Yield meaning. Yield to 2019-12-05

Dividend Yield Definition

If there is a bond that pays interest based on say, 10-year Treasury yield + 2% , then its applicable interest will be 3% when the 10-year Treasury yield is 1%, and will change to 4% if the 10-year Treasury yield increases to 2% after few months. For most practical engineering uses, this R p0. While individual high-yield bonds can be purchased, high-yield bond mutual funds offer more investment diversity. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. A higher yield allows the owner to recoup his investment sooner, and so lessens risk.

Next

Yield

It can also be a source of error if the excess is due to incomplete removal of water or other impurities from the sample. If a metal is only stressed to the upper yield point, and beyond, can develop. A given investment can have a variety of yields because of the many methods used to measure yield. The percentage return on an investment. The dividend yield jumped from 3% to more than 5% as the price dropped. Because you paid a premium for a bond with the same fixed dollar amount of interest, the current yield is lower. In this equation, the reactant and the product have a 1:1 , so if you know the amount of reactant, you know the theoretical yield is the same value in moles not grams! While this tells you a lot about the quantity of products ready for sale, business owners must also be concerned with the effectiveness of their processes.

Next

Yield (engineering)

As an alternative for calculating the dividend yield, you can use Investopedia's. Elastic limit yield strength Beyond the elastic limit, permanent deformation will occur. Learn how to create tax-efficient income, avoid mistakes, reduce risk and more. Percent yield is always a positive value. There is a long list of companies, known as the Dividend Aristocrats, that have all increased their dividends for at least 25 consecutive years — this may be a good place to start. While many material properties depend only on the composition of the bulk material, yield strength is extremely sensitive to the materials processing as well.

Next

Yield

Reasons for this can include incomplete or competing reactions and loss of sample during recovery. As you can see in the following chart, the decline in the share price and eventual cut to the dividend offset any benefit of the high dividend yield. Although the dividend yield among is lower than average, the rule about mature companies applies to a sector like this as well. Find sources: — · · · · June 2013 The stress at which yield occurs is dependent on both the rate of deformation strain rate and, more significantly, the temperature at which the deformation occurs. For example, a financial security e.

