Nwl stock. NWL Stock Price & News 2020-01-27

NWL

Coffee, Oster, Rubbermaid, Sistema, Breville, and Sunbeam brands. The technique has proven to be very useful for finding positive surprises. They made the same prediction in 2018. The Food and Appliances segment includes household products, including kitchen appliances, gourmet cookware, bakeware and cutlery, food storage and home storage products and fresh preserving products. The company was founded in 1903 and is based in Hoboken, New Jersey. For the last week, the stock has had daily average volatility of 3.

Next

NWL Stock Price & News

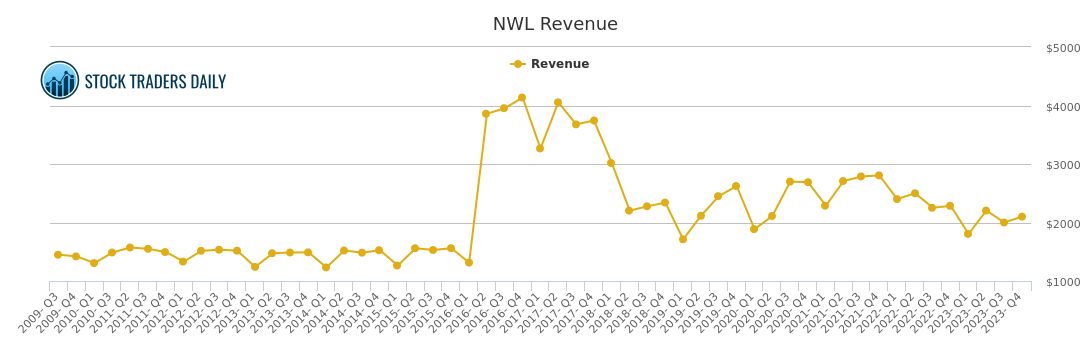

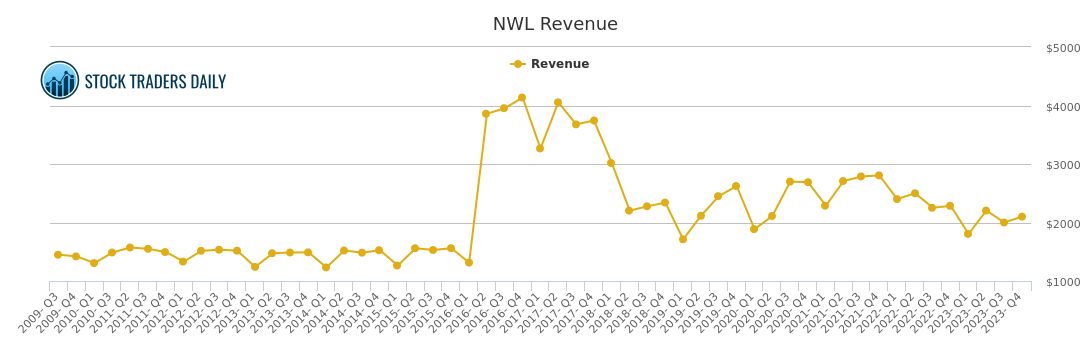

Related Companies All stock quotes on this website should be considered as having a 24-hour delay. The group derives majority of revenue from Home and Outdoor Living segment. Newell Rubbermaid has been paying dividends since 1972, and has increased them annually since 2011. But that hasn't worked out, either. Since announcing the deal in December 2015, Newell Brands has seen its stock lose almost two-thirds of its value: data by More recently, activist investor Carl Icahn and private equity group Starboard Value jumped into the mix, taking big stakes, strong-arming their way onto the Newell board, and agitating for big change, including selling off a substantial amount of the business.

Next

NWL Stock News

But at the same time, a high yield can be a misleading indicator, particularly if the company has struggled of late, and a sell-off in the stock has played a big role in pushing up the yield. All three have struggled to meet investor expectations. Since the deal closed at the end of August, Clearway's two share classes are down 26% and 28%, respectively, as the renewable-energy producer continues to struggle with weak cash flows and the overhang of the bankruptcy of one of its biggest customers. In short, management made a hard decision to prioritize balance-sheet improvements. Volume has increased in the last day along with the price, which is a positive technical sign, and, in total, 6. A break down below any of these levels will issue sell signals. Neither Zacks Investment Research, Inc.

