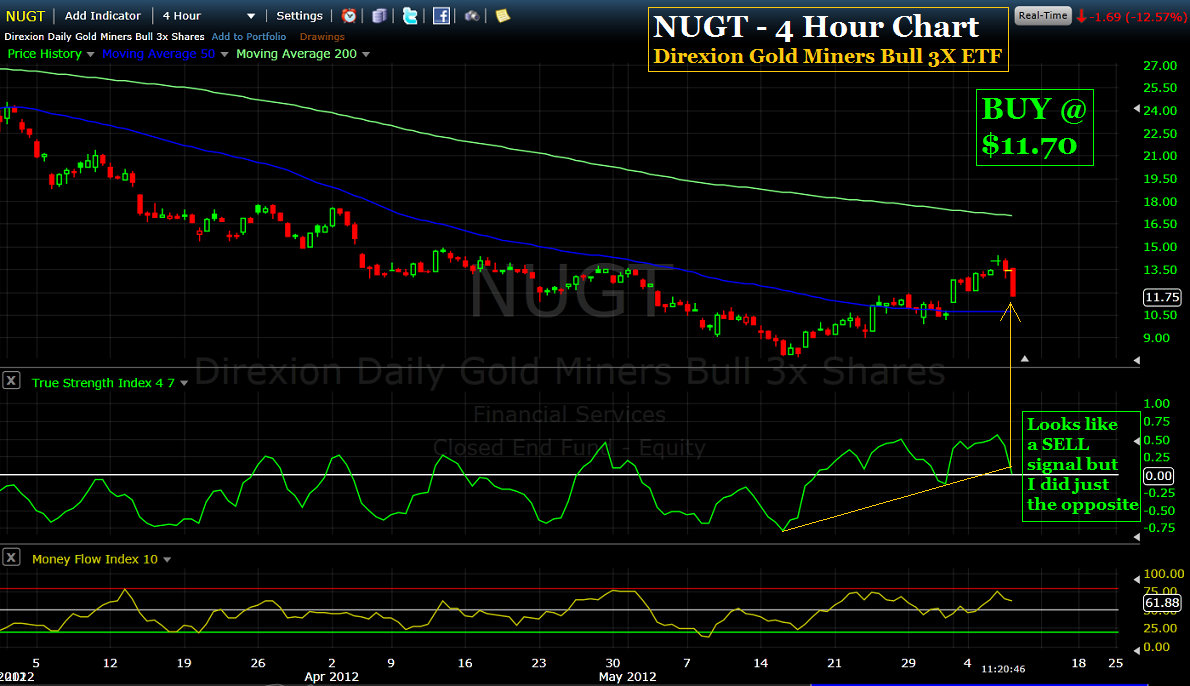

Returns for performance under one year are cumulative, not annualized. The investment return and principal value of an investment will fluctuate. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Intra day action still favoring the bulls but eyes wide open for an entry. Cryptocurrencies: Cryptocurrency quotes are updated in real-time. However, the expectation of a deflationary environment is based on my own research. .

Next

NUGT Stock Price and Chart — AMEX:NUGT — TradingView

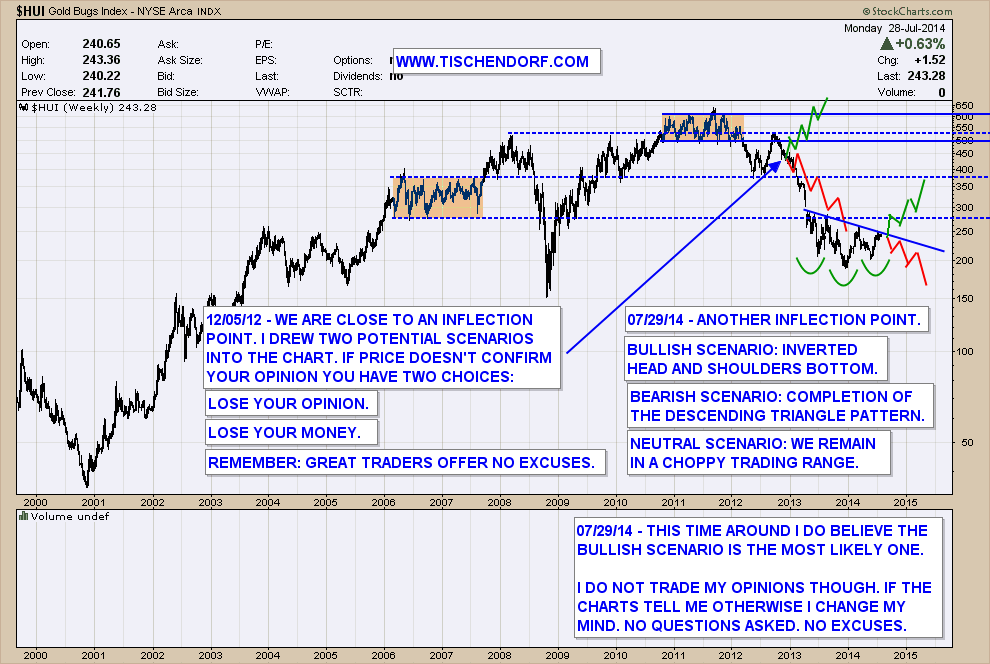

For instance, this fund attempts to track inverse the performance of the Gold Miners Index via , , , , agreements and similar exotic trading tactics. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, Valuation Time Risk, and risks specific to investment in securities in the Gold Mining Industry, including Emerging Markets Risk, Gold and Silver Mining Company Risk, Mining and Metal Industry Risk, and Canadian Securities Risk. The use of leverage by a Fund increases the risk to the Fund. This might seem impossible right now, but China having to contend with deflation at some point over the next several years is a very real possibility. Companies within the Direxion Group which do not carry out regulated activities in Hong Kong are not subject to the provisions of the Ordinance. FactSet a does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and b shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom.

Next

Gold Miners Bull & Bear 3X ETFs

Brokerage commissions will reduce returns. Sources: CoinDesk Bitcoin , Kraken all other cryptocurrencies Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Fundamental company data provided by Morningstar and Zacks Investment Research. Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. I think gold and miners ready for a little rally. Short Intrest The total number of shares of a security that have been sold short and not yet repurchased. Hard to be bullish at these levels, anyone agree? Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Next

NUGT

They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments. I see this going higher. Change from Last Percentage change in short interest from the previous report to the most recent report. Information herein is not intended for Professional Investors in any jurisdiction in which distribution or purchase is not authorized. That would increase the odds of this being a lower high. But the opportunity to take advantage of short-term trends is only won, if you get the direction right. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Next

NUGT Stock Price and Chart — AMEX:NUGT — TradingView

Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Our calculations are based on comprehensive, delayed quotes. Change value during other periods is calculated as the difference between the last trade and the most recent settle. We use cookies and browser capability checks to help us deliver our online services, including to learn if you enabled Flash for video or ad blocking. See table for 4 p. This Website is not directed to the general public in Hong Kong.

Next