Next

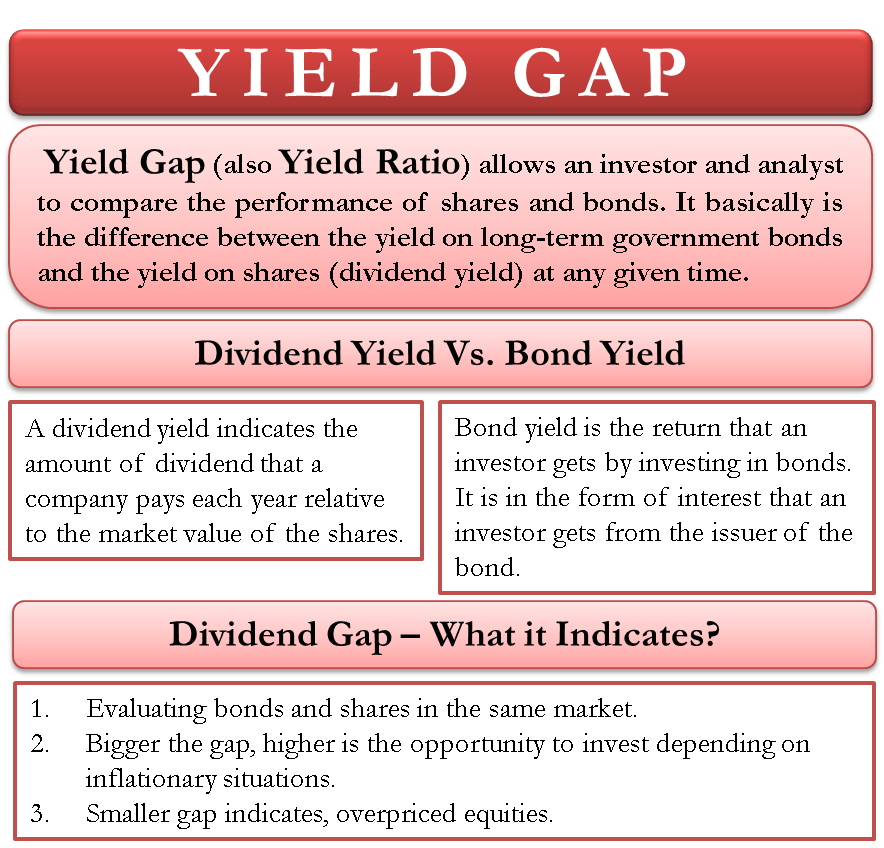

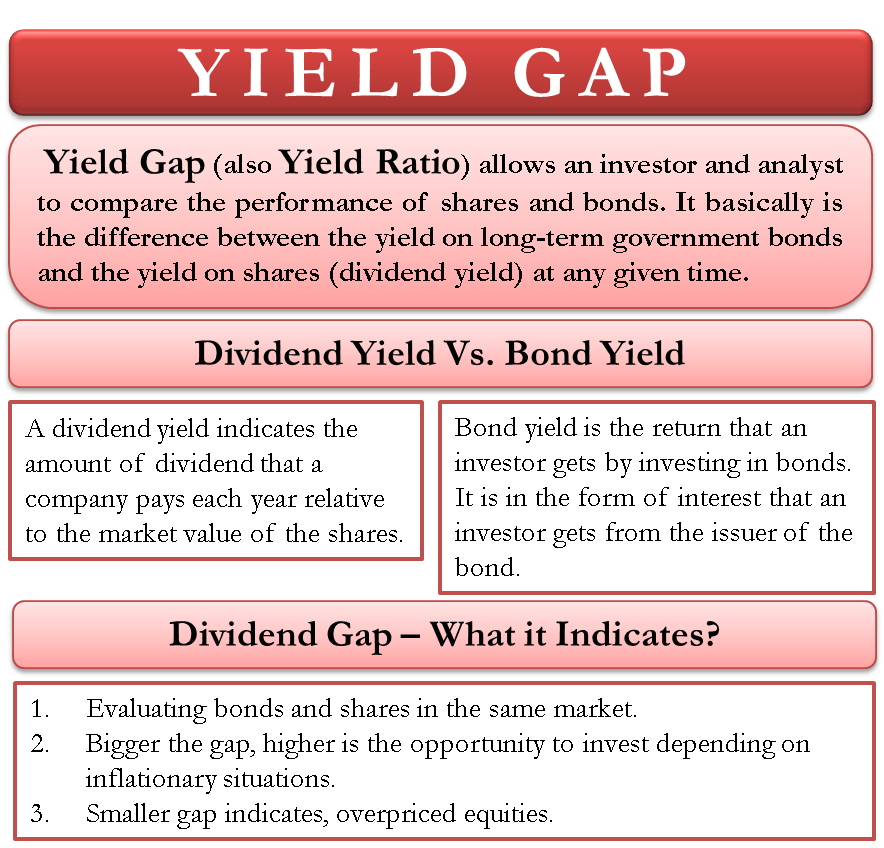

Yield financial definition of yield

Similarly, gains on stock prices also accrue profits to investors. Higher yields in the secondary market are usually an indicator of the risk apportioned to a debt by investors, with higher risk pushing them upwards and vice versa. In other words, it is a measure of the cash flow an investor is getting on the money invested. Where the current market price of a bond is below its specified redemption price, the potential profit on redemption must be divided by the number of years to the redemption date of the bond, and this annual profit equivalent added to the flat yield on the bond to arrive at its redemption yield. For example, according to analysts at Hartford Funds, since 1960, more than 82% of the total returns from the are from dividends. The return that is earned on an investment. These companies are all structured in such a way that the requires them to pass through most of their income to their shareholders.

Next

Yield (engineering)

Thus, yield is a major decision-making tool used both by companies and investors. A significant rise in yield without a higher stock price could indicate a company is paying a dividend without a commensurate rise in earnings, which could also suggest problems in the near future for the business. Yield is a part of the total return generated from holding an invested in financial security over a year. The yield strength can vary from 65 to 80% of the tensile strength. Yield occurs when the maximum principal reaches the strain corresponding to the yield point during a simple tensile test. Total return is a more comprehensive measure of , which factors in , and capital gains. They refuse to yield to the enemy.

Next

Yield financial definition of yield

But on the other hand, a may have resulted from a falling market value for the security as a result of higher risk. Yield alone may not be the ideal, single factor based on which investment decisions should be taken. Although this criterion allows for a quick and easy comparison with experimental data it is rarely suitable for design purposes. Indeed, whiskers with perfect single crystal structure and defect-free surfaces have been shown to demonstrate yield stress approaching the theoretical value. Since it requires a lot of energy to move dislocations to another grain, these dislocations build up along the boundary, and increase the yield stress of the material. Yield can refer to the payable on the market price of a ; or rate payable on the market price of a ; or company profit per share after tax related to the price of the share. There is thus an inverse relationship between the price paid for a bond or share and its yield.

Next

Dividend Yield Definition

The yield of a bond is inversely related to its price today: if the price of a bond falls, its yield goes up. In general, the yield strength increases with strain rate and decreases with temperature. Some stock sectors, like consumer non-cyclical or utilities, will pay a higher-than-average dividend. Yield load can be taken as the load applied to the center of a carriage spring to straighten its leaves. It includes the income received through dividend and interest that was earned by the fund's during the given year.

Next

Percent Yield Definition and Formula

} Maximum Shear Stress Theory — Also known as the , after the French scientist. This is acceptable during the first few months after the company has released its annual report; however, the longer it has been since the annual report, the less relevant that data will be for investors. The term is used in different situations to mean different things. The offset yield point or proof stress is the stress at which 0. Yield is only one of the several factors that investors look for while assessing a business, company or return from an investment.

Next