Next

NWL: Dividend Date & History for Newell Brands Inc

The Food and Appliances segment manufactures or sources, markets and distributes a diverse line of household products. Its Home and Outdoor Living segment offers products for outdoor and outdoor-related activities, home fragrance, and connected home and security products under Chesapeake Bay Candle, Coleman, Contigo, ExOfficio, First Alert, Marmot, WoodWick, and Yankee Candle brands. And all other things being equal, investing in companies that promise to regularly pay shareholders more money can result in better overall returns. Add it all up, and the company's operating results and cash flows haven't been very compelling: data by This deterioration in its operating results means Newell paid more in dividends than it generated in cash in multiple recent quarters: data by Sure, the proceeds from asset sales will help offset things in the near term, and with Icahn and Starboard involved, Newell is unlikely to cut the payout, but that could change quickly, and it isn't something I'd suggest investing on. Fourth-quarter sales in all three of its newly aligned business segments fell in the fourth quarter.

Next

NWL Stock Price & Charts

At the same time, the retained businesses aren't exactly killing it. Visit the company page on Wikipedia. Inventories rose 18% in the latest quarter from the same period a year ago. It operates through the following segments: Food and Appliances; Home and Outdoor Living; and Learning and Development. The unit comprises brands like Mr. All users should speak with their financial adviser before buying or selling any securities.

Next

NWL Stock Price & News

The stock has gained 2. This is considered to be a good technical signal. There may be delays, omissions, or inaccuracies in the Information. Tarsila Wey, director of marketing for First Alert, the most trusted brand in home safety. The company generates plenty of cash flow to maintain the prior dividend, but it also has substantial debt leverage: data by Buy on the dip? Over the past year, CenturyLink has substantially improved cash flows by combining with Level 3.

Next

NWL Stock Price

In short, CenturyLink's recent strategy following its merger with Level 3 Communications is actually working, as opposed to the unmitigated merger disaster at Newell Brands. Certain financial information included in Dividend. It's not uncommon for investors looking for dividend stocks to look for high yields. That likely means it will have to lower prices to clear excess inventory and gross margins will be pinched as a result. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. The Home and Outdoor Living segment manufactures or sources, markets and distributes global consumer active lifestyle products for outdoor and outdoor-related activities, home fragrance products and home security products.

Next

NWL Stock Price

Newell sells its products in about 200 countries worldwide. By essentially halving the payout, CenturyLink freed up substantial cash to more aggressively pay down debt. Furthermore, the new business , compared with its legacy wireline operations, which continue to shrink as more people and businesses cut the traditional copper phone line. It may not have the growth prospects of bigger wireless telecoms, but its cash flows, valuation, and very high yield make it a compelling buy right now. Given the current short-term trend, the stock is expected to rise 27. The Calphalon ActiveSense Blender precisely blends on its own with the help of five preset food settings for commonly blended foods and drinks including smoothies, salsas, milkshakes, juices, and frozen beverages. That's certainly been the case for Clearway Energy , Newell Brands , and CenturyLink so far this year.

Next

NWL Stock Price & News

There is natural risk involved when a stock is testing a support level, since if this is broken, the stock then may fall to the next support level. Trend Newell Rubbermaid Inc lies in the upper part of a strong rising trend in the short term, and this will normally pose a very good selling opportunity for the short-term trader as reaction back towards the lower part of the trend can be expected. Since the calendar turned to 2019, the stock prices for these three companies have fallen 15%, 19%, and 20% respectively. Newell Rubbermaid pays its dividends quarterly. Born and raised in the Deep South of Georgia, Jason now calls Southern California home.

Next

NWL Stock Price & News

Newell Rubbermaid is largely affected by commodity prices, which can add volatility to its operational results. Evaluation Newell Rubbermaid Inc holds several positive signals and is within a strong rising trend. The company's Food and Appliances segment offers household products, including kitchen appliances, gourmet cookware, bakeware and cutlery, food storage and home storage products, and fresh preserving products under Ball, Calphalon, Crock-Pot, FoodSaver, Mr. At some point, Newell must improve cash flows and reverse the trend of declining sales. Signals Only positive signals in the chart today. Newell sells its products in about 200 countries worldwide. The Home and Outdoor Living segment consists of products for outdoor and outdoor-related activities, home fragrance products and connected home and security.

Next